Gold has emerged as one of many best-performing belongings of 2025, lifted by geopolitical uncertainty, file central financial institution shopping for and skepticism over policymakers’ capability to rein in inflation as fiscal deficits widen.

Whereas Bitcoin (BTC) is commonly dubbed “digital gold,” the normal safe-haven asset is drawing renewed consideration from buyers. Gold has gained about 35% year-to-date, climbing to contemporary all-time highs above $3,600 an oz..

US retirement planners have a brand new technique to entry the metallic via blockchain-based tokenization, following a partnership between Chintai Nexus and SmartGold. The initiative provides momentum to the broader tokenization development, which is attracting rising institutional curiosity in digital belongings.

This week’s Crypto Biz explores gold’s rally, the rise of decentralized finance (DeFi) lending and the newest public providing from a crypto firm.

US IRAs acquire entry to tokenized gold

IRA supplier SmartGold has partnered with tokenization platform Chintai Nexus to permit buyers to deliver their vaulted gold onchain, the place it may be used to earn yield via DeFi lending platforms corresponding to Morpho and Kamino.

For these opting in, SmartGold’s IRA-held bullion is tokenized on a one-to-one foundation through Chintai, making a digital illustration of the underlying bodily gold, whereas preserving the self-directed IRA’s tax-deferred standing.

Gold’s tokenization development is accelerating. Worldwide Treasured Metals Bullion Group not too long ago launched tokenized merchandise throughout its provide chain, whereas Tether’s gold-backed stablecoin, XAUT, has elevated previous $1.3 billion in market worth.

DeFi lending surges on real-world asset increase

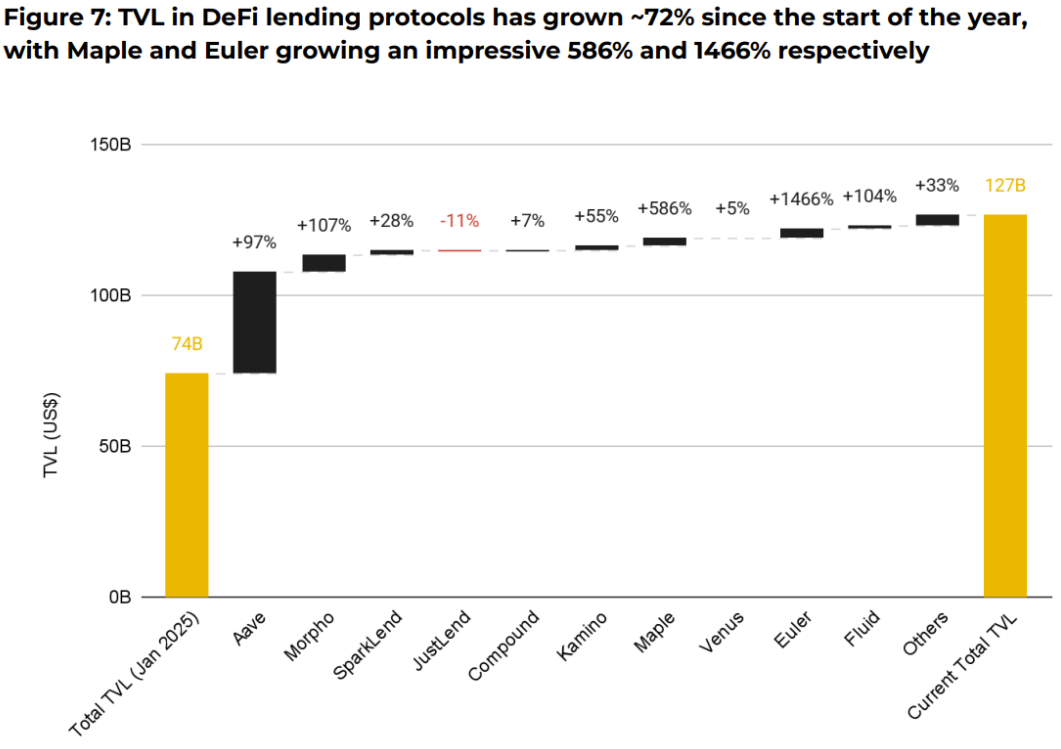

Decentralized finance lending is gaining traction amongst establishments, with the fast rise of stablecoins and real-world belongings (RWAs) driving contemporary community exercise.

In keeping with Binance Analysis, whole worth locked in DeFi lending protocols has climbed 72% to this point this yr, to $127 billion from $53 billion.

“As stablecoin and tokenized asset adoption accelerates, DeFi lending protocols are more and more positioned to facilitate institutional participation,” Binance Analysis famous in a report.

Tokenized RWAs have emerged as one in every of crypto’s fastest-growing use instances in 2025. Business knowledge exhibits the market has expanded to just about $28 billion, led by tokenized personal credit score and US Treasury bonds, with tokenized equities additionally gaining floor.

Determine Expertise eyes $526 million IPO

Determine Expertise Options has change into the newest crypto-focused firm to pursue a US preliminary public providing (IPO), aiming to boost as much as $526 million at a valuation of greater than $4 billion.

In keeping with regulatory filings, the corporate plans to promote 21.5 million shares priced between $18 and $20. Determine had beforehand signaled its intention to go public, and if the deal proceeds as anticipated, the IPO may very well be priced as early as Wednesday.

Determine, finest recognized for providing monetary merchandise on the Provenance Blockchain, reported $191 million in income in the course of the first half of the yr. Whereas the focused valuation might seem formidable, the corporate was valued at $3.2 billion in 2021.

A number of crypto corporations have not too long ago gone public or indicated plans to take action. As Cointelegraph reported, crypto alternate Gemini is pursuing a list that might elevate as much as $317 million, whereas separate studies counsel Kraken is in search of to boost about $500 million.

Gryphon finalizes merger with American Bitcoin

Shareholders of Gryphon Digital Mining have accepted a merger with American Bitcoin, a mining firm linked to the household of US President Donald Trump. The mixed entity will commerce below the ticker image “ABTC.”

As a part of the deal, a reverse inventory cut up diminished Gryphon’s excellent shares to about 16.6 million from 82.8 million. The transfer follows an preliminary settlement introduced in Might, when American Bitcoin outlined its intention to go public via a merger with Gryphon.

American Bitcoin itself is a rebrand of American Knowledge Heart, launched in March by Trump’s sons, and is affiliated with mining firm Hut 8. At its debut, the corporate described itself as a “pure-play” Bitcoin miner with plans to build up important holdings of the cryptocurrency.

Crypto Biz is your weekly pulse on the enterprise behind blockchain and crypto, delivered on to your inbox each Thursday.