Pokémon buying and selling playing cards may very well be the subsequent real-world asset to maneuver onchain at scale, probably bringing a $21.4 billion market to the blockchain.

“Pokémon and different [trading card games] are about to have their ‘Polymarket second,’” stated Bitwise analysis analyst Danny Nelson on Thursday.

“I count on the Pokémon growth will likely be sticky — a kind of moments the place an ‘solely in crypto’ innovation breaks into the mainstream. Kinda like what Polymarket did for prediction markets.”

RWA crypto tokenization has boomed right into a $28.2 billion market in 2025, however it’s virtually solely catered to TradFi belongings like shares, treasuries, commodities, non-public credit score and actual property.

Whereas this affords improved advantages similar to 24/7 buying and selling and potential price financial savings, it doesn’t rework them as “ok digital rails exist already,” Nelson stated.

Nonetheless, Pokémon card buying and selling may benefit way more from the blockchain, Nelson stated, noting that sellers nonetheless should bodily ship their Charizard, Pikachu and Gardevoirs to patrons.

Pokémon ETFs sooner or later? Nelson stated it’s doable

He famous that the inefficient resolution nonetheless noticed market chief Whatnot facilitate $3 billion in gross sales final yr. “This market stays largely casual. You don’t see Pokémon ETFs or funding funds, and also you most likely gained’t for some time. However perhaps not so long as you’d suppose.”

Pokémon playing cards and different buying and selling card video games like Magic: The Gathering have been round for about three a long time, lengthy earlier than non-fungible tokens (NFTs) had been ever an idea.

A brand new market chief is paving the way in which

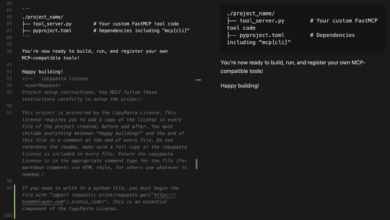

Nelson’s feedback come as Collector Crypt just lately emerged as a tokenization platform for promoting Pokémon playing cards on Solana, enabling quick trades and worthwhile exits.

The token backing Collector Crypt, CARDS, has already risen 10-fold to a totally diluted quantity of $450 million since launching final Saturday, Nelson identified.

Associated: CZ-owned Belief Pockets launches tokenized shares and ETFs

“Merchants are speeding to cost in revenue-generating potential,” Nelson stated, noting that it’s signaling an annualized income of $38 million. He added that a lot of the “early hype” rests on these yields probably flowing again to token buybacks.

The Pokémon card buying and selling has additionally pushed demand for Collector Crypt’s Gacha Machine venture, which has taken in $16.6 million in income over the past week.

NFTs clock most buying and selling quantity since January

In the meantime, NFT buying and selling volumes rose 9% month-on-month to $578 million in August, its largest tally since January, in line with the crypto analytics platform DappRadar, on Thursday.

Regardless of the 9% rise, the sale depend fell 4%, exhibiting that “fewer belongings traded fingers, collectors are paying extra per sale,” DappRadar stated.

Journal: Astrology might make you a greater crypto dealer: It has been foretold