Unhealthy information has simply been unhealthy information over the previous 24 hours. Friday’s weak U.S. jobs report bolstered bets on deeper Fed cuts, however bitcoin hasn’t performed alongside.

The main cryptocurrency by market worth stays heavy under $112,000, as a substitute of rallying on the prospect of simpler financial coverage as many had anticipated. The lack to search out upside suggests potential for a deeper sell-off forward.

NFP shock

Job seekers had a tricky time in August because the nonfarm payrolls revealed simply 22,000 job additions, considerably lower than the Dow Jones’ projection of 75,000. The report additionally revised decrease the mixed job creation over June and July by 21,000. Notably, the revised June determine confirmed a web lack of 13,000.

9 sectors, together with manufacturing, building, wholesale commerce, {and professional} providers, registered job losses, whereas well being providers and leisure and hospitality had been brilliant spots.

The Kobeissi Letter referred to as the roles report “completely insane.” The publication service described the downward revisions in prior months as an indication of a damaged system and the labour market coming into recession territory.

Following the roles knowledge, the chance of a Fed price minimize on the Sept. 17 assembly surged to 100%, and the chances of a 50-basis-point minimize jumped to 12%. The probability of extra price cuts in November and December additionally elevated, sending Treasury yields decrease.

The upcoming revisions to earlier jobs reviews are anticipated so as to add gas to the speed minimize bets. “The BLS will announce annual benchmark revisions on Tuesday, and they’re anticipated to level to even weaker job development earlier. Some surveys counsel between 500k and 1 mln jobs might be revised away,” Bannockburn World Foreign exchange’s Managing Director and Chief Market Strategist, Marc Chandler mentioned in a market replace.

