The verification course of on grownup platforms may be extra cumbersome than Know Your Buyer (KYC) checks on cryptocurrency exchanges — although added problem doesn’t essentially mirror stronger compliance.

Signing up as a mannequin on OnlyFans or Pornhub isn’t all that totally different from opening an account on a crypto buying and selling platform. The method typically begins with a Google login (or different on-line accounts, relying on the change), adopted by the acquainted ritual of selfies and ID uploads.

Each grownup platforms and crypto exchanges are underneath mounting scrutiny over how they confirm customers — one to forestall minors from promoting express content material, the opposite to cease criminals from laundering cash.

To check how these methods work in observe, Cointelegraph tried to move id checks on each forms of platforms. The outcomes present that grownup websites typically frustrate creators with repeated rejections and arbitrary hurdles, whereas crypto exchanges impose extra structured checks tied to monetary regulation.

KYC in crypto vs. OnlyFans and Pornhub

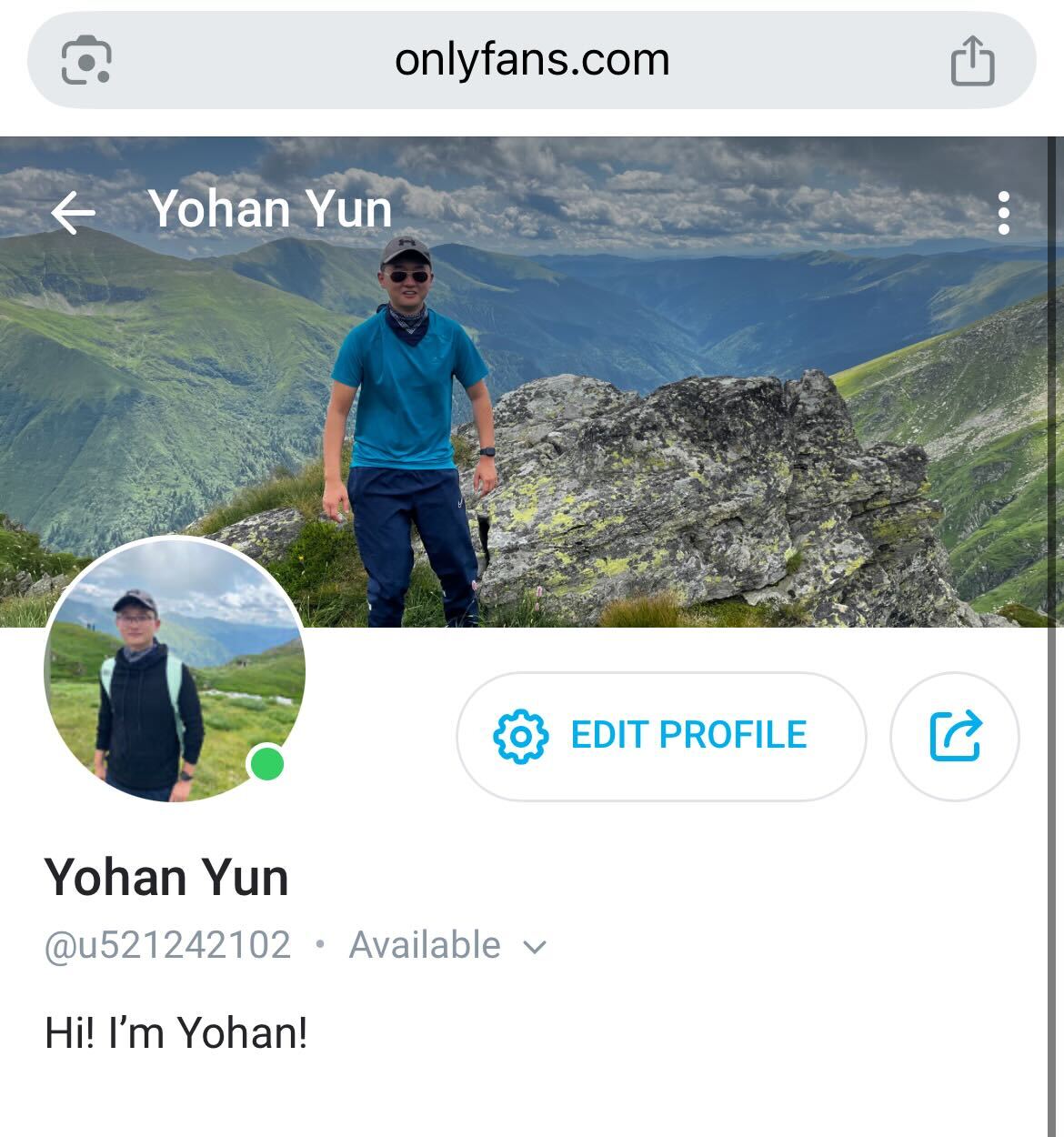

On OnlyFans, verification went past a normal ID and selfie to incorporate an handle, a number of resubmissions and social media handles. The appliance was denied after the platform claimed the profile picture and selfie didn’t meet its requirements, although they adopted the said circumstances. OnlyFans later stated the supplied social media hyperlinks have been invalid although they have been respectable.

