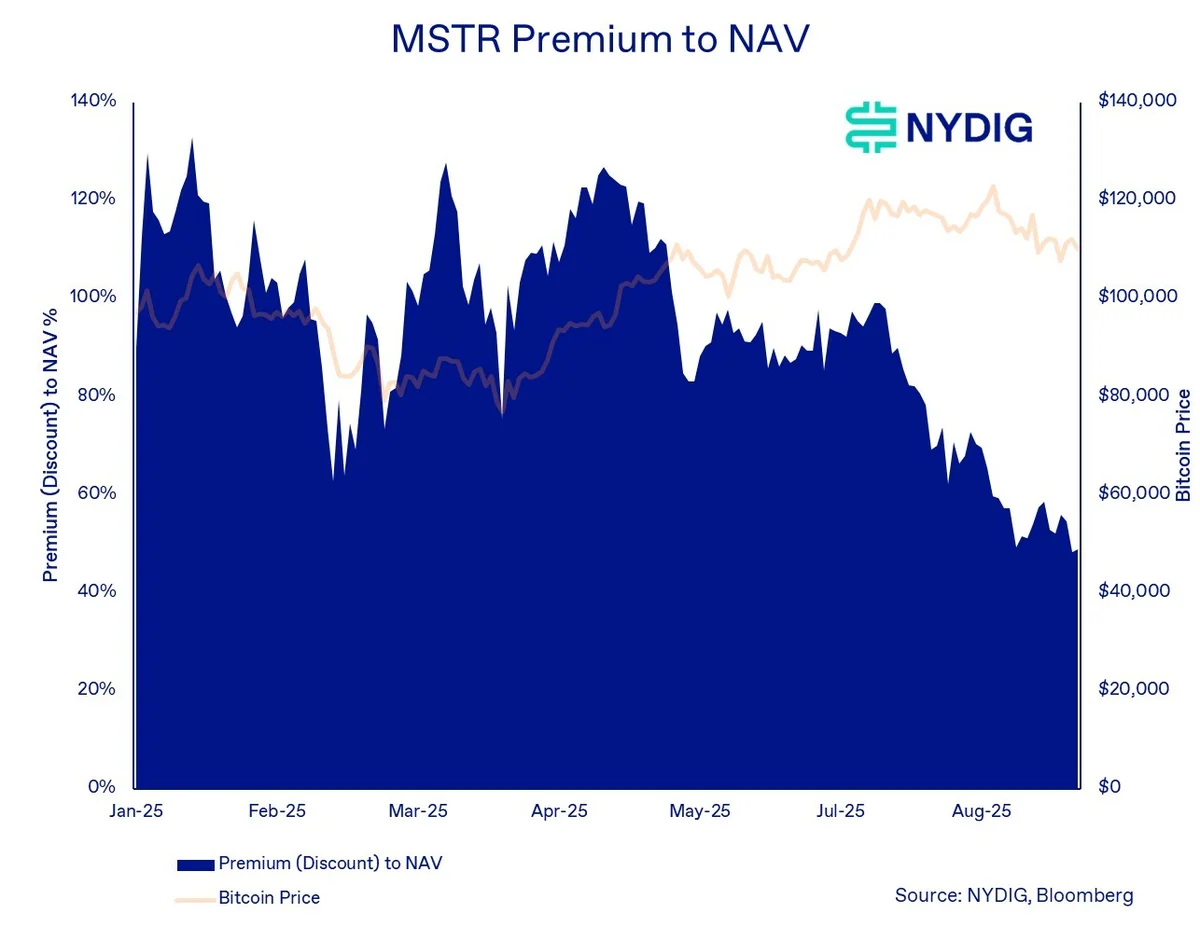

The premiums of digital asset treasury (DAT) companies are falling and it’s more likely to worsen within the close to future until they take motion, says New York Digital Funding Group (NYDIG).

NYDIG international head of analysis Greg Cipolaro stated on Friday that the hole between inventory worth and internet asset values (NAV) of main Bitcoin (BTC) shopping for companies resembling Metaplanet and Technique “proceed to compress” whilst BTC has reached new highs.

“The forces behind this compression seem like assorted,” Cipolaro added. “Investor anxiousness over forthcoming provide unlocks, altering company targets from DAT administration groups, tangible will increase in share issuance, investor profit-taking, and restricted differentiation throughout treasury methods.”

Crypto treasury companies have develop into the most recent fad on Wall Road and have garnered billions of {dollars} within the final yr. Traders will usually evaluate share costs to the worth of the belongings they maintain as a metric to evaluate their well being.

Share buyback applications wanted to spice up well being

Cipolaro stated a “bumpy journey could also be forward” for crypto treasury companies as many are awaiting mergers or financing offers to go public, which might see a “substantial wave of promoting” from present shareholders.

He added many treasury corporations, together with KindlyMD and Twenty One Capital, are buying and selling at or under the worth of latest fundraises, and a share worth drop “would possibly exacerbate promoting as soon as shares are freely tradeable.”

If shares in a treasury firm traded under its NAV, “probably the most easy plan of action could be inventory buybacks,” Cipolaro stated, which goal to extend share costs by lowering provide.