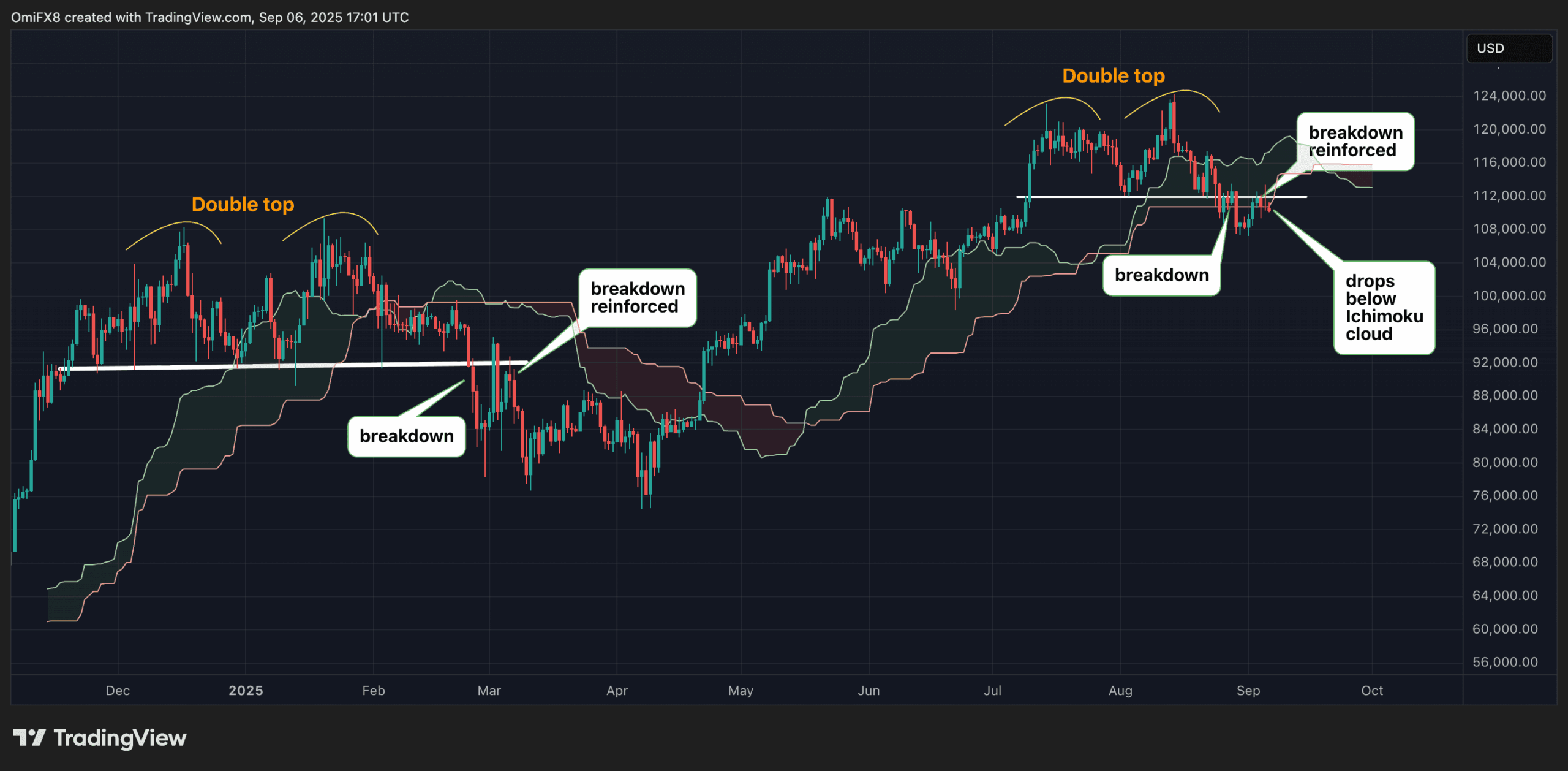

BTC’s double high is unbroken; volatility in Treasury yields might rise

Bitcoin briefly rallied on hopes of a Fed price minimize and softer yields, reaching a excessive of over $113,300. However the bounce rapidly light, with costs slipping again underneath $111,982 — the double‑high neckline.

Failing to retake that degree underscored the late August double high breakdown and validates the bearish setup, holding draw back dangers in focus. Costs crossing under the Ichimoku cloud additional validates the bearish outlook, as Brent Donnelly, president of Spectra Markets, famous in a market replace.

The primary line of help is positioned round $101,700, which corresponds to the 200-day easy transferring common (SMA). The most recent double high breakdown in bitcoin intently mirrors the one from February this yr, which led to a major multi-week sell-off that pushed costs all the way down to round $75,000.

The double high is a bearish reversal chart formation that happens after an asset has skilled an uptrend. It varieties when the worth reaches a excessive level (the primary peak), then pulls again to a help degree referred to as the neckline. The value then rises once more however fails to surpass the primary peak, making a second peak at roughly the identical degree. The sample is confirmed when the worth breaks under the neckline, signaling that the earlier uptrend has misplaced momentum and a downtrend might comply with.

Treasury yields might flip risky

The bearish technical outlook, offered by the most recent double high breakdown, is strengthened by the potential for a pickup in volatility in Treasury yields, which regularly results in monetary tightening.

The volatility may decide up within the coming days, as the approaching Fed price cuts may initially ship the 10-year yield decrease in a optimistic growth for BTC and threat property. That mentioned, the draw back seems restricted and might be rapidly reversed, very similar to what occurred in late 2024.

Final yr, from September by December, the 10-year yield really rose, even because the Fed started reducing charges, reversing earlier declines that had occurred within the lead-up to September. The ten-year yield bottomed out at 3.6% in mid-September 2024 after which rose to 4.80% by mid-January.

Whereas the labour market at the moment seems considerably weaker than final yr, inflation is comparatively greater, and monetary spending continues unabated, each of which imply that the yield may surge following the September price minimize.

“Why the 10yr yield rose from September by December 2024 is open to interpretation, however there was an underpinning of macro resilience, sticky-ish inflation and many discuss on fiscal largesse as a medium-term threat. This time round, granted, worries on the economic system are extra intense. However offsetting this are ongoing fiscal issues, and fairly a special inflation dynamic,” analysts at ING mentioned in a notice to shoppers.

August CPI knowledge due subsequent week

When the Fed minimize charges final September, the U.S. shopper value index was nicely under 3%. Since then, it has edged again as much as 3%. Extra importantly, the August CPI knowledge, due subsequent week, is probably going to offer additional proof of inflation stickiness.

In line with Wells Fargo, the core CPI is more likely to have risen by 0.3%, holding the year-over-year price at 3.1%. In the meantime, the headline CPI is forecast to have risen 0.3% month-over-month and a pair of.9% year-over-year.