Nasdaq’s newly proposed itemizing guidelines might give established digital asset treasury companies an edge, whereas elevating new obstacles for smaller gamers trying to incorporate cryptocurrencies into their stability sheets.

The modifications, introduced Wednesday, embody lifting the minimal public float to $15 million and fast-tracking delistings for firms that fall out of compliance.

In response to Brandon Ferrick, normal counsel at Web3 infrastructure firm Douro Labs, the proposed modifications are unlikely to harm well-managed digital asset treasury companies. As an alternative, they provide stronger gamers a buying and selling premium.

“You possibly can count on the most effective names to commerce at a premium as a result of the weaker performing companies will probably be washed out. This successfully places an mNAV premium on high-quality DATs,” Ferrick informed Cointelegraph.

A DAT is a digital asset treasury firm. A a number of of web asset worth, or mNAV, is the market’s worth of an organization relative to its digital asset holdings.

The proposed itemizing requirements function three key updates: a $15 million public minimal float for brand new listings, an acceleration of delisting firms which have “compliance deficiency” or a market worth under $5 million, and a $25 million minimal public-offering proceeds requirement “for new listings of firms principally working in China.”

The proposed $15 million minimal float might have unintended penalties, in keeping with Ferrick, making shell firms costlier and successfully elevating the barrier to entry for brand new issuers.

“The [shell companies] will turn into costlier […] which implies that the barrier to entry was simply raised.”

A shell firm is a authorized entity with little to no lively operations, usually used for functions akin to enterprise capital offers, asset administration, or company restructuring. A typical sort of shell firm is the particular function acquisition firm (SPAC), which is created to boost funds and later merge with or purchase one other agency. SPACs and different shell entities have been largely utilized in enterprise offers involving digital asset treasuries.

“Nasdaq is submitting the proposed guidelines to the SEC for evaluate and, if accredited, is proposing to implement the modifications to the preliminary itemizing necessities promptly,” the trade stated in a press release.

Nasdaq is without doubt one of the largest inventory exchanges worldwide, with a dominant presence in choices and tech shares buying and selling. As of August 2025, the trade listed 3,324 firms within the US and dealt with greater than 49 billion fairness shares in month-to-month buying and selling quantity.

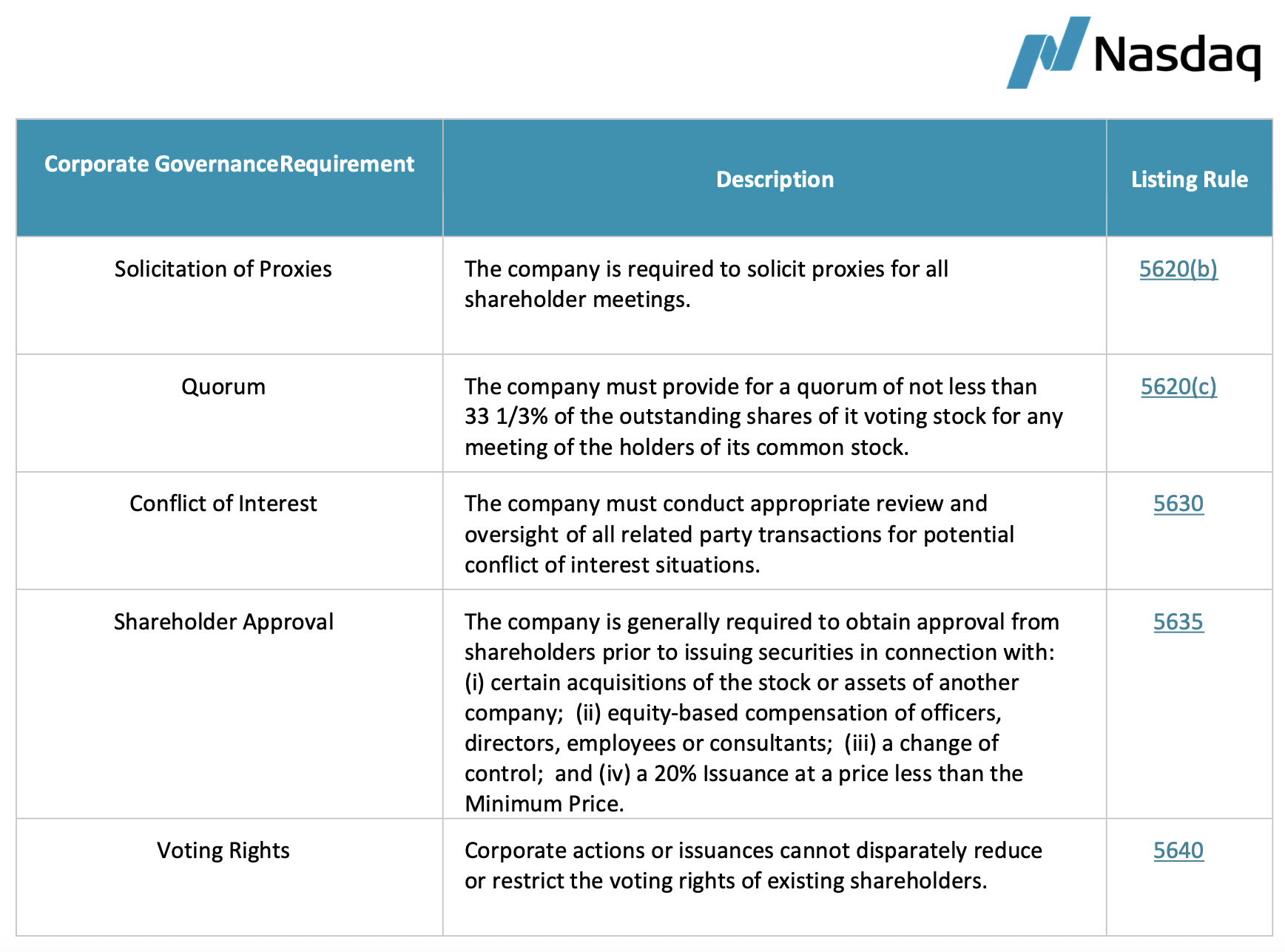

Nasdaq guidelines typically require firms to hunt shareholder approval earlier than issuing new securities tied to main acquisitions, fairness compensation, a change of management, or a sale representing 20% or extra of shares under market worth, in keeping with the trade’s itemizing heart.

Journal: How Ethereum treasury firms might spark ‘DeFi Summer season 2.0’