Key takeaways

-

Corporations aren’t simply holding ETH; they’re staking and restaking to generate regular onchain earnings.

-

Mega-holders like BitMine (1.5 million ETH) can sway liquidity, validator distribution and even improve dynamics.

-

Weekly ETH disclosures from corporations like SharpLink give traders real-time perception into accumulation and staking rewards.

-

Coinbase units the benchmark by clearly splitting ETH “held for operations” from ETH “held for funding.”

Company Ether treasuries have grow to be a defining pattern in stability sheet methods of public corporations. As of mid-2025, a rising variety of corporations are switching to Ether (ETH) as a major treasury reserve as an alternative of simply holding money or Bitcoin (BTC).

What units this ongoing pattern aside is the strategy. As an alternative of solely shopping for ETH, corporations are staking for yield, restaking for larger returns and publishing common investor updates.

For conventional traders, this pattern gives a brand new and controlled strategy to achieve ETH publicity by way of equities with out the complexity of self-custody.

This text discusses the seven largest Ether treasury corporations as of August 2025.

1. BitMine Immersion (NYSE: BMNR)

In line with BitMine’s 8-Okay exhibit filed with the US Securities and Trade Fee on Aug. 18, 2025, the corporate’s Ether stash jumped to 1,523,373 ETH as of Aug. 17, a part of a $6.6-billion crypto place that additionally features a small quantity of BTC and money readily available.

However why does it matter?

BitMine has grow to be the biggest company holder of ETH, positioning itself because the “Technique of Ether.” The size alone (properly over 1 million ETH) means its treasury strikes and staking insurance policies can affect market construction and liquidity.

2. SharpLink Gaming (Nasdaq: SBET)

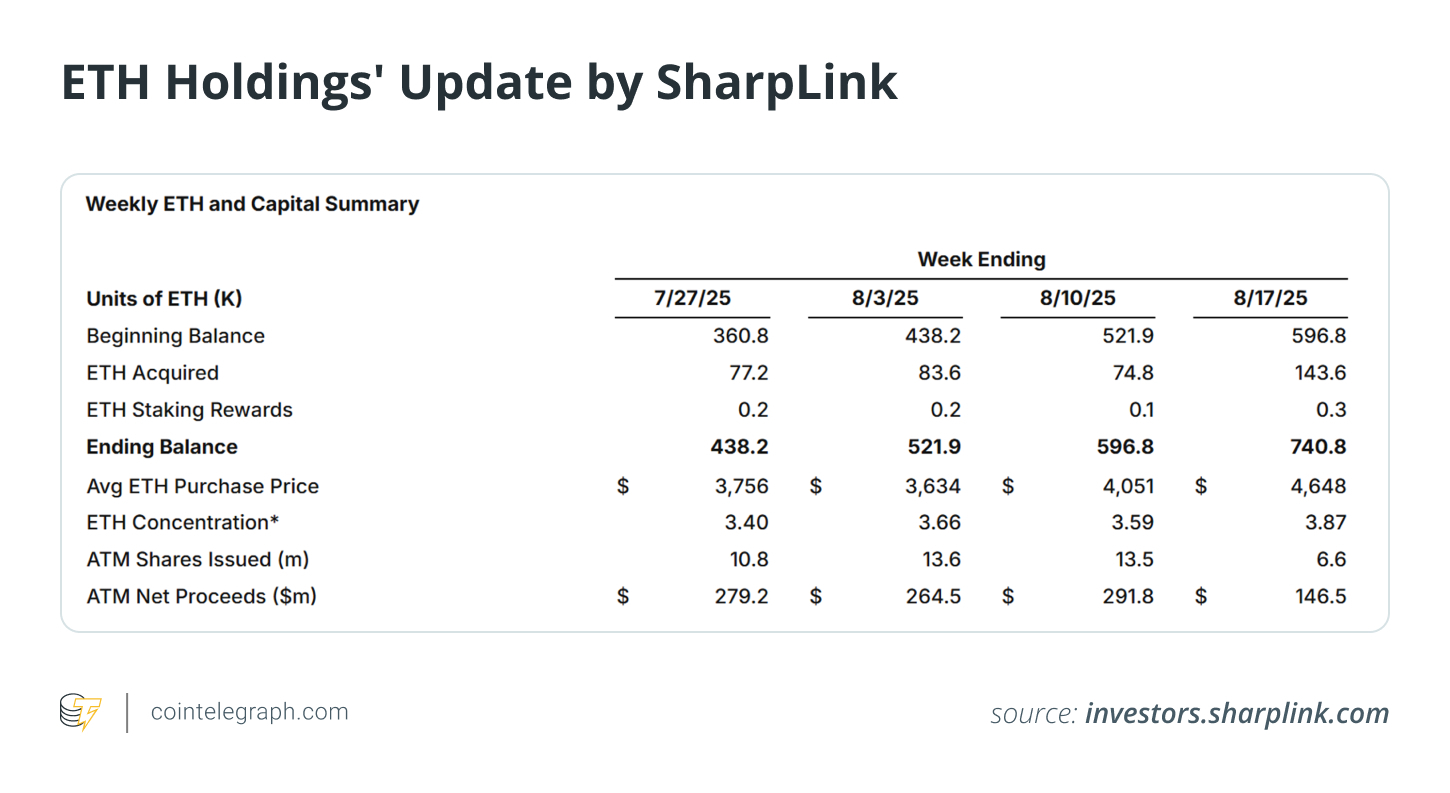

SharpLink’s investor replace on Aug. 19, 2025, acknowledged the corporate bought 143,593 ETH within the prior week. This introduced its whole holdings to 740,760 ETH as of Aug. 17, 2025, with staking rewards persevering with to build up.