Cointelegraph refiled the small print, however the software was rejected once more. When approached for remark, OnlyFans’ media staff didn’t handle particular questions. As a substitute, they referred to the transparency heart, which states that the platform invests closely in expertise and moderation groups.

Cointelegraph’s software rejection is just not a singular case. OnlyFans creator profiles have a low acceptance charge. In July, the platform acquired 184,844 creator purposes, of which solely 35% have been permitted.

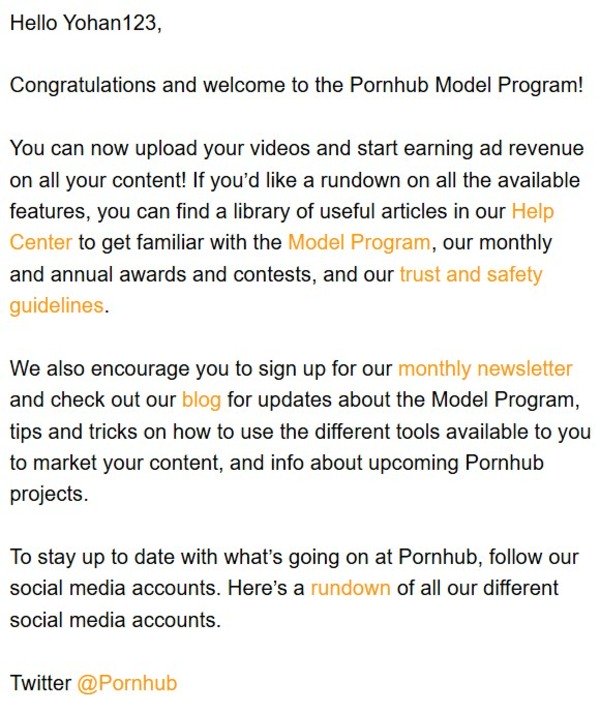

Pornhub additionally rejected Cointelegraph’s software, citing solely “different” as the rationale. A second try utilizing a passport was later permitted, coincidentally after a media inquiry. Pornhub didn’t reply to a request for remark.

Joshua Chu, an asset restoration lawyer and co-chair of the Hong Kong Web3 Affiliation, additionally independently performed these assessments. His OnlyFans creator software was equally rejected.

“I seemed into becoming a member of as a performer, solely to seek out the verification course of considerably extra rigorous than anticipated,” Chu advised Cointelegraph. “I finally didn’t succeed.”

“Throughout the identical interval, I’ve opened and verified a number of crypto change accounts, together with ones not even formally purported to be working in Hong Kong, and buying and selling there proved much less difficult,” he added.

