Tether, the issuer of the world’s largest stablecoin USDT, is reportedly discussing deepening its funding in gold mining firms as a part of its wider enlargement technique.

In line with a Sept. 5 Monetary Instances report, the corporate has held discussions with mining and funding teams to discover alternatives throughout your entire gold provide chain.

If the plan materializes, it could permit Tether to take part in each stage of the method—from mining and refining to buying and selling and royalties.

Tether has not responded to CryptoSlate’s request for remark as of press time.

In the meantime, the discussions coincide with renewed power within the gold market.

Buyers in search of safe-haven property through the present international financial atmosphere have pushed the valuable steel’s value to a brand new all-time excessive of $3,550 per ounce.

This value rally has created a positive backdrop for Tether’s curiosity within the sector.

Tether’s gold embrace

Tether’s reported curiosity in gold mining builds on its earlier strikes into the sector.

The corporate spent practically $90 million in June to safe a controlling stake in Canadian royalty agency Elemental Altus Royalties Corp. The deal concerned buying 78.4 million widespread shares from La Mancha Investments, giving Tether 31.9% possession and the choice to lift its stake to 50%.

The Crypto Investor Blueprint: A 5-Day Course On Bagholding, Insider Entrance-Runs, and Lacking Alpha

On Sept. 4, the stablecoin issuer agreed to increase its stake within the gold-focused agency by buying a further $100 million value of the corporate shares.

Past fairness offers, Tether already points Tether Gold (XAUT), a number one gold-backed digital token. The agency disclosed in July that XAUT is backed by greater than 7.66 tons of gold saved in Switzerland.

Notably, Tether has additionally reported that its gold holdings characterize over 5% of the reserves for its USDT stablecoins.

Tether’s enlargement into gold indicators a method of linking tangible property with blockchain finance at a time when each safe-haven demand and stablecoin adoption are rising

USDT dominance continues

Whereas increasing into gold, Tether’s core enterprise stays unmatched within the crypto business.

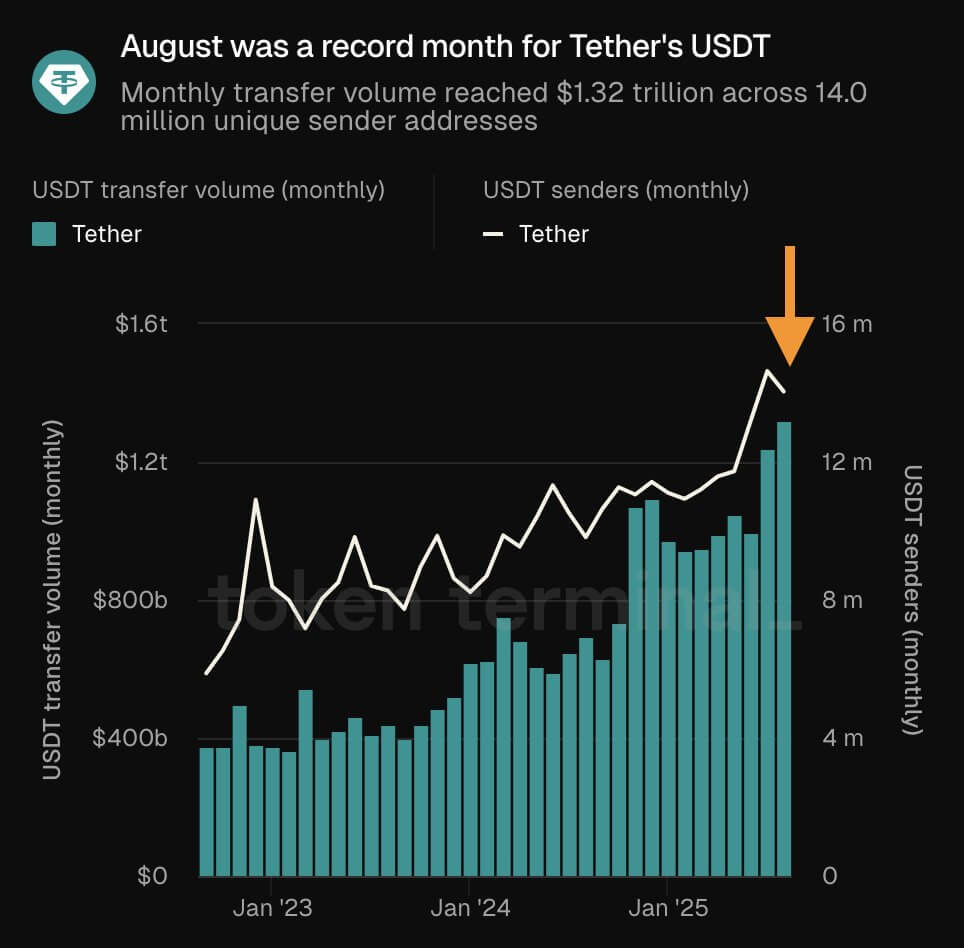

Information from Token Terminal reveals that USDT switch volumes reached a report $1.32 trillion in August, facilitated by 14 million distinctive addresses.

With a circulating provide exceeding $170 billion, USDT represents 59.2% of the $288 billion stablecoin market.

That scale makes it the sector’s most essential token, cementing its function because the spine of worldwide crypto liquidity.