Crypto trade Gemini, based by Cameron and Tyler Winklevoss, is increasing in Europe with new staking and derivatives choices.

Gemini customers within the European Financial Space (EEA) at the moment are capable of stake Ether (ETH) and Solana (SOL), in addition to commerce perpetual contracts denominated in Circle’s USDC (USDC) stablecoin, the corporate introduced to Cointelegraph on Friday.

The launch follows Gemini’s approval below Markets in Crypto-Property Regulation (MiCA) in Malta in August and its earlier authorization below the Markets in Monetary Devices Directive (MiFID II) in Might.

“Our purpose is to be one of many main exchanges in Europe, and now that we have now a full suite of merchandise together with spot trade, staking, and perpetuals within the EU from a single interface, we consider that we’re a severe contender,” Gemini’s head of Europe, Mark Jennings, informed Cointelegraph.

Derivatives acquire traction as spot buying and selling slows

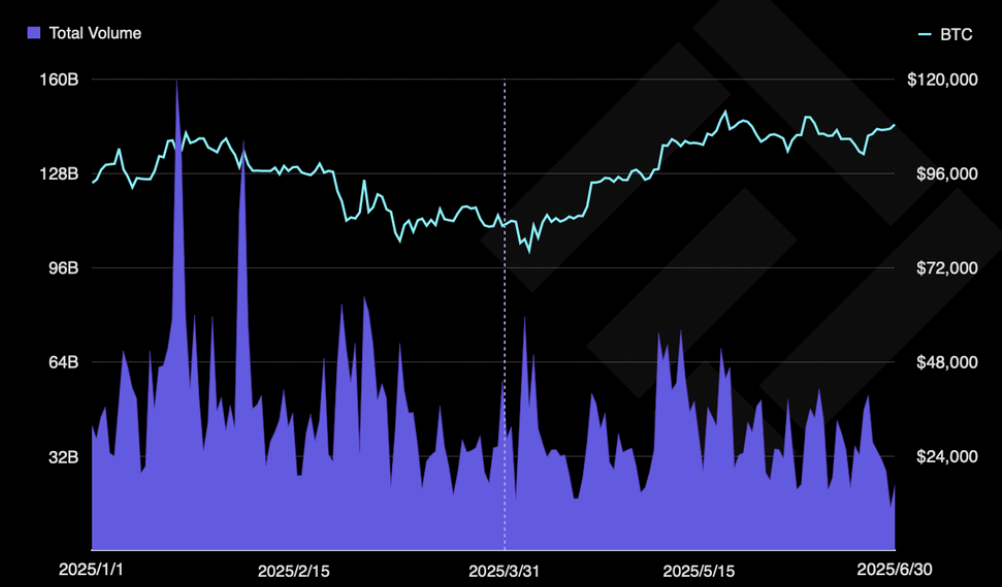

Gemini’s push into derivatives within the EU comes as spot crypto buying and selling — the shopping for and promoting of tokens at present market costs — has been shedding steam, significantly in opposition to exchange-traded funds (ETFs).

Regardless of the Bitcoin worth rising in 2025, spot buying and selling volumes declined 32% within the first two quarters of the yr, netting simply $3.6 trillion in Q2, in accordance with the crypto analytics platform TokenInsight. In distinction, crypto derivatives’ volumes netted $20.2 trillion.

“The worldwide derivatives market has exploded in current months,” Jennings stated, including that the sector is estimated to be value $23 trillion by the top of 2025.

“As crypto adoption grows, there’s growing demand for different, risk-managed monetary devices, and derivatives enable customers to execute advanced methods to achieve lengthy or brief publicity to crypto,” he added.

Ethereum staking deposits surge in EU

Whereas crypto derivatives are regulated below the EU’s MiFID II, staking is regulated not directly below the MiCA framework, which entered into full drive in late 2024.

MiCA has pushed important development in institutional staking exercise in Europe, with the EU staking participation surging by 39% in 2025, whereas non-EU staking development remained at 22%, in accordance with a examine by CoinLaw in June.

Associated: ETH staking entry queue surges to two-year excessive as establishments accumulate

“Staking is changing into more and more standard in Europe,” Jennings stated, citing CoinLaw’s knowledge that Ethereum staking deposits within the EU surged by 28% in 2025 in comparison with 2024, reaching $90 billion in whole staked ETH.

“Gemini Staking is accessible to retail and institutional traders however we consider that will probably be standard amongst subtle, skilled retail traders who need to put their crypto funds to make use of and earn passive revenue from a single, built-in, centralized trade,” the exec famous.

Gemini’s staking and derivatives launch within the EU got here days after the trade formally filed a Type S-1 for an preliminary public providing within the US. The corporate expects to promote 16.67 million shares priced between $17 and $19 per share, to boost as much as $317 million.

Journal: How Ethereum treasury firms may spark ‘DeFi Summer season 2.0’