Polygon developer Bruno Skvorc lashed out at World Liberty Monetary (WLF) on Saturday, accusing the corporate of stealing his funds. In a put up on X, Skvorc wrote:

“…they stole my cash, and since it’s the @POTUS household, I can’t do something about it.”

Skvorc was one of many a whole lot of customers, together with Tron founder and WLF investor Justin Solar, whose tokens have been frozen by WLF.

The decentralized finance (DeFi) agency is intently linked to the U.S. President Donald Trump and his household. A Trump entity owns 60% of WLF and earns 75% of income from token sale. Trump’s sons, Eric and Donald Trump Jr. are a part of the agency’s administration. In keeping with an estimate revealed by The New Yorker in August, the Trump household earned about $412.5 million from WLF.

Skvorc connected the e-mail response he acquired from WLF to his X put up, which famous that the agency would “not have the ability to unlock” his tokens. The agency justified the freezing of the tokens “as a result of excessive danger blockchain publicity related to” Skvorc’s pockets.

Polygon developer likened WLF to ‘new age mafia’

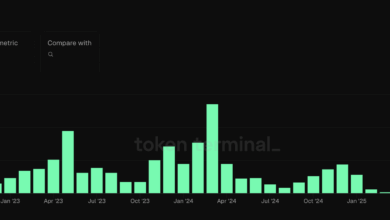

Since WLF began buying and selling on Sept. 1, the protocol has blocked not less than 272 wallets. Denouncing the protocol as “the rip-off of all scams,” Skvorc famous:

“That is the brand new age mafia. There isn’t any one to complain to, nobody to argue with, nobody to sue. It simply… is.”

Skvorc is much from being the one one to criticize WLF’s freezing of property. In an extended X put up on Friday, Solar, who invested $45 million in WLF final 12 months, said that his property have been “unreasonably frozen.”

Moreover, Solar famous that an incredible monetary model should be rooted in “equity, transparency, and belief.” And never “on unilateral actions that freeze investor property,” he wrote, including:

“Such measures [freezing user assets] not solely violate the respectable rights of buyers, but additionally danger damaging broader confidence in World Liberty Financials.”

The WLFI token is buying and selling at round $0.19 on the time of writing—greater than 67% under its all-time-high on launch day.

The Crypto Investor Blueprint: A 5-Day Course On Bagholding, Insider Entrance-Runs, and Lacking Alpha

WLF has doubled down on its transfer to freeze property

In an X put up WLF defended its resolution to blacklist person wallets, stating:

“WLFI solely intervenes to guard customers, by no means to silence regular exercise.”

The agency additional added that the transfer was made “solely to forestall hurt” whereas it investigated and helped impacted customers.

WLF additionally shared a breakdown of the blacklisted wallets, which confirmed that 79% of the blocked wallets have been linked to a phishing assault. The agency claimed that it had preemptively frozen the 215 wallets to forestall hackers from draining the funds. WLF mentioned it’s working with the rightful proprietor of the wallets to safe their respective property.

The breakdown additionally revealed that WLF blocked 50 wallets on the homeowners’ request after they reported that their wallets have been compromised. Solely 5 wallets have been flagged for high-risk publicity, whose safety dangers are at present beneath evaluation, as per WLF.

Moreover, WLF blocked one pockets for suspected misappropriation of different customers’ funds. The agency mentioned it would proceed to work with customers to confirm management and safe funds, and share clear outcomes for every class of wallets as soon as evaluations are concluded.

On-chain sleuth ZachXBT praised WLF’s method however cautioned in opposition to the reputational dangers of blacklisting false positives. ZachXBT famous:

“The problem is majority of the time “excessive danger” publicity is inaccurate so you can not turn out to be reliant on compliance instruments as a crew.”

ZachXBT wrote that the entire prime compliance instruments are flawed, and WLF is doing a greater job than others like Circle, however warned that the majority groups fail to seek out the suitable steadiness.