SharpLink issues as a result of it’s the quickest riser within the ETH-treasury cohort. Weekly disclosures present an aggressive accumulation schedule funded by way of at-the-market (ATM) and direct choices, coupled with staking to generate onchain yield.

Do you know? At-the-Market (ATM) issuance lets public corporations promote new shares immediately into the open market at prevailing costs. In 2025, corporations like SharpLink and Bit Digital have used ATM packages to rapidly increase money and convert it into ETH for his or her rising treasuries.

3. Coinbase (Nasdaq: COIN)

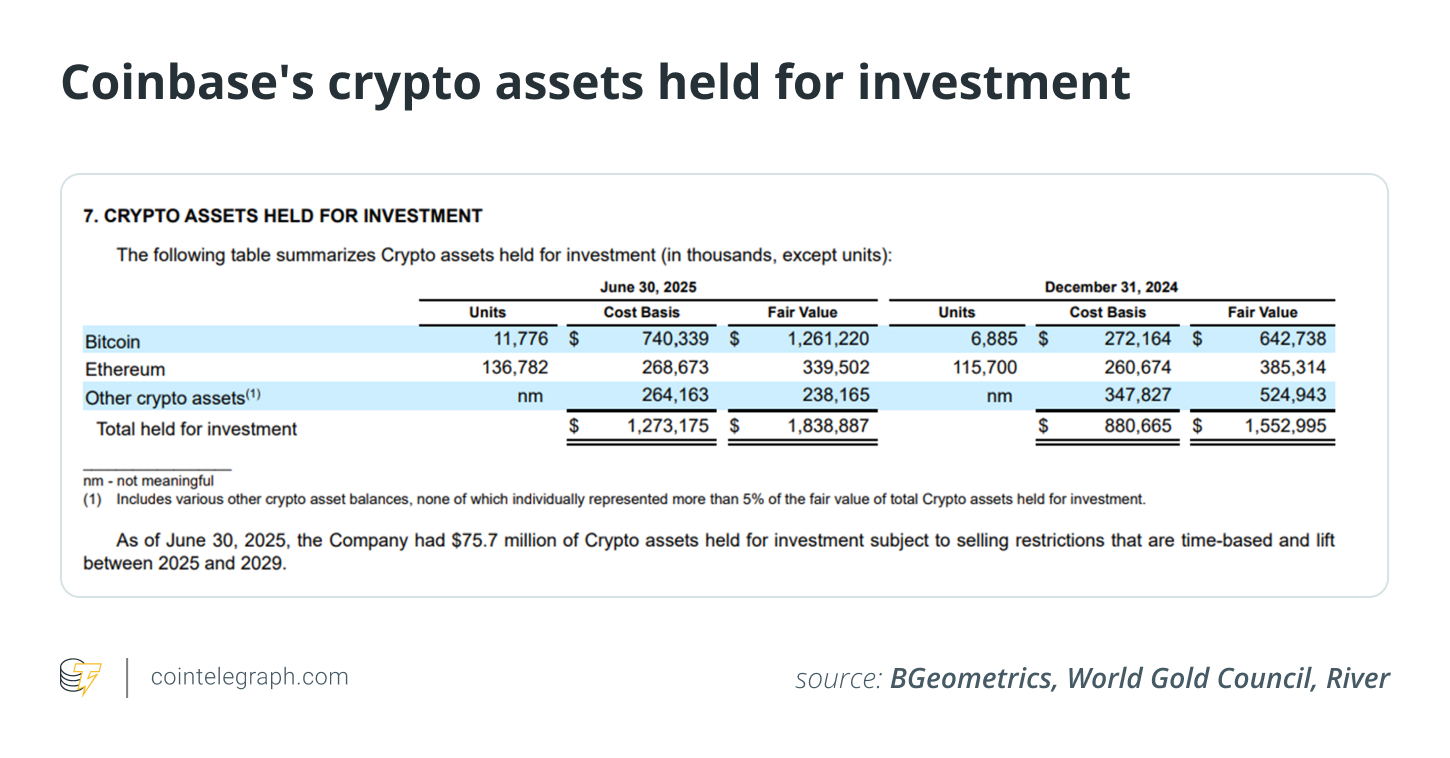

Coinbase’s Q2 2025 Kind 10-Q particulars 136,782 ETH categorized as “crypto property held for funding” as of Jun. 30, 2025 (honest worth $339.5 million). Individually, the submitting exhibits 11,195 ETH beneath “crypto property held for operations.” For this rating, the funding bucket was used to mirror true treasury reserves, in step with main trackers.

