Key takeaways:

-

Bitcoin briefly surged to $113,000 earlier than reversing after weaker-than-expected US payrolls information.

-

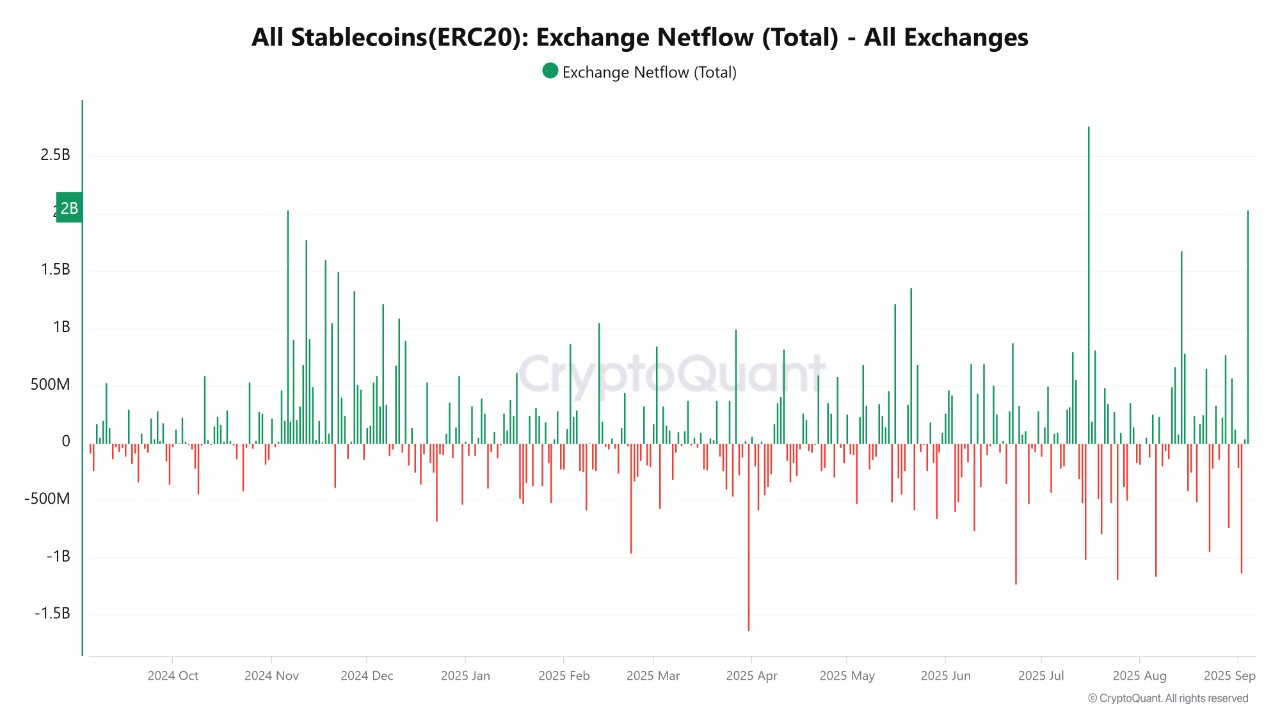

Onchain flows present $2 billion in stablecoin inflows and document open curiosity close to all-time highs.

-

A weekly shut above $112,500 is required to verify a long-lasting market backside.

Bitcoin (BTC) has rallied as a lot as 4.75% this week, rising to $113,384 from $109,250, extending its bullish momentum into the US Nonfarm Payrolls (NFP) launch on Friday.

The information got here in considerably weaker than anticipated, with solely 22,000 jobs added in August versus forecasts of 75,000 and July’s 73,000 print. The unemployment price ticked as much as 4.3%, according to expectations however increased than July’s 4.2%, whereas wage development slowed to three.7% year-over-year from 3.9%.

For danger belongings like Bitcoin, weaker labor market information strengthens the case for Federal Reserve price cuts. With Fed minimize odds at 88.2%, the report underscores cooling inflationary pressures and will increase the probability of liquidity injections. Decrease charges and greenback weak spot sometimes act as a tailwind for crypto markets.

Onchain information alerts counsel that the market was getting ready for this final result a day prior. Stablecoin inflows into exchanges surged to over $2 billion, with merchants parking liquidity on the sidelines.

Traditionally, such exercise displays “dry powder” able to rotate into BTC and ETH as soon as a catalyst emerges. On the identical time, Bitcoin’s open curiosity has climbed above $80 billion, close to all-time highs, regardless of worth consolidation round $110,000, an indication that leveraged positions are constructing slightly than unwinding.

The mix of easing macroeconomic stress and bullish onchain positioning units the stage for volatility, however the structural bias stays upward. With liquidity primed and sentiment shifting risk-on, Bitcoin could also be getting ready to carve out a backside and ignite its subsequent leg increased.

Associated: Uncommon Binance Bitcoin backside sign fires: Will bulls or bears profit?

Is the Bitcoin backside in?

Following the weaker-than-expected NFP print, Bitcoin initially tracked increased however rapidly reversed, sliding 1.5% after the New York session open. The drop pushed BTC again beneath $111,000, after retesting the important thing provide zone between $112,500 and $113,650.

These abrupt intraday pullbacks typically stem from early lengthy liquidations, with over $63 million erased within the final 4 hours, alongside potential stop-hunting by market makers capitalizing on crowded positioning earlier than resetting pattern route.

On the one-hour chart, the construction stays constructive. Regardless of the setback, Bitcoin continues to carve out increased highs and better lows, a basic signal of an uptrend. Until BTC decisively closes beneath $109,500, the short-term bullish construction holds, with the dip trying extra like a liquidity sweep than a real pattern shift.

Zooming out, the upper time frames inform a extra cautious story. With two days left earlier than the weekly shut, it’s untimely to name a confirmed backside. A decisive shut above $112,500 would meaningfully strengthen the case {that a} base has fashioned close to $107,500.

Till then, the broader market stays in a transitional section, balancing between macro-driven optimism and native provide pressures. In brief, the lower-timeframe bias stays bullish, however affirmation of a sturdy backside rests on the weekly shut holding above resistance.

Associated: Bitcoin worth ignores main US payrolls miss to erase $113.4K surge

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a call.