Stablecoin Retail Transfers Hit Report Degree as BSC, Ethereum Positive factors Floor, Tron Slips

Stablecoin adoption amongst retail customers has set new data this yr, with transaction volumes by means of August already exceeding final yr’s complete, a contemporary report by CEX.io stated.

Retail-sized transfers, counting transactions beneath $250, crossed $5.84 billion in August alone, the best ever recorded, based on information by Visa and Allium cited within the report. With practically 4 months left within the yr, 2025 has already change into the busiest interval but for stablecoin switch quantity on the shopper degree.

The figures underscore stablecoins, a gaggle of cryptos tied to fiat currencies just like the U.S. greenback, turning into more and more embedded into on a regular basis monetary exercise, from cross-border remittances to microtransactions, the report identified.

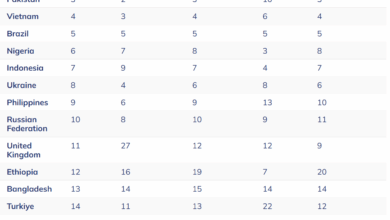

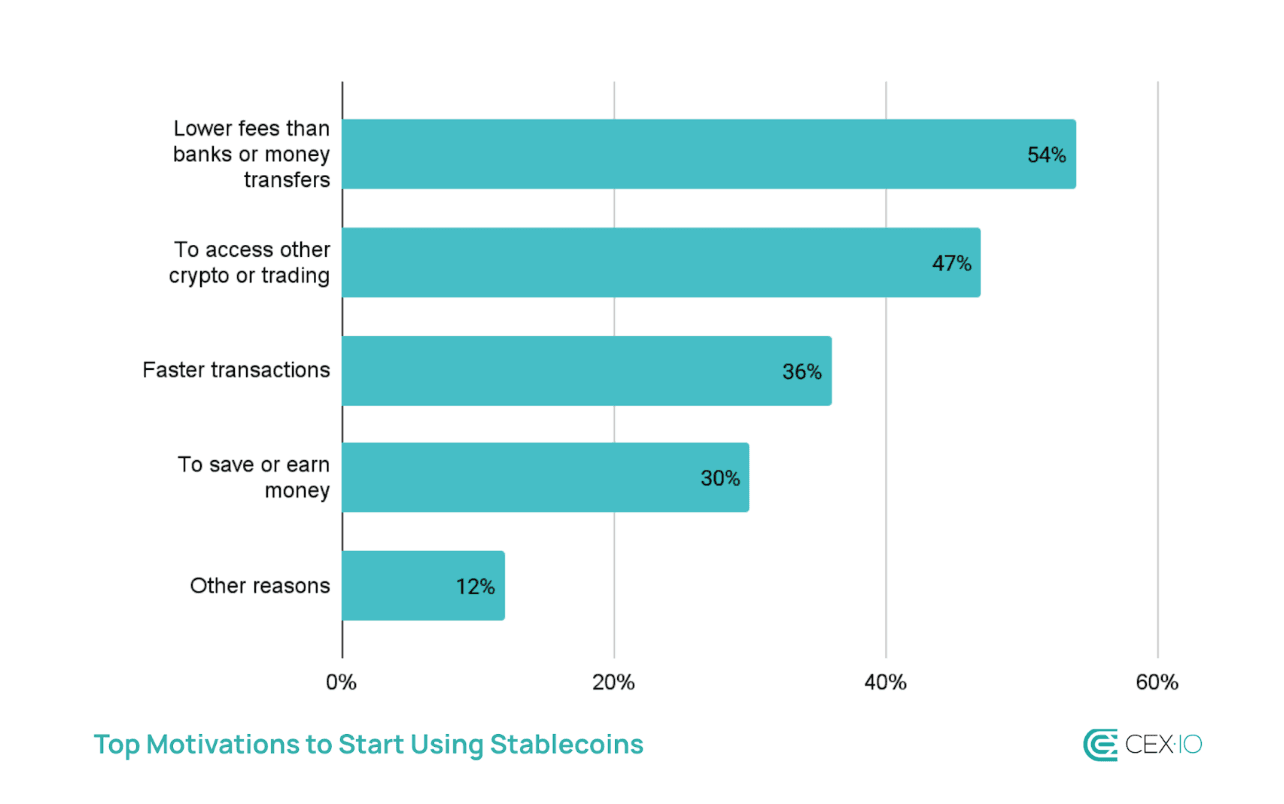

Survey information from rising markets, asking over 2,600 shopper in Nigeria, India, Bangladesh, Pakistan and Indonesia, bolstered this image, CEX.io analysts. A majority of respondents stated they turned to stablecoins to keep away from excessive banking charges and sluggish transfers, the report stated. Practically 70% of them reported utilizing stablecoins extra steadily than final yr, and greater than three-quarters count on utilization to maintain rising, the report stated.

Ethereum good points, Tron falls again

The distribution of exercise amongst blockchains have shifted, the report famous. The Tron blockchain, historically common for retail transfers because of its low charges and broad help for Tether’s USDT (USDT), has given up market share. Month-to-month transaction counts fell by 1.3 million, or 6%, and its progress in quantity lagged behind its closest rivals.

As a replacement, Binance Sensible Chain (BSC) emerged because the best choice for retail customers, capturing practically 40% of retail stablecoin exercise, the report stated. The community’s transaction rely jumped 75% this yr with switch quantity rising 67%. A lot of the momentum got here after Binance delisted USDT in March for European customers and a resurgence of memecoin buying and selling on PancakeSwap on BSC.

The Ethereum complicated, with the bottom chain and layer-2 networks mixed, made up over 20% of switch quantity and 31% of transaction counts, the report famous. Whereas small transfers largely befell on L2s, the mainnet loved a big rise within the retail section. Sub-$250 transfers on the mainnet rose 81% in quantity and 184% in rely.

Ethereum has been principally used for large-value transactions because of its excessive charges, however transaction prices have dropped greater than 70% over the previous yr, making mainnet transactions extra aggressive even within the sub-$250 vary, the authors stated.

Learn extra: Ripple Brings $700M RLUSD Stablecoin to Africa, Trials Excessive Climate Insurances