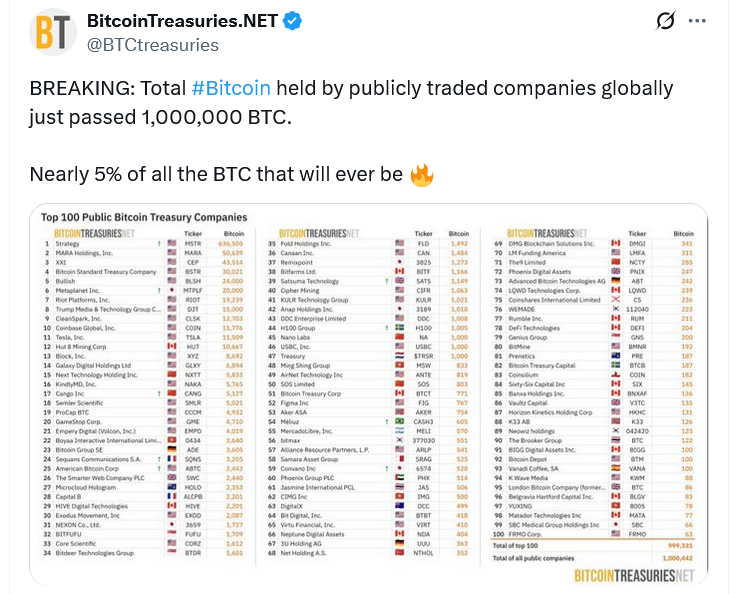

Company Bitcoin treasury adoption has hit an enormous milestone, reaching 1 million Bitcoin as extra corporations tout Bitcoin’s potential to bolster their steadiness sheets.

BitcoinTreasuries.NET confirmed the feat on Thursday, with just a few extra purchases pushing the tally to 1,000,698 Bitcoin, value over $111 billion.

Whereas Bitcoin miners like MARA Holdings have been the OG Bitcoin accumulators, Michael Saylor’s Technique was the primary public firm to undertake a Bitcoin (BTC) technique in August 2020 — paving the best way for most of the 184 listed corporations that maintain Bitcoin in the present day.

Saylor’s firm holds by far essentially the most Bitcoin at 636,505 BTC, whereas MARA Holdings has held regular in second place with 52,477 BTC after mining 705 BTC in August.

Nevertheless, just a few new Bitcoin treasury corporations are closing in, together with Jack Mallers-led XXI and Bitcoin Normal Treasury Firm, which now maintain 43,514 BTC and 30,021 BTC, respectively.

Crypto change Bullish and Japanese funding agency Metaplanet maintain 24,000 BTC and 20,000 BTC, whereas Riot Platforms, Trump Media & Know-how Group Corp, CleanSpark and Coinbase spherical out the highest 10.

The fast Bitcoin shopping for from public corporations and exchange-traded funds have created a requirement shock this cycle, and plenty of see it as a major catalyst behind Bitcoin’s worth rally to a brand new all-time excessive of $124,450 final month.

Extra publicly listed corporations are saying Bitcoin accumulation methods by the week, too. With simply 5.2% of Bitcoin’s mounted provide but to enter circulation, a supply-side shock might be spurred on by additional adoption within the years to come back.

For instance, Metaplanet and Semler Scientific are aiming to build up 210,000 BTC and 105,000 BTC by the top of 2027, which is greater than 10 and 20 occasions their present stash.

Bitcoin treasury methods copped criticism within the bear market

Technique was one of many few Bitcoin accumulating corporations that held robust on its conviction within the 2022 bear market, which noticed Bitcoin miners offload 58,770 BTC — up from 3,500 the yr earlier than — whereas FTX’s collapse pushed Bitcoin all the way down to a 2022 low of $15,740.

Saylor even mentioned he was keen to trip Bitcoin out to $0 amid a wave of criticism from the likes of Fortune, which shed doubt on the sustainability of his firm’s “wild experiment.”

Nevertheless, seeing Technique popping out on the opposite aspect seemingly impressed a second wave of Bitcoin adoption, together with from Metaplanet and Semler Scientific, whose CEOs mentioned they have been zombie corporations earlier than taking the leap into Bitcoin.

Wall Road instruments allow company Bitcoin adoption

Like Technique, many of those corporations have adopted a spread of monetary devices, equivalent to fairness choices and debt financing (via senior convertible notes), to extend their Bitcoin holdings and create shareholder worth on a Bitcoin-per-share foundation.

XXI and the Bitcoin Normal Treasury Firm are among the many entities that launched as Particular Objective Acquisition Corporations, or SPACs, to construct Bitcoin treasuries and supply traders a sooner, extra versatile route for Bitcoin publicity than via preliminary public choices.

Associated: Bitcoin drop to $108K potential as traders fly to ‘safer’ belongings

Company Bitcoin adoption is going on all over the world, too. Whereas 64 corporations are primarily based within the US, 34 are in Canada, 11 are within the UK and Hong Kong, and others have appeared in international locations equivalent to Mexico, South Africa, and Bahrain.

Public corporations aren’t even the most important Bitcoin-holding entities

Crypto exchanges and exchange-traded fund issuers are the one entities that maintain extra Bitcoin than public corporations at 1.62 million BTC, whereas governments and personal corporations maintain 526,363 BTC and 295,015 BTC.

One other 242,866 BTC is locked in crypto protocols, leaving the remaining 16.2 million of BTC within the arms of people — or no less than those that nonetheless have entry to their non-public keys.

Journal: 3 individuals who unexpectedly turned crypto millionaires… and one who didn’t