Associated: Stripper index doesn’t apply to Bitcoin, OnlyFans fashions say

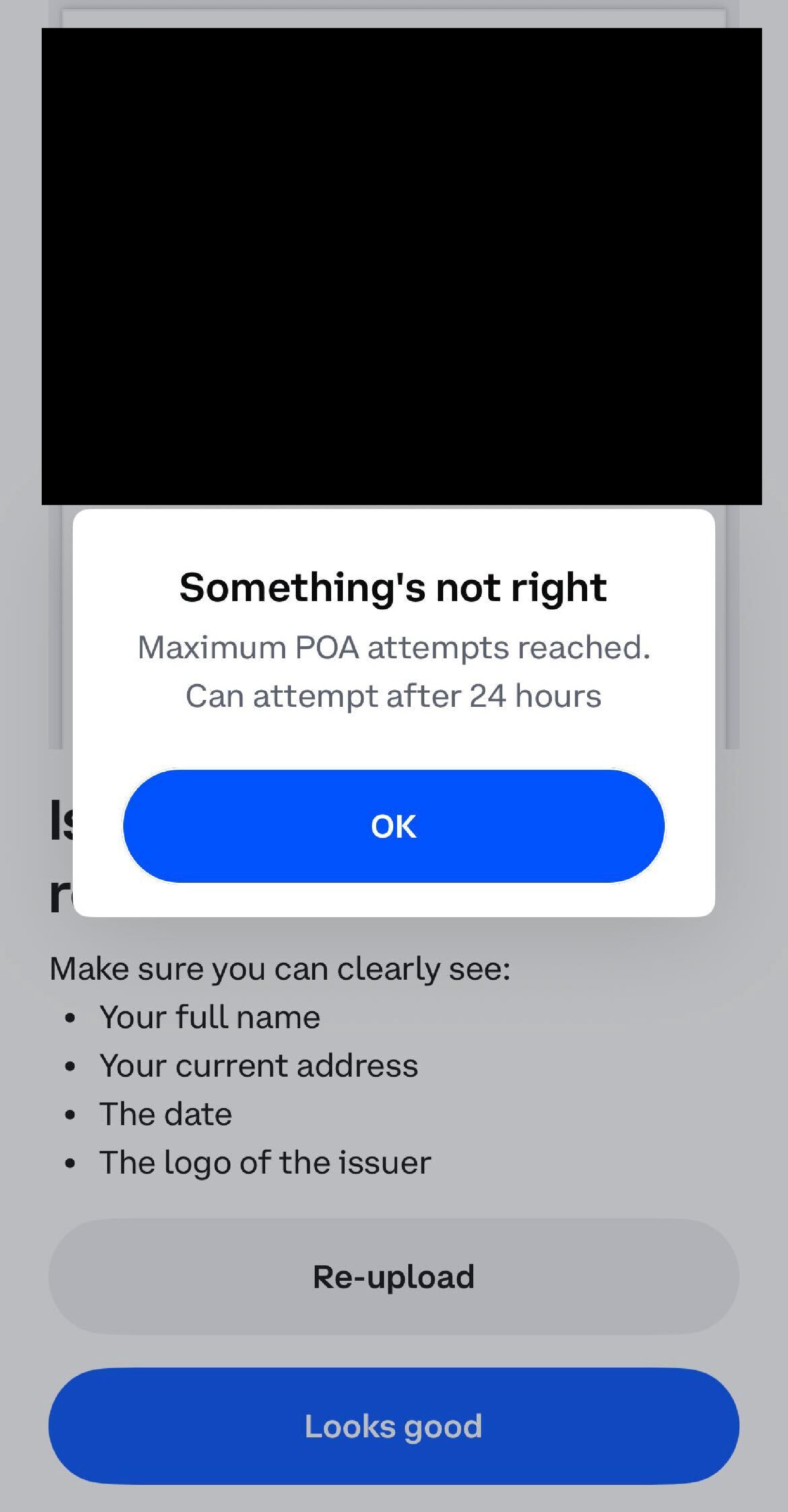

Crypto exchanges Coinbase, Bybit and Bitget centered their checks on monetary documentation, supply of funds and proof of handle. Cointelegraph tried to move KYC on every of those platforms to measure how their processes in contrast.

On Coinbase, registration started with a Google login and SMS verification, adopted by questions on employment and the anticipated supply of funds. The change required proof of handle by paperwork reminiscent of a financial institution assertion or utility invoice. The check was performed on Sept. 1, and a financial institution assertion with minimal transactions submitted by Cointelegraph was rejected a number of occasions. The appliance was locked for twenty-four hours. Cointelegraph returned to the appliance after the time expired, and a July financial institution assertion was accepted and permitted. A small 6-euro deposit was made to Coinbase by way of its banking companion, Estonia-based LHV Pank, to check the on-ramp.

Bybit redirected European Union customers to its licensed subsidiary, the place verification was accomplished by normal ID checks. A video of a tilted passport needed to be taken to show its hologram. The method was accomplished inside minutes.

Bitget supplied the quickest approval: A easy ID add and selfie unlocked crypto transfers in about 10 minutes. Further verification was wanted to commerce crypto towards fiat, requiring cellphone and e mail codes and a linked financial institution card.

Coinbase and Bybit didn’t reply to Cointelegraph’s request to touch upon the story.

Bitget, when requested how the platform’s KYC verification happens virtually immediately, responded by saying it depends on its eKYC service suppliers and its evaluate staff.

“Grownup content material platforms, then again, typically depend on extra conservative, typically handbook or third-party age checks — suppose uploaded scans, liveness assessments or bank card checks,” Hon Ng, Bitget’s chief authorized officer, advised Cointelegraph.

“It’s not that grownup websites are deliberately extra rigorous; typically, it’s that the necessities themselves are murkier,” Ng stated.