Coinbase’s place is exclusive, because it holds ETH each to function its enterprise (validators, community charges) and as a long-term funding. The clear breakdown in an SEC submitting supplies one of many cleanest appears to be like at a public firm’s ETH accounting.

4. Bit Digital (Nasdaq: BTBT)

Bit Digital introduced on Jul. 18, 2025, that it had bought 19,683 ETH by way of a registered direct providing, bringing whole holdings to about 120,306 ETH. Administration referred to as ETH “foundational” to its onchain yield and infrastructure technique.

The corporate pairs treasury accumulation with validator operations, incomes native ETH yield whereas compounding reserves — a mannequin many 2025 entrants now comply with.

5. ETHZilla (Nasdaq: ETHZ)

ETHZilla’s SEC submitting on Aug. 18, 2025 (Exhibit 99.1), exhibits the corporate gathered 94,675 ETH at a mean value of $3,902.20, together with $187 million in money equivalents.

The submitting highlights ETHZilla’s high-profile shift to an ETH treasury mannequin, beginning with a large preliminary stake and plans for onchain yield packages managed by exterior asset specialists.

6. BTCS (Nasdaq: BTCS)

BTCS reported on Aug. 14, 2025, that post-quarter, it elevated Ether holdings to 70,140 ETH (valued at over $321 million on Aug. 12) whereas scaling its Ether “Builder+” and validator infrastructure.

The corporate positions itself as an “Ethereum-first” public firm, emphasizing block constructing and staking alongside a rising treasury. It additionally makes use of ETH-backed decentralized finance borrowing to enhance capital effectivity.

Do you know? Ether lately surpassed its November 2021 all-time excessive, climbing above $4,870 because the US Federal Reserve signaled a extra dovish stance and institutional demand surged. Analysts now anticipate ETH to push properly past $5,000 in 2025.

7. Elementary International/FG Nexus (Nasdaq: FGNX)

Elementary International (branding its initiative as FG Nexus) disclosed on Aug. 11, 2025, that it now holds 47,331 ETH as of Aug. 10, 2025, after launching its ETH accumulation technique. It additionally outlined plans to stake and restake to boost ETH yield.

FG Nexus is a newcomer aiming to construct “one of many largest” ETH treasuries. Its technique facilities on staking, restaking and the identical playbook driving 2025’s company ETH wave.

Why Ether treasury reserves matter

When public corporations purchase and maintain Ether as a treasury reserve, it does extra than simply add one other asset to their stability sheet. It immediately impacts the ETH market and ecosystem.

Giant company purchases cut back circulating provide, which then creates upward stress on value, particularly when mixed with Ether’s deflationary tokenomics after Ethereum Enchancment Proposal 1559. Staking these reserves compounds the impact by locking ETH out of liquid markets, which additional tightens availability.

Past value, company treasuries additionally strengthen Ethereum’s community. By working validators, corporations contribute to safety and decentralization whereas incomes staking rewards that develop their reserves.

For traders, company adoption indicators institutional confidence in ETH as a long-term retailer of worth, not only a speculative asset.

In brief, company ETH treasuries enhance demand, limit provide and reinforce the ecosystem, making them a robust drive in Ethereum’s future.

How company Ether holdings are reshaping the market

In case you are monitoring Ether adoption, company treasuries are actually one of many greatest indicators to observe. Right here’s what the 2025 ETH wave means for you:

-

Purchase, stake and compound: Corporations aren’t simply shopping for ETH; they’re staking and restaking to generate regular onchain yield.

-

Weekly updates construct belief: Corporations like SharpLink launch weekly ETH studies, giving traders real-time transparency.

-

Scale strikes markets: With over 1.5 million ETH, BitMine Immersion proves company treasuries can affect validator units and liquidity.

-

Accounting issues: Coinbase units the usual by clearly separating ETH held for funding vs. operations.

-

Shares as ETH publicity: Public corporations provide regulated methods to realize ETH publicity, although shares might commerce above or beneath internet ETH worth.

Key dangers it’s best to watch with company Ether treasuries

Whereas company ETH reserves deliver legitimacy and demand, in addition they introduce dangers it’s best to watch:

-

Market volatility: ETH costs stay extremely unstable. A sudden downturn can slash the worth of company treasuries and set off shareholder issues.

-

Regulatory uncertainty: Guidelines for digital property are nonetheless evolving. Future regulation might affect how treasuries are reported, taxed and even allowed.

-

Focus threat: A number of corporations holding tens of millions of ETH can distort liquidity. If a big holder sells, it might trigger sharp value swings.

-

Operational and custody dangers: Operating validators, securing personal keys and managing staking contracts all introduce technical vulnerabilities.

-

Fairness publicity limits: For traders utilizing shares as ETH proxies, share costs can commerce at steep premiums or reductions, creating mismatches with precise ETH worth.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.