Crypto markets rapidly bought off in mid-morning U.S. Friday hours at the same time as August employment information argued for a fast tempo of financial easing from the Federal Reserve.

At first, information that the U.S. added simply 22,000 jobs final month had all markets – crypto, shares, bonds and gold — in rally mode amid anticipation of the Fed chopping its benchmark rate of interest 25 and even 50 foundation factors later in September.

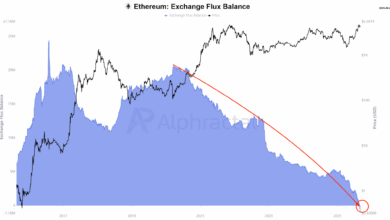

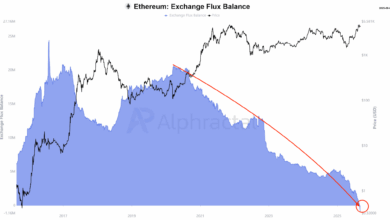

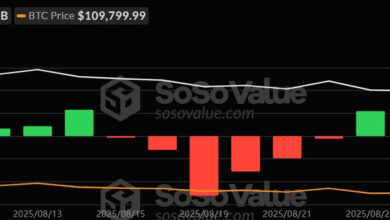

Issues, nevertheless, rapidly reversed following the opening of the inventory market. Main the way in which decrease, was ether (ETH), which shed practically 4% in a way of minutes and is now down by 1.5% over the previous 24 hours at $4,279. Solana and XRP suffered comparable percentage-wise declines. Bitcoin outperformed a bit, sliding nearer to 2.5%, however nonetheless remaining barely greater over the previous day at $110,500.

U.S. shares reversed early features, with the Nasdaq now down 0.6% and S&P 500 0.7%. Gold, nevertheless, continues to draw capital — although decrease by a hair since touching a report excessive of $3,654 following the roles information, the yellow metallic remains to be up 0.9% for the session.

“There’s barely been any job development previously 4 months,” Heather Lengthy, chief economist at Navy Federal, wrote on X. “The Federal Reserve has to chop in September. And possibly October now.”

Merchants on the Chicago Mercantile Change (CME) have shifted their opinion on the dimensions of the Fed’s minimize in September. Earlier than this morning’s report, odds of a 25 foundation level charge minimize had been primarily 100%, however that is now slipped to 86%, with a 14% likelihood of a 50 foundation level transfer.

President Trump additionally weighed in on his Reality Social: Jerome ‘Too Late”‘Powell ought to have lowered charges way back. As typical, he is ‘too late’.”

“The warning bell that rang within the labor market a month in the past simply acquired louder,” stated Olu Sonola, Head of US Financial Analysis at Fitch Scores. “A weaker-than-expected jobs report all however seals a 25-basis-point charge minimize later this month,” he continued. “Close to time period, the Fed is more likely to prioritize labor market stability over its inflation mandate, at the same time as inflation drifts farther from the two% goal. 4 straight months of producing job losses stand out. It’s laborious to argue that tariff uncertainty isn’t a key driver of this weak spot.”

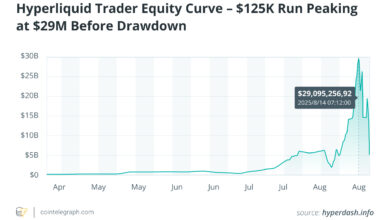

A examine of crypto-related shares finds this week’s sizable weak spot persevering with. Coinbase (COIN) is decrease by 4%, Circle (CRLC) by 7.5%, Technique (MSTR) by 1.5%, MARA Holdings (MARA) by 3.2%.

Main ether treasury names Bitmine Immersion (BMNR) and Sharplink Gaming (SBET) are down 5.4% and 6%, respectively.