The current Commodity Futures Buying and selling Fee (CFTC) advisory on offshore exchanges serving US residents underneath the Overseas Board of Commerce (FBOT) framework gained’t carry offshore crypto exchanges again to the US, based on Eli Cohen, basic counsel at real-world asset (RWA) tokenization firm Centrifuge.

Cohen instructed Cointelegraph that settlement, clearing, and different regulatory necessities designed for the normal monetary system, required to serve US purchasers underneath the FBOT framework, aren’t tailor-made for crypto exchanges and will likely be troublesome or inconceivable to satisfy.

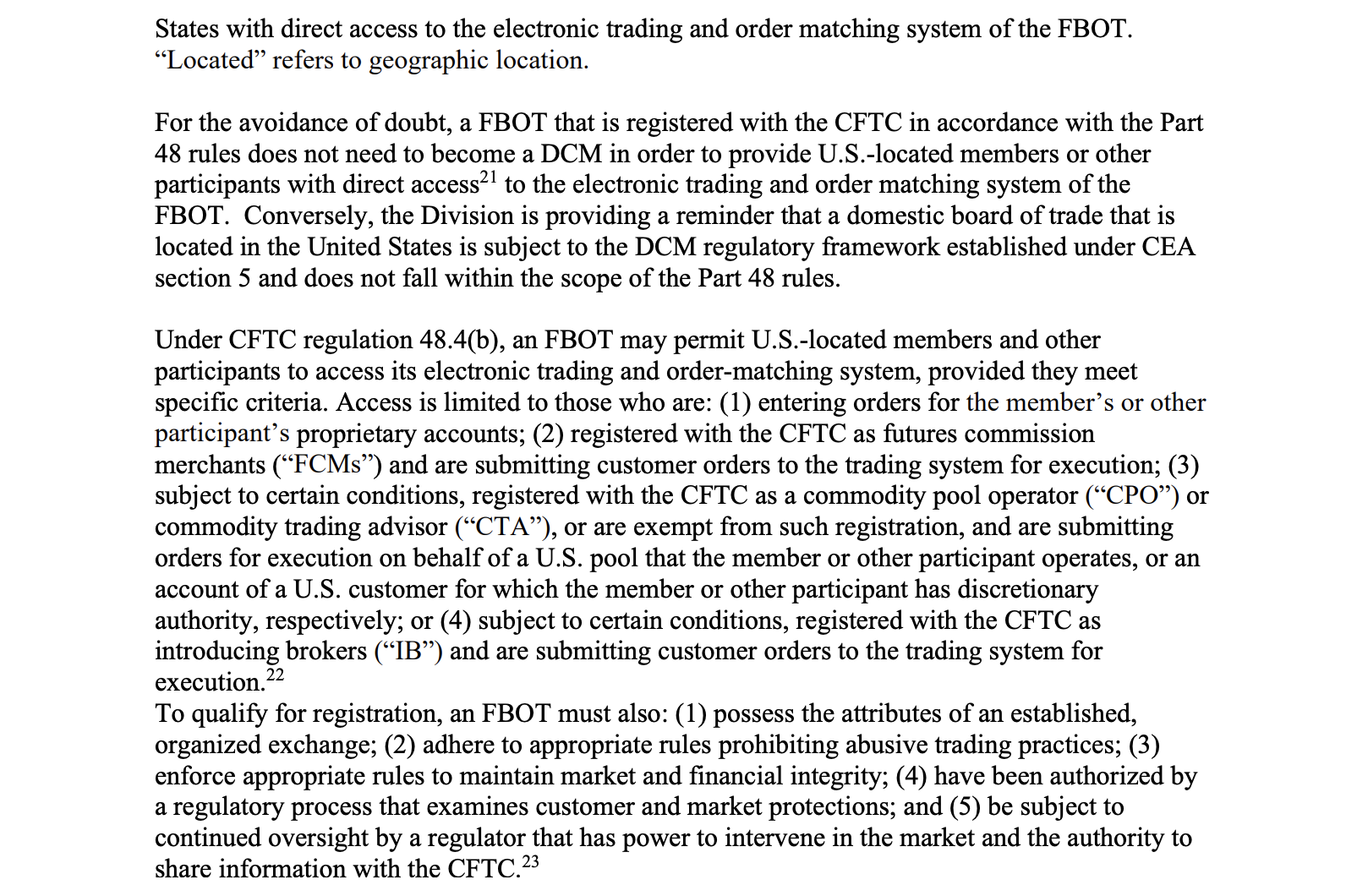

The CFTC’s steering additionally stipulated that solely Licensed Futures Fee (FCM) exchanges, that are broker-dealers for futures contracts, and different extremely regulated entities, are certified to use underneath the FBOT framework, Cohen stated. He added:

“The primary downside is that solely regulated exchanges outdoors america can apply for the FBOT. So, it’s essential to have an current regulatory framework in your house nation.”

Many exchanges select to arrange companies in Seychelles or different unregulated jurisdictions to keep away from such a framework within the first place, Cohen added.

One of the simplest ways to offer readability for crypto exchanges is to cross a crypto market construction invoice in Congress, codifying crypto laws into legislation, and creating lasting change that doesn’t shift from administration to administration, Cohen stated.

Associated: ‘Too few guardrails,’ CFTC’s Johnson warns on prediction market dangers

CFTC’s “crypto dash” guarantees readability on laws and an overhaul of the monetary system

The CFTC’s “crypto dash” is an initiative to overtake crypto laws to satisfy US president Donald Trump’s agenda of constructing the US the worldwide chief in crypto.

A number of coverage suggestions have been proposed within the Trump administration’s crypto report, which was revealed in July, together with giving the Securities and Alternate Fee (SEC) and the CFTC joint oversight over crypto.

Each regulatory businesses have proposed a number of collaborative coverage efforts, together with the potential for monetary markets to develop into perpetual, making a 24/7 buying and selling cycle throughout asset lessons.

The proposed change can be a big departure from legacy monetary markets, which presently don’t function on nights or weekends and shut throughout sure holidays.

Journal: Coinbase and Base: Is crypto simply changing into conventional finance 2.0?