Key factors:

-

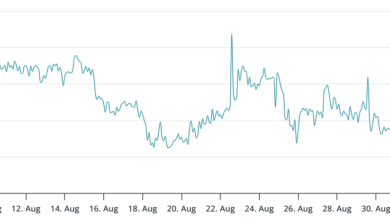

Bitcoin rallied above $113,000 on Friday, however the lengthy wick on the candlestick exhibits stable promoting at larger ranges.

-

A number of main altcoins are attempting to carry on to their help ranges, however the bears have maintained their promoting stress.

Sellers pulled Bitcoin (BTC) under $110,000 on Thursday, however the bulls bought the dip and pushed the value above $113,000 on Friday. Larger ranges attracted promoting by the bears making an attempt to drag the BTC worth again under $110,000.

In keeping with Glassnode’s newest The Week Onchain Report, BTC’s essential degree to look at on the upside is $116,000. If patrons pierce the $116,000 resistance, BTC may begin the following leg of the uptrend. Then again, BTC dangers falling to the $93,000 to $95,000 vary if the $104,000 degree cracks.

Alphractal founder and CEO Joao Wedson mentioned in a submit on X that BTC’s fractal cycle could finish in October 2025, however earlier than that, a transfer to $140,000 is feasible. If BTC tops out in October, it dangers getting into a bear market in 2026, which may pull the value under $50,000. Wedson added that he was desperate to see if BTC’s 4-year cycle had ended as a result of sturdy demand from exchange-traded funds and institutional traders, as some analysts declare.

What are the essential help ranges to be careful for in BTC and the main altcoins? Let’s analyze the charts of the highest 10 cryptocurrencies to seek out out.

Bitcoin worth prediction

BTC bulls pushed the value above the 20-day exponential transferring common ($112,093) however couldn’t maintain the upper ranges.

Sellers must swiftly tug the value under $109,000 to retain the benefit. The Bitcoin worth could then descend to $107,250, a significant degree to be careful for. If the help breaks down, the BTC/USDT pair could plunge to $105,000 after which to $100,000.

Patrons must push and maintain the value above the 20-day EMA to point power. The pair could then climb to the 50-day easy transferring common ($115,304), which may entice sellers. If patrons overcome the sellers, the rally may attain $120,000 and finally $124,474.

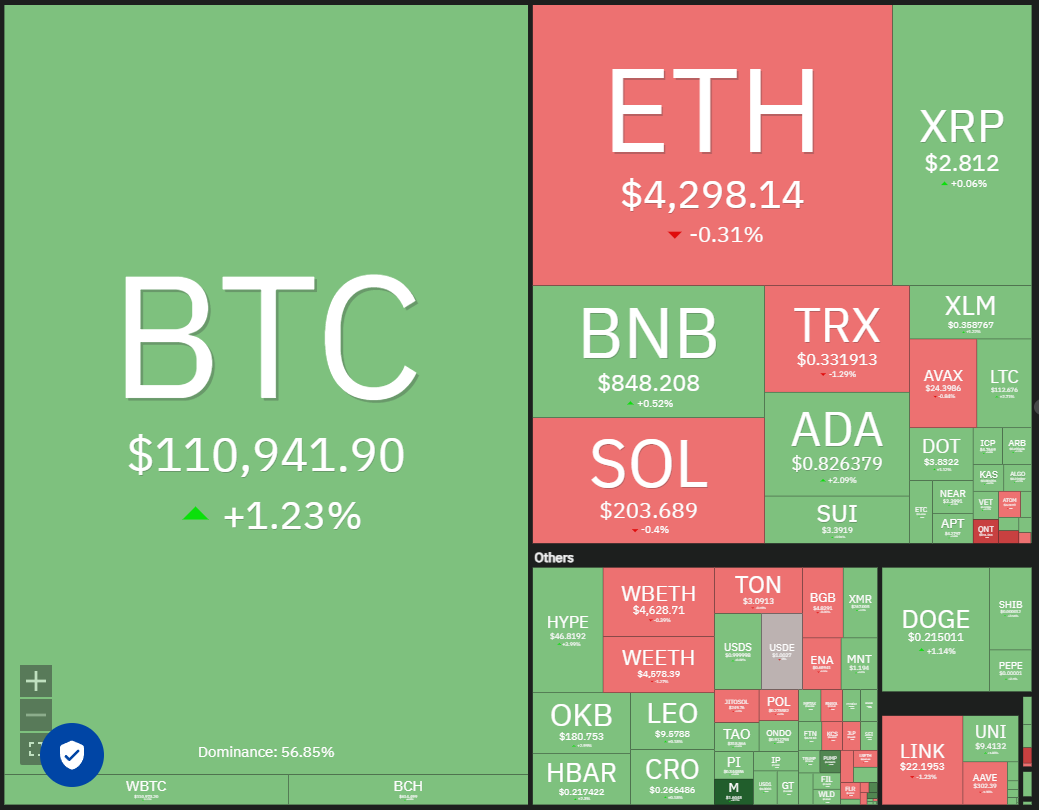

Ether worth prediction

ETH (ETH) has been buying and selling in a good vary between $4,500 and $4,250 for the previous few days, indicating a stability between provide and demand.

