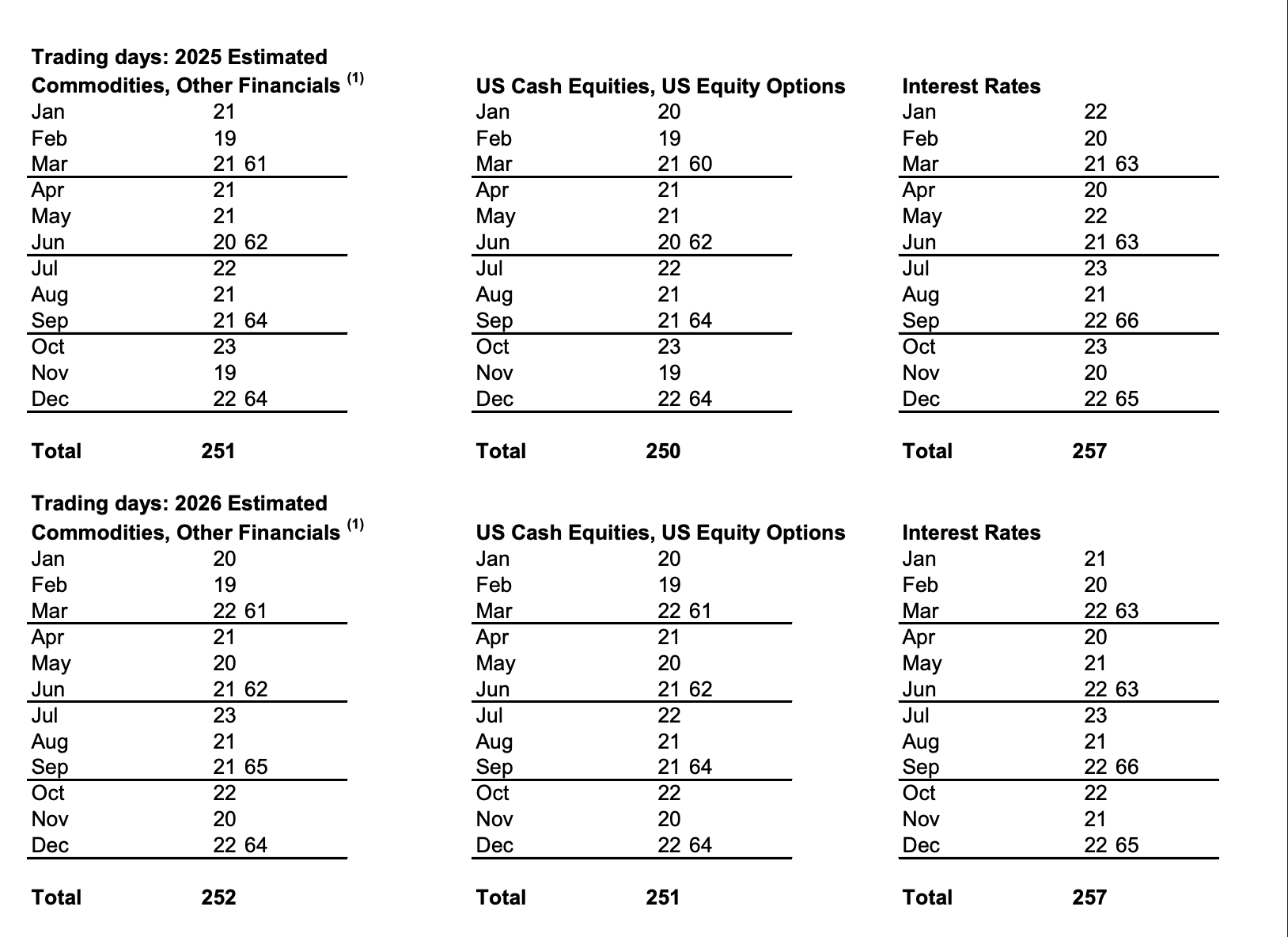

The US Securities and Alternate Fee (SEC) and the Commodity Futures Buying and selling Fee (CFTC) launched a joint assertion on Friday exploring a doable shift to 24/7 capital markets and rules for crypto derivatives.

Scaling onchain finance requires a 24/7 buying and selling atmosphere throughout asset lessons, the regulators mentioned within the assertion.

Crafting regulatory readability for occasion contracts and perpetual futures — futures contracts with out an expiry date — was additionally a precedence. Nonetheless, the businesses clarified:

“Additional increasing buying and selling hours might higher align US markets with the evolving actuality of a worldwide, always-on economic system. Increasing buying and selling hours could also be extra viable in some asset lessons than others, so there might not be a one-size-fits-all method for all merchandise.”

The potential pivot to “always-on” monetary markets would enhance capital velocity but in addition enhance danger for merchants, exposing their in a single day and long-term positions to market contributors in numerous time zones, who might knock them out of trades whereas they sleep.

Associated: SEC’s agenda proposes crypto secure harbors, broker-dealers reforms

CFTC and SEC push Trump administration’s crypto targets ahead

US president Donald Trump’s administration printed its crypto report in July, outlining interagency coverage suggestions to develop a complete framework for the digital economic system.

The report directed the SEC and CFTC to determine cooperative oversight over the crypto sector, with the CFTC having the “clear authority” to manage spot crypto markets, whereas the SEC would have purview over tokenized securities.

In August, the CFTC introduced a pathway for offshore crypto exchanges to serve US purchasers via the International Board of Commerce (FBOT) framework.

The FBOT registry permits regulated offshore exchanges throughout all asset lessons to use for a license to do enterprise in the USA and has existed for the reason that Nineties.

The Trump administration’s July crypto report additionally advisable the event of quantum-resistant structure to safeguard cryptographic protocols from assault by quantum computer systems that will crack trendy encryption requirements sooner or later.

The SEC’s Crypto Property Job Pressure is at the moment reviewing a proposal to quantum-proof digital belongings earlier than the present encryption requirements that safe banking, finance and navy purposes are breached by a quantum system.

Journal: SEC’s U-turn on crypto leaves key questions unanswered