“If we have been to provide one piece of recommendation to DATs, it’s to save lots of among the funds raised apart to help shares through buybacks.”

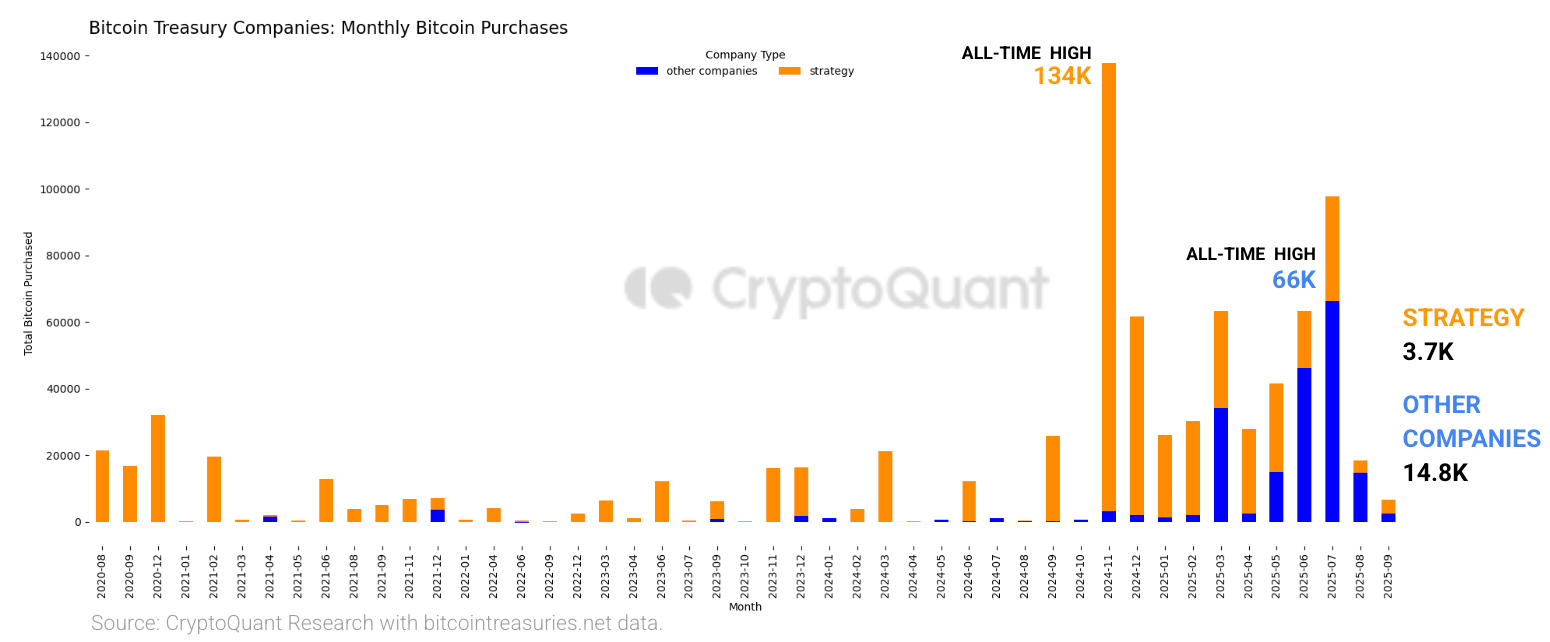

Firm Bitcoin holdings hit peak, however shopping for slows

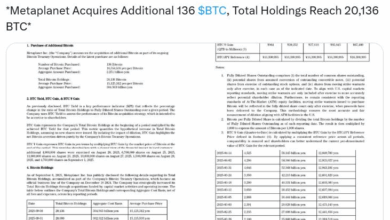

The holdings of Bitcoin shopping for corporations have reached a peak excessive this yr, at 840,000 BTC, with Technique holding 76%, or 637,000, of the entire, with the remaining unfold throughout 32 different companies, in response to a CryptoQuant report on Friday.

Associated: Public corporations attain 1M Bitcoin, hitting 5.1% of BTC provide

The variety of purchases per 30 days can be up, however CryptoQuant stated the entire quantity of Bitcoin purchased by the businesses slowed in August to under this yr’s month-to-month common, and the companies are scooping up much less Bitcoin per transaction.

For instance, Technique’s common buy measurement fell to 1,200 BTC in August in comparison with its 2025 peak of 14,000 BTC, whereas different corporations bought 86% much less Bitcoin in comparison with their 2025 excessive of two,400 BTC in March.

That’s led to a sudden slowdown within the progress of Bitcoin treasury holdings, with Technique’s month-to-month progress charge dropping to five% final month, in comparison with 44% on the finish of 2024, whereas different corporations noticed an 8% progress in August in comparison with 163% in March.

Bitcoin has traded flat within the final 24 hours at round $111,200, and has fallen 10.5% from its over $124,000 peak in mid-August, in response to CoinGecko.

Commerce Secrets and techniques: Bitcoin to see ‘yet one more huge thrust’ to $150K, ETH strain builds