Cathie Wooden’s ARK Make investments has continued its crypto inventory purchasing spree, including extra shares of BitMine Immersion Applied sciences and crypto change Bullish throughout its flagship ETFs.

In accordance with commerce disclosures from Friday, ARK’s Innovation ETF (ARKK), Subsequent Technology Web ETF (ARKW), and Fintech Innovation ETF (ARKF) collectively purchased over 387,000 shares of BitMine and 144,000 shares of Bullish.

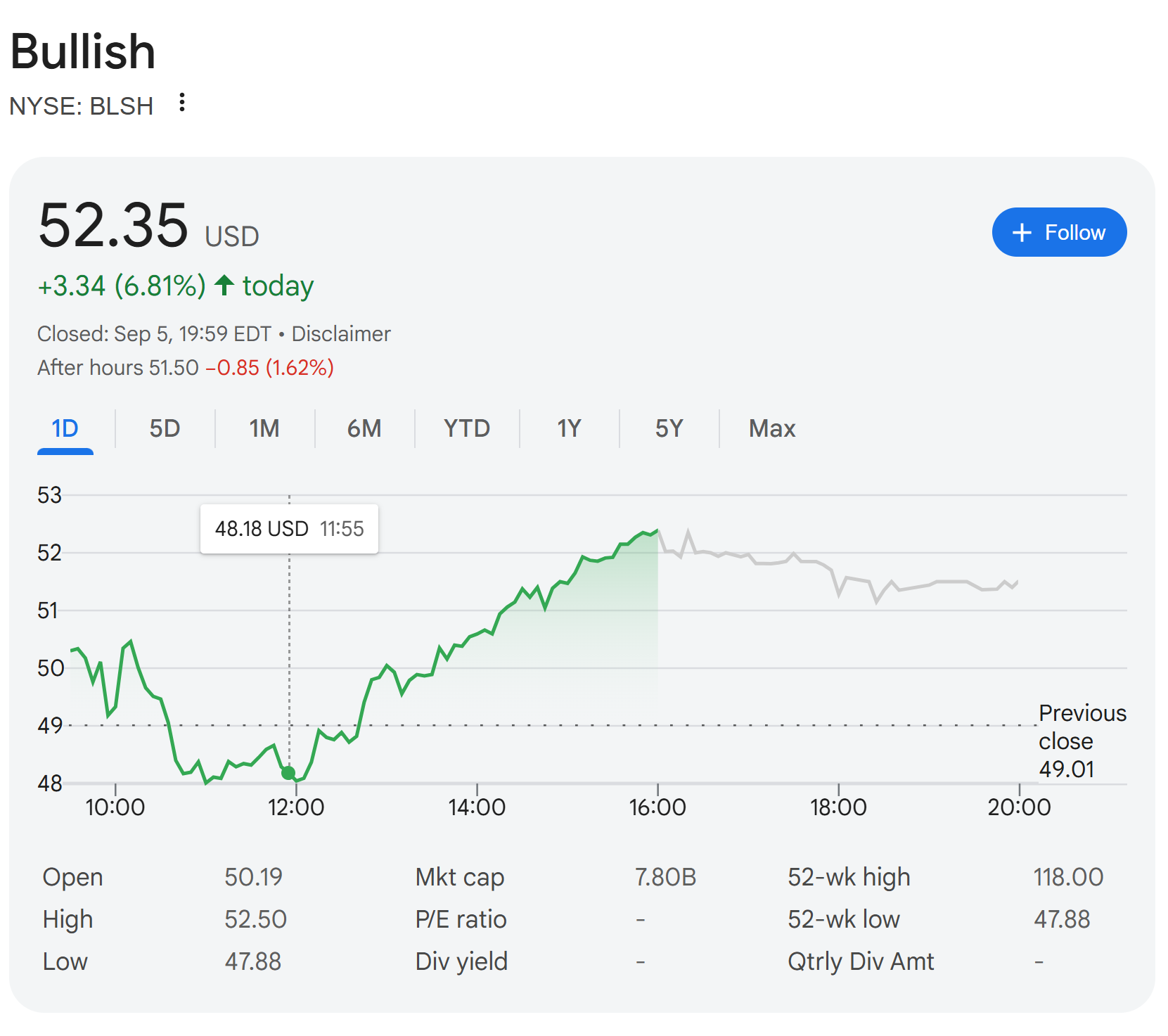

Based mostly on current market costs, the purchases quantity to roughly $16 million in BitMine and $7.5 million in Bullish inventory.

The largest BitMine purchase got here from ARKK with 257,108 shares, adopted by ARKW with 83,082 and ARKF with 47,135. For Bullish, ARKK once more led with 81,811 shares, whereas ARKW and ARKF added 39,597 and 22,498 shares, respectively.

Associated: Cathie Wooden’s ARK Make investments buys one other $15M of ETH agency BitMine

ARK continues to purchase Bullish

The most recent spherical of allocations builds on ARK’s August transfer, when the agency scooped up 2.53 million Bullish shares on its first buying and selling day, investing about $172 million throughout all three ETFs.

As reported, Bullish’s inventory surged 83.8% throughout its IPO session and raised $1.1 billion, making it one of many yr’s most-watched public listings in crypto.

Bullish, which owns CoinDesk and operates a world crypto change, went public by way of a standard IPO after its 2021 SPAC deal collapsed. The corporate runs regulated entities throughout Hong Kong, Gibraltar, Singapore, the UK and different jurisdictions.

Associated: CoinDesk proprietor Bullish ups IPO purpose to $1B as Wall Road backs crypto push

BitMine provides $65M in ETH

On Thursday, BitMine, the most important company holder of Ether (ETH), bought one other $65 million price of ETH by way of six OTC transactions by way of Galaxy Digital. This newest acquisition pushes BitMine’s holdings to greater than 1.5% of Ethereum’s circulating provide, all purchased with money and no leverage.

The purchase comes as centralized exchanges face a big Ether provide squeeze, with reserves down 38% since 2022 as a consequence of rising institutional accumulation and ETF exercise.

Journal: Bitcoin is ‘humorous web cash’ throughout a disaster: Tezos co-founder