Tether CEO Paolo Ardoino has denied latest rumors that the stablecoin issuer is offloading its Bitcoin holdings to purchase gold.

In a Sunday publish on X, Ardoino stated the corporate “didn’t promote any Bitcoin,” and reaffirmed its technique of allocating earnings into property like “Bitcoin, gold, and land.”

The feedback got here in response to hypothesis from YouTuber Clive Thompson, who cited Tether’s Q1 and Q2 2025 attestation information from BDO to say the agency had decreased its Bitcoin (BTC) place. Thompson pointed to a drop from 92,650 BTC in Q1 to 83,274 BTC in Q2 as proof of a sell-off.

Nonetheless, Jan3 CEO Samson Mow debunked the declare, noting that Tether transferred 19,800 BTC to a separate initiative referred to as Twenty One Capital (XXI) throughout the identical interval. That included 14,000 BTC despatched in June and one other 5,800 BTC in July.

Associated: Tether holds talks to take a position throughout gold provide chain: Report

Tether strikes $3.9 billion in BTC to XXI

In early June, Tether moved over 37,000 BTC, value roughly $3.9 billion, throughout quite a few transactions to help XXI, a Bitcoin-native monetary platform led by Strike CEO Jack Mallers.

“Tether would have had 4,624 BTC greater than on the finish of Q1 if the switch is accounted for,” Mow defined, including that the agency truly elevated its internet holdings.

Ardoino echoed the reason, saying the Bitcoin was moved, not bought. “Whereas the world continues to get darker, Tether will proceed to take a position a part of its earnings into secure property,” he wrote.

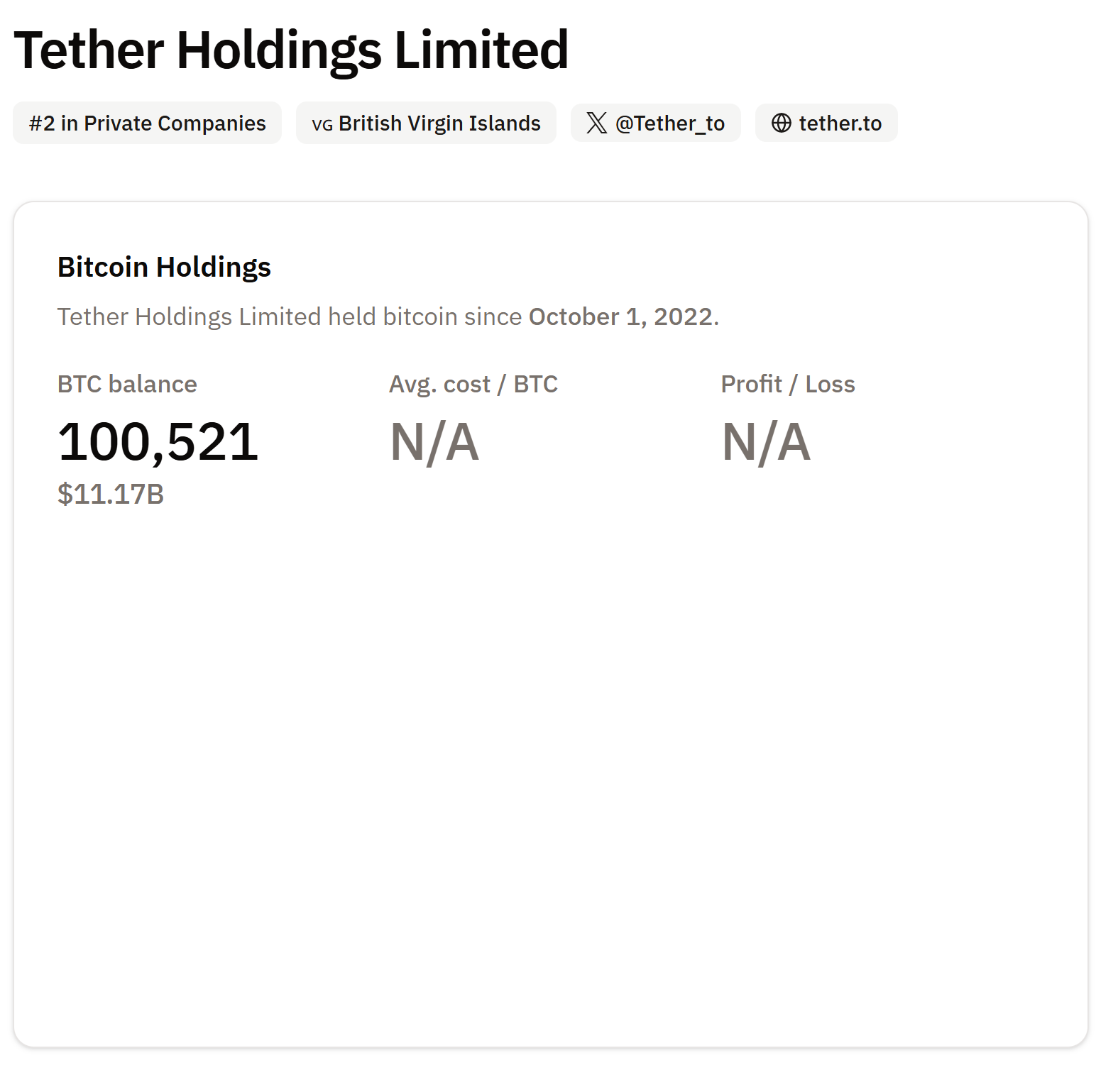

Tether, the issuer of the USDt (USDT) stablecoin, holds over 100,521 BTC, value round $11.17 billion, in keeping with information from BitcoinTreasuries.NET.

Associated: Tether scraps plan to freeze USDT on 5 blockchains

El Salvador buys $50 million in gold

Tether’s Bitcoin sell-off rumors got here as El Salvador revealed it has added 13,999 troy ounces of gold value $50 million to its international reserves, marking its first gold acquisition since 1990. The central financial institution stated the transfer is a part of a diversification technique to scale back reliance on the US greenback.

Earlier than turning to gold, El Salvador constructed a $700 million Bitcoin reserve, holding 6,292 BTC. Nonetheless, an Worldwide Financial Fund report in July claimed that the Central American nation has not made any new Bitcoin purchases since February.

Journal: Bitcoin is ‘humorous web cash’ throughout a disaster: Tezos co-founder