The next is a visitor put up and opinion of Eneko Knörr, CEO and Co-Founding father of Stabolut.

Months in the past, in an op-ed for CryptoSlate, I warned that the EU’s flagship crypto regulation, MiCA, would obtain the other of its objectives. I argued it might strangle euro innovation whereas cementing the US greenback’s dominance for a brand new era.

On the time, some thought this was alarmist. At present, with grim validation, the identical considerations are being echoed from inside the European Central Financial institution itself. In a current weblog put up, additionally highlighted by the Monetary Instances, ECB advisor Jürgen Schaaf described the state of the euro-denominated stablecoin market as “dismal” and warned that Europe dangers being “steamrollered” by dollar-based rivals.

This warning comes at a important time. Within the conventional world economic system, non-USD currencies are the lifeblood of commerce. They account for 73% of world GDP, 53% of SWIFT transactions, and 42% of central financial institution reserves. But, within the burgeoning digital economic system, these similar currencies are practically invisible. The world’s second most vital forex, the euro, has been decreased to a digital rounding error.

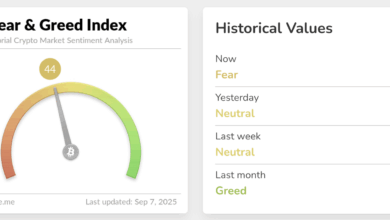

By the Numbers: A Digital Chasm

The information reveals a startling disconnect. Whereas privately issued, dollar-denominated stablecoins command a market capitalization approaching $300 billion, their euro-denominated counterparts wrestle to succeed in $450 million, in keeping with information from CoinGecko. That’s a market share of simply 0.15%.

This isn’t a spot; it’s a chasm. It signifies that for each €1 of worth transacted on a blockchain, there are practically €700 in US {dollars}. This dollarization of the digital world presents a profound strategic threat to Europe’s financial sovereignty and financial competitiveness.

MiCA’s Billion-Euro Handbrake

The EU’s landmark Markets in Crypto-Belongings (MiCA) regulation was meant to create readability, however in its ambition to regulate threat, it has inadvertently constructed a cage. Whereas its framework for E-Cash Tokens (EMTs) offers a path to regulation, it accommodates a poison capsule for any euro stablecoin with world ambitions.

The only greatest limitation is the €200 million cap on each day transactions for any EMT deemed “vital,” as detailed within the official MiCA textual content. This isn’t an accident or a easy oversight; it’s a characteristic designed to make sure no personal euro stablecoin can ever actually succeed.

For context, the main greenback stablecoin, Tether (USDT), recurrently processes over $50 billion in each day quantity. A €200 million cap isn’t a security measure; it’s a declaration of non-ambition that makes it mathematically unattainable for a euro stablecoin to operate on the scale required for worldwide commerce or decentralized finance.

The Crypto Investor Blueprint: A 5-Day Course On Bagholding, Insider Entrance-Runs, and Lacking Alpha

The motivation appears clear: policymakers are deliberately sabotaging the personal sector to clear the sphere for their very own venture—the Digital Euro.

The Digital Euro: A Menace to Citizen Privateness?

By stifling personal innovation, the EU is putting all its bets on a state-controlled Central Financial institution Digital Forex (CBDC). This isn’t solely a sluggish, centralized reply to a fast-moving, decentralized market, however it additionally poses a elementary menace to the privateness of European residents.

Bodily money gives anonymity. A transaction with a €5 notice is personal, peer-to-peer, and leaves no information path. A CBDC is the other. It could transfer all transactions onto a centralized digital ledger, making a system of granular surveillance. It offers the state the potential energy to observe, observe, and even management how each citizen makes use of their very own cash. Constructing the euro’s future on this basis means swapping the liberty of the pockets for a clear digital piggy financial institution—a trade-off most residents would rightly refuse.

The World Race Europe Is Ignoring

Whereas Brussels focuses on constructing its walled backyard, different main financial powers have acknowledged the strategic significance of privately issued stablecoins. They see them not as a menace however as a significant instrument for projecting financial affect within the digital age.

Even China is reportedly exploring the function a CNY-backed stablecoin may play in internationalizing the yuan. In Japan, regulators have already handed a landmark stablecoin invoice, creating clear pathways for the issuance of yen-backed stablecoins. These nations perceive that the digital forex struggle will probably be received by empowering personal innovation, not by centralizing management. Europe’s present path makes it a spectator in a race it ought to be main.

A Coverage Playbook for the Euro

If the euro is to compete, Brussels should execute a radical coverage U-turn. The objective shouldn’t be to include stablecoins however to make the EU the premier world hub for issuing them. This requires a clear-eyed technique that acknowledges personal innovation will all the time outpace centralized options.

Here’s a playbook for the way Europe can win:

- Uncap the Future: Take away the crippling €200 million transaction cap solely. The market, not regulators, ought to decide the dimensions of a profitable venture. Let euro stablecoins develop advert infinitum and compete on a world stage with out synthetic ceilings.

- Quick-Observe Licensing: Set up a pan-European fast-track authorization course of for certified EMT issuers to cut back time-to-market and encourage a vibrant, aggressive ecosystem.

- Observe the US Mannequin—Cancel the CBDC: The USA has gained its benefit by prioritizing regulatory readability for personal issuers whereas successfully shelving its personal retail CBDC plans. Europe should do the identical. Formally cancel the Digital Euro venture, acknowledge the elemental privateness dangers it poses, and acknowledge that the one greatest technique to develop the euro’s worldwide affect is to totally assist a thriving, privately issued stablecoin market.

The selection is stark: Europe can proceed down its path of self-imposed digital irrelevance, or it might probably unleash its innovators to construct the way forward for finance. Proper now, that future is being constructed virtually solely with American digital {dollars}, and time is operating out to vary that.