Stablecoins like USDt have turn into the de facto forex for tens of millions of individuals navigating a crumbling monetary system in Venezuela because the nation’s annual inflation price surges to 229%.

As soon as restricted to crypto-savvy customers, Tether’s USDt (USDT), typically referred to domestically as “Binance {dollars},” is now extensively used throughout Venezuela for the whole lot from groceries and condominium charges to salaries and vendor funds, Mauricio Di Bartolomeo, who fled Venezuela earlier than co-founding Ledn in 2018, informed Cointelegraph.

The bolívar, Venezuela’s nationwide forex, is basically lifeless in every day commerce. Hyperinflation, strict capital controls, and a fractured alternate price panorama drive a rising desire for stablecoins over money or native financial institution transfers.

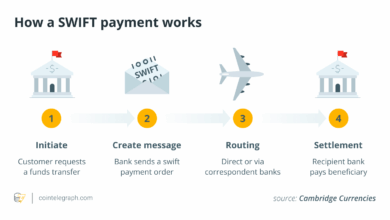

There are presently three charges for the US greenback in Venezuela. The official Central Financial institution price (BCV) is 151.57 bolívars per USD, the parallel market price is 231.76, and the USDt price on Binance is 219.62. USDt’s liquidity and reliability make it essentially the most used price amongst distributors and shoppers.

“Folks and corporations choose to cost their items and providers in USD, and obtain fee for a similar in USD,” Di Bartolomeo stated. He famous that USDt now features as each a greater greenback and a monetary equalizer throughout social lessons.