“For crypto exchanges, KYC is a well-charted, globally acquainted course of; for age verification in grownup content material, the foundations are newer, interpreted otherwise throughout jurisdictions and tangled in privateness debates.”

How OnlyFans and crypto ended up with stricter verifications

Id checks weren’t at all times strict in both grownup platforms or cryptocurrency exchanges. Each industries tightened their processes solely after scandals and regulatory stress made the established order unsustainable.

Pornhub was compelled to overtake its system in 2020 after a New York Instances opinion article revealed underage and non-consensual movies on the location. Visa and Mastercard rapidly suspended cost companies, whereas the platform deleted thousands and thousands of unverified uploads and required all content material creators to move authorities ID verification.

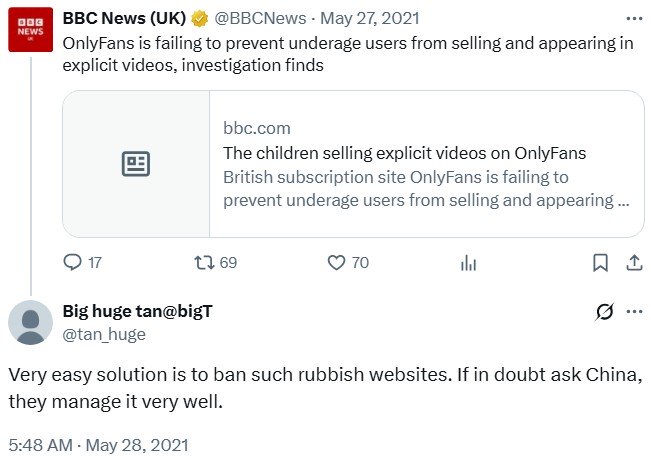

OnlyFans confronted related scrutiny in 2021 because the platform exploded in recognition throughout the pandemic. A BBC Information investigation discovered that minors have been promoting and showing in express movies on the platform. The BBC discovered instances of minors utilizing pretend IDs and social media profiles of kinfolk to bypass the platform’s restrictions.

In March 2025, UK communications watchdog Ofcom fined OnlyFans’ father or mother firm, Fenix Worldwide, 1.05 million British kilos (about $1.4 million) for offering inaccurate details about its age-verification system. The regulator stated it had twice requested particulars in 2022 and 2023 in regards to the platform’s “facial age estimation” software, which was supposed to dam minors.

Crypto exchanges adopted a parallel however separate path. For years, platforms reminiscent of BitMEX and Binance allowed customers to commerce with little or no verification, drawing the ire of economic regulators.

Associated: FATF’s crypto guidelines hints on the subsequent regulatory crackdown

BitMEX first settled with US regulators in 2021, agreeing to pay $100 million resulting from Anti-Cash Laundering (AML) and registration failures. In 2024, the change pleaded responsible to violating the Financial institution Secrecy Act, and in January 2025, a federal decide imposed one other $100-million legal superb together with probation. KuCoin was a newer instance, pleading responsible in 2025 to working as an unlicensed cash transmitter and agreeing to pay almost $300 million in penalties for optionally available and inconsistent KYC.

OnlyFans, Pornhub and crypto discovered the arduous method

In each industries, id checks solely grew to become stricter after a scandal and enforcement made inaction inconceivable.

Pornhub and OnlyFans toughened their requirements after revelations of underage customers and youngster safety failures. Crypto exchanges did so solely after regulators imposed heavy fines and legal expenses for weak AML safeguards.

From 2021, the Monetary Motion Job Pressure up to date its international steerage to use AML requirements to crypto, that means exchanges needed to undertake KYC guidelines just like banks.

“KYC is essential for figuring out and pursuing unhealthy actors; it’s actually the muse of efficient asset restoration work. Nevertheless, in observe, I’ve noticed that some exchanges have gaps of their KYC information or fail to correctly confirm key paperwork like handle proofs,” Chu stated.

“With the rise of AI-generated fakes, these weaknesses have change into extra pronounced. Though there are enhancements, crypto KYC requirements nonetheless lag behind conventional finance in integrity and thoroughness.”

In the present day, onboarding as a creator on an grownup website can contain extra hoops than opening an account on a crypto change, however that doesn’t imply their methods are safer or correct. OnlyFans has not expanded on why Cointelegraph’s software was rejected regardless of the submission of correct documentation and social profiles.

Each sectors finally share the identical trajectory: Programs tightened solely after crises uncovered their weaknesses, and as we speak’s stricter checks are the product of these classes discovered the arduous method.

Journal: Astrology might make you a greater crypto dealer: It has been foretold