If They Can Do it to Solar, Who’s Subsequent?’ Say Insiders as WLFI Claims Freeze Was to ‘Defend Customers’

World Liberty Monetary (WLFI) is defending its determination to freeze a whole lot of wallets, together with Tron discovered Justin Solar’s, saying the transfer was meant to guard customers from phishing-related compromises, to not stifle regular buying and selling.

“WLFI solely intervenes to guard customers, by no means to silence regular exercise,” the undertaking wrote on X.

We’ve heard group issues about current pockets blacklists. Transparency first: WLFI solely intervenes to guard customers, by no means to silence regular exercise. 🦅

— WLFI (@worldlibertyfi) September 5, 2025

WLFI mentioned earlier this week that 272 wallets have been blacklisted, with roughly 215 of these linked to a phishing assault and 150 compromised by assist channels.

Justin Solar’s WLFI handle was frozen on Friday, following a number of small “dispersion check” transfers between his personal wallets after claiming unlocked tokens at launch, none of which have been gross sales.

The outbound transfers from Solar-tagged wallets made it seem that the big-name WLFI investor was promoting his tokens, however onchain information paints a special image.

In a put up on X, Nansen founder Alex Svanevik identified that Solar’s transfers did not match the timeline of WLFI’s token decline.

Nansen information reveals Justin Solar transferred 50 million WLFI value about $9.2 million on Sept. 4 at 09:18 UTC — three to 5 hours after the token’s steepest drop — that means the switch adopted the crash quite than brought on it.

Onchain information from Nansen reveals a $12 million WLFI switch from HTX to Binance by a third-party market maker.

The tokens have been borrowed utilizing HTX’s personal capital as a part of a routine rebalance, however the transfer got here after WLFI’s sharpest declines and was too small to have moved the market, contemplating WLFI has a each day buying and selling quantity of over $700 million.

As soon as deposited on Binance, it’s inconceivable to find out whether or not the tokens have been bought or just held.

Market contributors as a substitute level to broad shorting and dumping of WLFI by market makers and buying and selling desks throughout a number of exchanges as the actual driver of the crash.

Onchain information again this view: a switch from BitGo to Flowdesk flagged by Nansen, coincided with the beginning of WLFI’s slide and has turn into a key datapoint in explaining the sell-off.

In the meantime, WLFI’s determination to freeze funds linked to the crash set off nervous chatter amongst whales, market makers, and different buying and selling desks that their tokens may very well be frozen by literal fiat.

“If they will do it to Solar, who’s subsequent?” an individual accustomed to conversations amongst massive market contributors instructed CoinDesk.

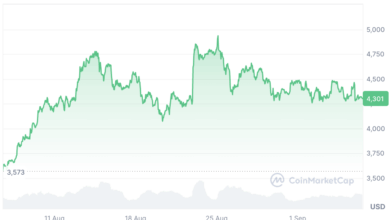

WLFI is at present buying and selling for $0.18, in response to CoinGecko. It is down 40% since itemizing.