Associated: Venezuela’s crypto adoption surges amid inflation and forex collapse

Venezuela ranks #9 in per capita crypto use

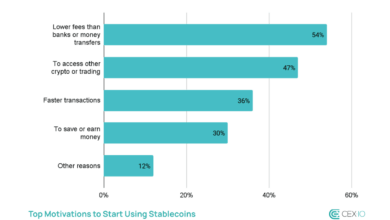

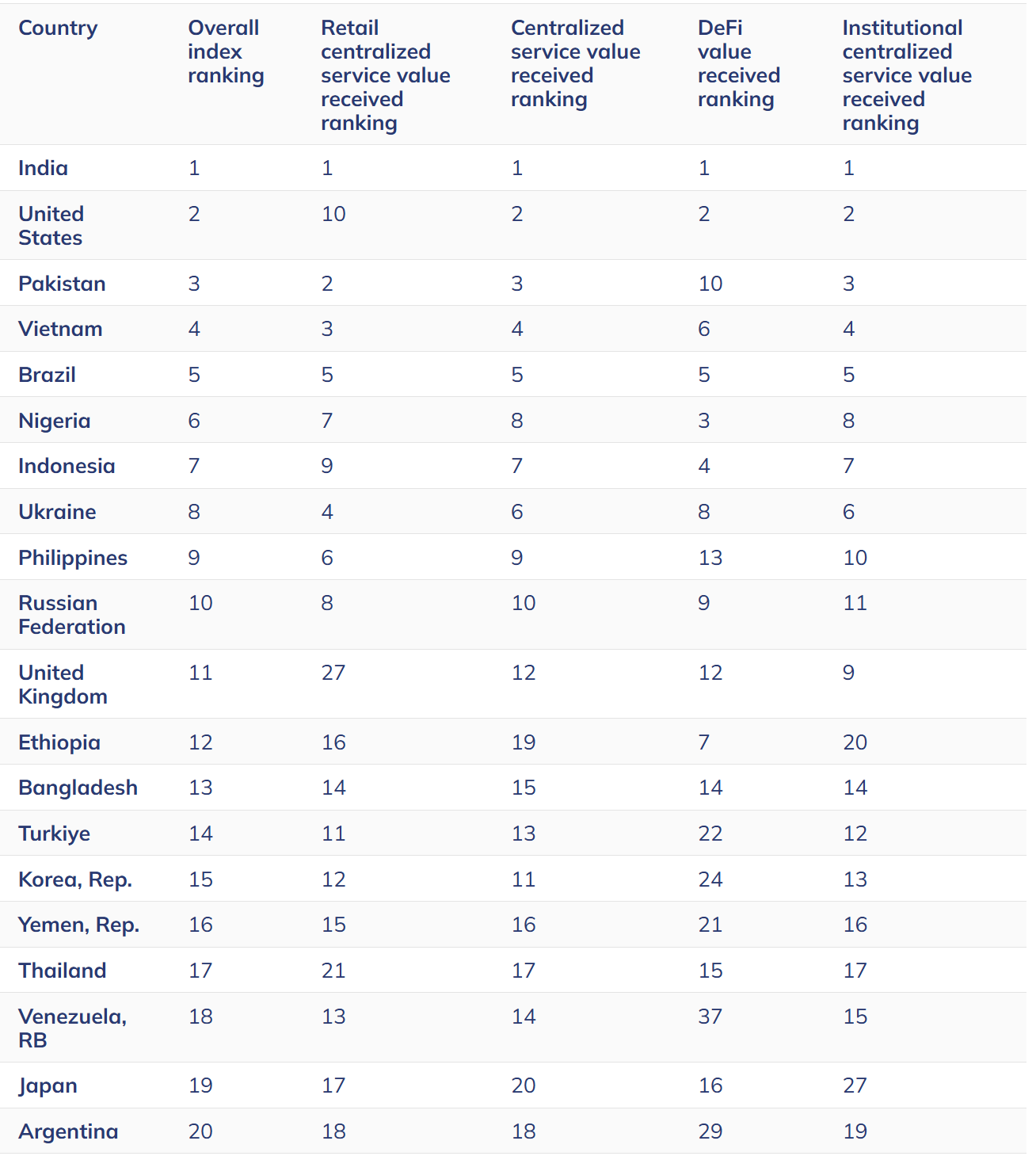

Based on Chainalysis’ 2025 World Crypto Adoption Index, Venezuela ranks #18 globally and #9 when adjusted by inhabitants. Stablecoins accounted for 47% of all Venezuelan crypto transactions underneath $10,000 in 2024, and total crypto exercise rose 110% final 12 months.

Di Bartolomeo stated that even routine bills like condominium charges, safety providers, and gardening are actually quoted and paid in stablecoins. From small bodegas to mid-sized companies, USDt has changed fiat money because the settlement methodology of selection.

Bigger state-controlled entities stay tethered to the BCV alternate price, however most market contributors choose the Binance greenback’s effectivity and accessibility.

Venezuela’s government-imposed capital controls have additionally led to parallel markets for international forex and digital property. Official USD allocations are reportedly handed to regime-connected companies, who resell {dollars} at parallel charges for revenue.

“Capital controls additionally create a parallel marketplace for money and stablecoins, as financial actors refuse to simply accept the nugatory native forex for fee,” Di Bartolomeo stated. “If and once they reluctantly settle for it, they rush to commerce it into stablecoins or USD.”

Associated: Venezuela blocks Binance, X amid presidential election dispute

Crypto rises the place fiat fails

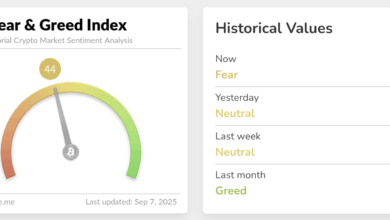

In nations dealing with financial instability and capital controls, crypto adoption is accelerating as individuals search for options to failing currencies. Venezuela, Argentina, Turkey and Nigeria observe an analogous sample, with locals turning to stablecoins amid hovering inflation.

Di Bartolomeo stated that after the US enacted its newest batch of sanctions on Venezuela, together with its oil sector, some native banks additionally turned to stablecoins.

“Oil firms and different industries are additionally more and more pivoting to them,” he stated. “Reportedly, a restricted variety of native banks have began promoting USDt to some companies in alternate for bolivars to keep away from restrictions.”

Journal: Bitcoin is ‘humorous web cash’ throughout a disaster: Tezos co-founder