- The Dow Jones backslid on Friday, falling again beneath 45,500.

- NFP job features got here in properly beneath expectations, including additional bets to Fed price cuts.

- A steepening decline in job creation has gone too far, overshooting market hopes for price cuts and reigniting recessionary issues.

The Dow Jones Industrial Common (DJIA) sank on Friday, falling practically 500 factors at its lowest after United States (US) Nonfarm Payrolls (NFP) information confirmed the US added far fewer jobs than anticipated, pinning expectations of a Federal Reserve (Fed) rate of interest reduce on September 17.

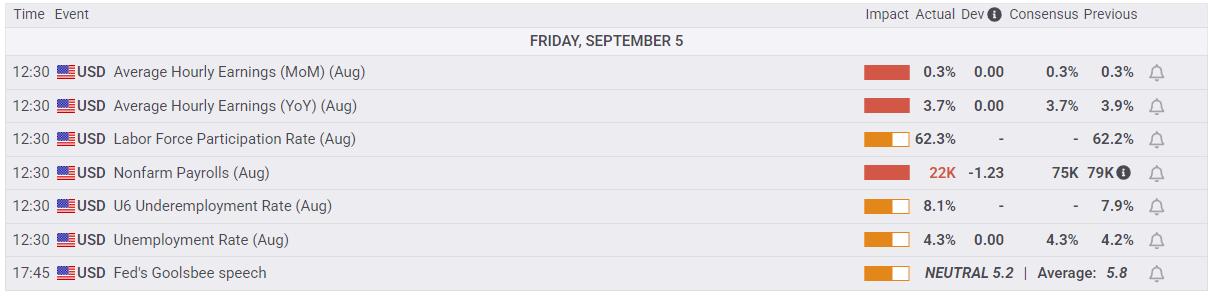

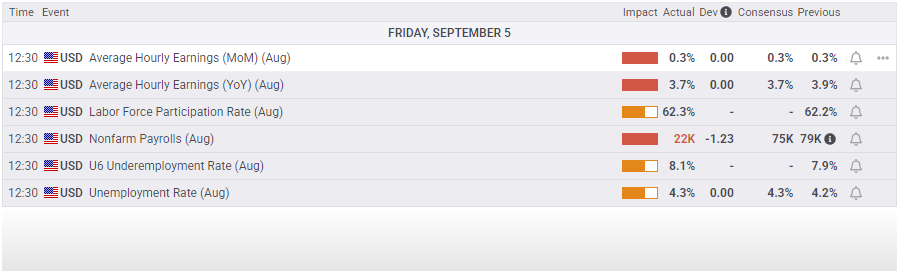

The newest NFP jobs report confirmed the US added simply 22K internet new jobs in August, coming in even decrease than the median market forecast of 75K. The earlier month’s determine was revised upward barely to 79K, however August’s sharp drop has pushed bets of a Fed price reduce into the ceiling. Market discuss of a jumbo double-cut is again on the desk, with price markets pricing in 10% odds of a 50 foundation level rate of interest trim on the Fed’s subsequent price name this month.

Equities fumble expectations for low however not too-low NFP figures

Regardless of fairness merchants getting their want for an underperforming NFP print, the newest spherical of jobs information has became a monkey’s paw situation. Whereas low hiring figures will assist push the Fed into an rate of interest reduce in a few weeks, too low of an NFP determine has reignited recession fears throughout the broader market. Regardless of hitting a brand new all-time excessive on intraday bids, the Dow Jones has recoiled sharply from file territory, paring away Thursday’s hopeful features and sending the main fairness index again into the pink for the week.

Subsequent week poses a contemporary set of challenges for information watchers. The newest spherical of Shopper Worth Index (CPI) inflation and College of Michigan (UoM) Shopper Sentiment and Inflation Expectations are due subsequent Thursday and Friday, respectively. Headline CPI inflation is once more anticipated to tick greater for the 12 months led to August, whereas market forecasts count on the UoM Shopper Sentiment Index to get well floor.

Dow Jones day by day chart

Dow Jones FAQs

The Dow Jones Industrial Common, one of many oldest inventory market indices on the earth, is compiled of the 30 most traded shares within the US. The index is price-weighted quite than weighted by capitalization. It’s calculated by summing the costs of the constituent shares and dividing them by an element, at present 0.152. The index was based by Charles Dow, who additionally based the Wall Avenue Journal. In later years it has been criticized for not being broadly consultant sufficient as a result of it solely tracks 30 conglomerates, not like broader indices such because the S&P 500.

Many alternative components drive the Dow Jones Industrial Common (DJIA). The mixture efficiency of the element firms revealed in quarterly firm earnings stories is the principle one. US and world macroeconomic information additionally contributes because it impacts on investor sentiment. The extent of rates of interest, set by the Federal Reserve (Fed), additionally influences the DJIA because it impacts the price of credit score, on which many companies are closely reliant. Due to this fact, inflation generally is a main driver in addition to different metrics which affect the Fed selections.

Dow Concept is a technique for figuring out the first pattern of the inventory market developed by Charles Dow. A key step is to match the path of the Dow Jones Industrial Common (DJIA) and the Dow Jones Transportation Common (DJTA) and solely comply with tendencies the place each are shifting in the identical path. Quantity is a confirmatory standards. The idea makes use of parts of peak and trough evaluation. Dow’s principle posits three pattern phases: accumulation, when sensible cash begins shopping for or promoting; public participation, when the broader public joins in; and distribution, when the sensible cash exits.

There are a variety of the way to commerce the DJIA. One is to make use of ETFs which permit buyers to commerce the DJIA as a single safety, quite than having to purchase shares in all 30 constituent firms. A number one instance is the SPDR Dow Jones Industrial Common ETF (DIA). DJIA futures contracts allow merchants to invest on the long run worth of the index and Choices present the fitting, however not the duty, to purchase or promote the index at a predetermined worth sooner or later. Mutual funds allow buyers to purchase a share of a diversified portfolio of DJIA shares thus offering publicity to the general index.