The flattish 20-day EMA and the RSI close to the midpoint don’t give a transparent benefit both to the bulls or the bears. If the value rises above $4,500, it suggests the bulls are again within the recreation. The ETH/USDT pair could rally to $4,664 after which to $4,957.

Alternatively, if the value continues decrease and slips under $4,250, the pair may dip to the breakout degree of $4,094. Patrons are anticipated to vigorously defend the $4,094 degree as a result of a break under it might sink the Ether worth to $3,745.

XRP worth prediction

XRP (XRP) has shaped a descending triangle sample, which is able to full on a break and shut under $2.73.

The downsloping 20-day EMA ($2.90) and the RSI slightly below the midpoint point out a bonus to sellers. If the value turns down sharply from the 20-day EMA, the chance of a break under $2.73 will increase. The XRP/USDT pair may then plummet towards $2.20.

Contrarily, a break above the 20-day EMA suggests the bears are dropping their grip. The XRP worth could then attain the downtrend line, the place the bears are anticipated to mount a robust protection. A break and shut above the downtrend line negates the bearish setup, clearing the trail for a rally to $3.40 after which $3.66.

BNB worth prediction

BNB (BNB) has been witnessing a tricky battle between the bulls and the bears on the 20-day EMA ($848).

The flattish 20-day EMA and the RSI simply above the midpoint don’t give a transparent benefit both to the bulls or the bears. If the value skids under $840, the following cease may very well be the 50-day SMA ($816). Patrons will attempt to stall the pullback within the zone between the 50-day SMA and the $794 degree.

The primary signal of power on the upside will likely be a break and shut above $881. That means the bulls are again within the driver’s seat. The BNB worth may decide up momentum above $900 and rally to $1,000.

Solana worth prediction

Solana (SOL) turned down from the $210 degree on Thursday however is taking help on the 20-day EMA ($198).

The bulls will attempt to seize management by pushing the value above the $218 resistance. If they’ll pull it off, the SOL/USDT pair will full a bullish ascending triangle sample, beginning the following leg of the up transfer to $240 and finally to $260.

Sellers must yank the value under the uptrend line to invalidate the bullish setup. The pair could fall to $175 after which to $155, the place patrons are anticipated to step in. That might preserve the Solana worth contained in the $155 to $218 vary for just a few days.

Dogecoin worth prediction

Dogecoin (DOGE) has been buying and selling between the transferring averages and the $0.21 help for just a few days.

The progressively downsloping 20-day EMA ($0.21) and the RSI slightly below the midpoint give a slight benefit to the bears. A break and shut under $0.21 tilts the benefit in favor of the bears. The DOGE/USDT pair could then drop to $0.19, bringing the big $0.14 to $0.29 vary into play.

Patrons must drive the Dogecoin worth above the 50-day SMA ($0.22) to achieve power. The pair could then march towards $0.26.

Cardano worth prediction

Patrons tried to push Cardano (ADA) above the 20-day EMA ($0.84) on Friday, however the bears held their floor.

There’s help at $0.80, but when the extent offers means, the ADA/USDT pair may tumble to the help line of the descending channel sample. A bounce off the help line is predicted to face promoting on the 20-day EMA. If that occurs, the probability of a break under the help line will increase. The Cardano worth could then descend to $0.68.

Contrarily, a detailed above the 20-day EMA means that the promoting stress is lowering. The pair could then attain the downtrend line. Patrons must pierce the downtrend line to sign the beginning of a brand new up transfer to $1.02.

Associated: Bitcoin worth ignores main US payrolls miss to erase $113.4K surge

Chainlink worth prediction

Chainlink (LINK) turned down from the 20-day EMA ($23.24) on Thursday, signaling that the bears are aggressively defending the extent.

Sellers will attempt to pull the value to the 50-day SMA ($21.19), which is prone to act as sturdy help. If the value rebounds off the 50-day SMA and breaks above $24.10, it means that the bears are dropping their grip. The LINK/USDT pair could then climb to $26 and subsequently to $28.

Opposite to this assumption, a break and shut under the 50-day SMA may sink the Chainlink worth to the uptrend line.

Hyperliquid worth prediction

Hyperliquid (HYPE) bounced off the 20-day EMA ($44.78) on Friday, indicating stable shopping for by the bulls.

If patrons preserve the value above $46.50, the HYPE/USDT pair may rally to the $49.88 to $51.19 overhead resistance zone. Sellers are anticipated to defend the resistance zone with all their may as a result of a detailed above it completes a bullish ascending triangle sample. The Hyperliquid worth could then surge towards the sample goal of $64.25.

This optimistic view will likely be invalidated within the close to time period if the value turns down and breaks under the uptrend line. The pair could droop to $40 after which to $35.51.

Sui worth prediction

Sui (SUI) turned down from the 20-day EMA ($3.43) on Thursday, however the bulls are attempting to kind a help at $3.26.

The bulls will attempt to strengthen their place by pushing Sui’s worth above the 20-day EMA. In the event that they do this, the SUI/USDT pair may rally to the 50-day SMA ($3.64). It is a essential degree to be careful for as a result of a break above the 50-day SMA suggests the value could swing between $3.26 and $4.44 for some extra time.

The bears must tug the value under the $3.11 degree to achieve the higher hand. The pair could then droop to $2.80.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a choice.