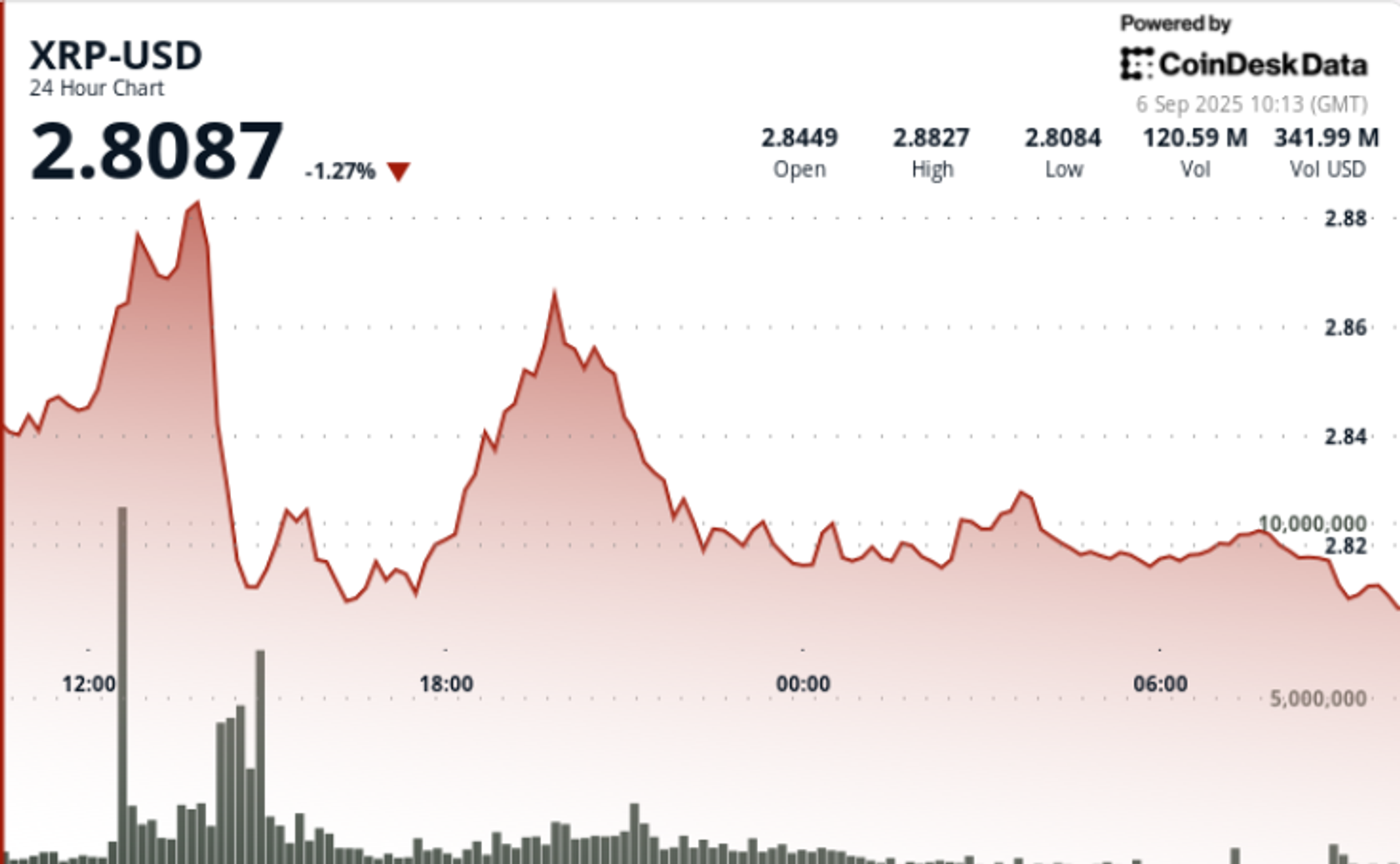

XRP didn’t maintain momentum above $2.88–$2.89, triggering a 4% decline as institutional promoting capped the advance. Heavy quantity confirmed resistance at these ranges, whereas consumers reappeared within the $2.81–$2.83 vary to stabilize worth motion.

The transfer retains XRP locked in a 47-day consolidation underneath $3.00, with merchants now eyeing the $2.77 help pivot and October’s SEC ETF choices as the following catalysts.

Information Background

- Six institutional asset managers have filed spot XRP ETF purposes, with SEC choices anticipated in October.

- Whale accumulation continues, with roughly 340 million tokens bought in current weeks regardless of persistent volatility.

- Trade balances stay elevated above 3.5 billion XRP, elevating questions of potential provide strain if promoting resumes.

- Federal Reserve coverage shifts and inflation prints are shaping broader liquidity circumstances throughout threat property.

- Earlier makes an attempt to interrupt increased noticed 227.7 million tokens commerce close to $2.88–$2.89, confirming that zone as agency resistance.

Worth Motion Abstract

- XRP traded inside a $0.08 vary from $2.81 to $2.89, representing 3% volatility.

- The sharpest decline got here at 14:00 on Sept 5, dropping from $2.88 to $2.81 on practically 280 million tokens traded.

- Stabilization adopted, with consolidation between $2.82 and $2.83 on lighter quantity.

- Closing worth close to $2.82 stored XRP simply above the $2.77 help pivot, seen as the following key draw back guardrail.

Technical Evaluation

- Help: Robust bid zone recognized at $2.77–$2.81 following repeated defenses.

- Resistance: Rapid ceiling at $2.88–$2.89, with $3.00 psychological stage and $3.30 breakout threshold above.

- Indicators: RSI sits mid-50s, reflecting neutral-to-bullish bias.

- MACD histogram converges towards bullish crossover, signaling potential momentum shift if quantity returns.

- Construction: Ongoing 47-day consolidation underneath $3.00, with an in depth above $3.30 opening potential path to $4.00+.

What Merchants Are Watching

- Whether or not $2.77 holds because the decisive help stage if promoting resumes.

- Worth conduct on retests of $2.88–$2.89 resistance, notably if quantity surpasses day by day averages.

- How whale accumulation offsets elevated trade balances, which recommend latent provide threat.

- October SEC choices on spot XRP ETFs, seen as a key institutional adoption catalyst.

- Macro drivers from Fed coverage and inflation information releases that will affect flows throughout digital property.