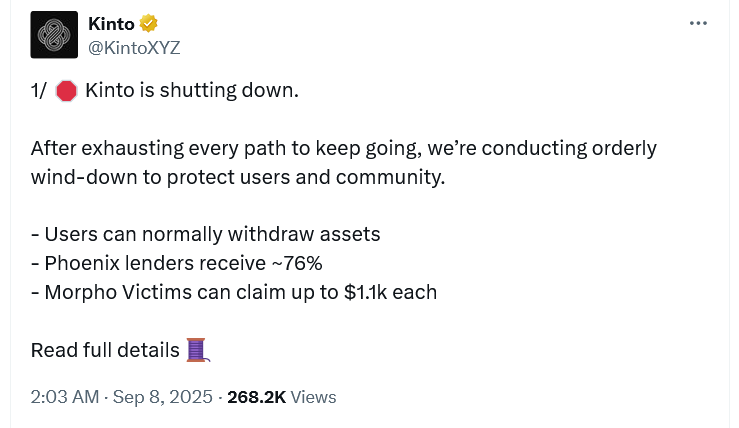

The Kinto token, the governance token of the Kinto Community, has plummeted over 80% after its workforce introduced its Ethereum layer-2 blockchain is shutting down on the finish of September, following months of setbacks.

Kinto raised $1 million in debt to revive buying and selling on its “modular trade” after an industry-wide hack in July drained about 577 Ether (ETH) price round $1.6 million from the protocol.

Nevertheless, worsening market circumstances “killed additional fundraising,” forcing the crypto undertaking to close down, Kinto posted to Medium on Sunday.

“Daily that we go on, the funds dwindle additional. We’ve operated with out salaries since July, and after the final financing path fell via, we’ve got one accountable alternative left: shut down cleanly and shield customers/lenders as finest as doable.”

The $1.6 million hack resulted from a safety vulnerability within the ERC-1967 Proxy normal — a standard OpenZeppelin codebase that permits sensible contracts to be upgraded with out altering their deal with. A number of different initiatives have been additionally affected.

Whereas Kinto blamed the failure on the hack and rising monetary pressures, one onlooker pointed to Kinto’s excessively excessive annual share yield (APY) choices on stablecoins, even at occasions after the hack after they have been struggling to make income.

One among Kinto’s founders, Ramon Recuero, famous in April that Okay staking supplied a 130% APY in USDC (USDC) — one of many highest in all the DeFi area. Different decentralized finance platforms with excessive yields have had rocky pasts.

The undertaking, which was constructed on Arbitrum and leverages the Ethereum mainnet for settlements, additionally supplied buying and selling of tokenized shares like Apple, Microsoft and Nvidia.

Its modular trade tried to mix the effectivity of centralized exchanges with the security measures supplied by decentralized exchanges.

Kinto unveils restoration plan

Kinto stated all remaining property — together with $800,000 of Uniswap liquidity — shall be moved to the Basis Secure and distributed to “Phoenix” lenders “who took the chance” to assist Kinto relaunch. They’re anticipated to recuperate 76% of their mortgage principal.

Kinto and Recuero are additionally establishing a “goodwill grant” for victims of the hack, every receiving $1,100 per affected deal with. Recuero stated he’ll contribute greater than $130,000 of his personal funds to offer aid.

Kinto stated it’ll proceed to recuperate misplaced property and that if recoveries exceeded sufferer quantities, it might share that with the neighborhood through Snapshot, a voting platform usually utilized by decentralized autonomous organizations.

The Kinto workforce urged customers to withdraw property by Sept. 30. After that, they would want to say any property via a perpetual declare contract that Kinto plans to create.

Kinto is Recuero’s second failed crypto undertaking

Kinto marks Recuero’s second crypto enterprise to close down, following Babylon Finance, which closed in November 2022 after it fell sufferer to a $3.4 million hack earlier that 12 months.

Recuero equally stated at the moment that his workforce wasn’t “in a position to revert the adverse momentum” attributable to the hack, forcing Babylon to close down simply six months after its public launch.

Associated: Ethereum L2 Starknet suffers 2nd mainnet outage in 2 months

Okay token falls practically 80%

Kinto (Okay) has tanked 81.4% to $0.46 because the workforce introduced the information, with its market cap barely hovering above the $1 million mark, CoinGecko information exhibits.

The autumn comes virtually a month after reaching an all-time excessive of $14.5 million on Aug. 14. The Kinto token launched simply 4 months in the past in April.

Change in market cap of Kinto since March 31, 2025. Supply: CoinGecko

Journal: Astrology might make you a greater crypto dealer: It has been foretold