Key takeaways:

-

Rising demand for presidency bonds and gold underscores recession fears, limiting Bitcoin’s capacity to maintain bullish momentum.

-

Correlation with equities stays excessive, however structural catalysts like Technique’s S&P 500 inclusion may shift sentiment.

Bitcoin (BTC) failed to carry onto its bullish momentum on Thursday as merchants fled towards the security of presidency bonds after weaker-than-expected United States labor market information. This transfer drove gold to an all-time excessive and raised doubts over Bitcoin’s $108,000 degree, with recession fears more and more dominating investor sentiment.

Equities, nonetheless, responded positively. Market individuals grew extra assured that the US Federal Reserve would decrease rates of interest. In distinction, cryptocurrencies confronted renewed stress as BTC briefly traded underneath $110,000. In contrast to digital belongings, shares profit extra straight from decrease financing prices and decreased family debt burdens, each of which might stimulate consumption.

Yields on the 2-year US Treasury dropped to three.60%, their lowest degree in 4 months, signaling traders’ willingness to just accept decrease returns in change for security. The surge in demand adopted ADP’s Thursday report exhibiting US non-public payrolls added 54,000 positions in August, a pointy decline from July’s 106,000. The Institute for Provide Administration (ISM) additionally reported that total employment contracted.

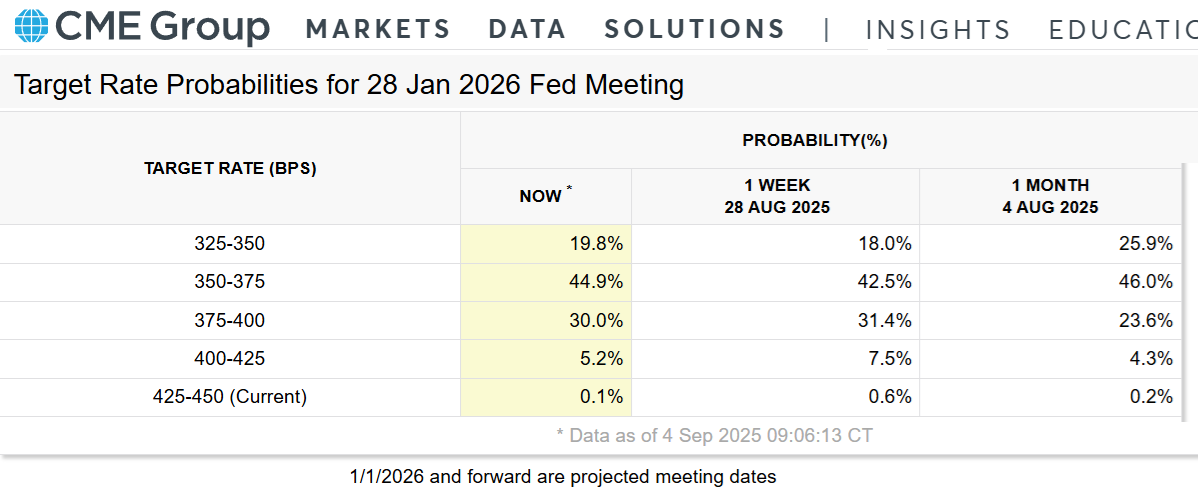

Consensus across the Sept. 16-17 Federal Open Market Committee (FOMC) assembly factors to a 0.25% price minimize, bringing the benchmark right down to 4.25%. Nonetheless, traders stay skeptical that the Federal Reserve can maintain such easing for lengthy.

The CME FedWatch instrument exhibits that merchants anticipating January 2026 charges at 3.75% or decrease declined to 65% from 72% a month in the past. This gauge makes use of Fed Funds futures costs to calculate implied possibilities forward of the Fed’s Jan. 28 assembly. Friday’s US Bureau of Labor Statistics report will probably be essential in guiding positioning throughout threat belongings.

Bitcoin stays extremely correlated to tech shares

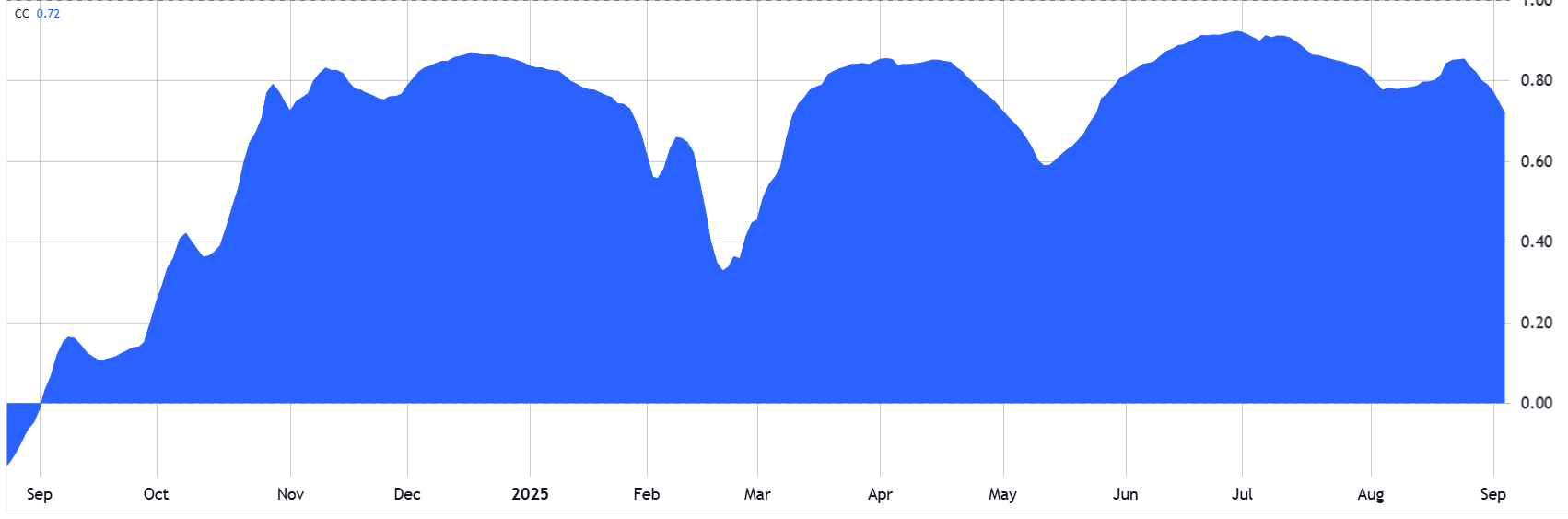

An eventual rise in inflationary stress from decrease capital prices may undermine financial progress, significantly with larger import tariffs in place. So, whereas decrease rates of interest could supply short-term aid, robust demand for gold and short-term bonds highlights persistent threat aversion, which may weigh closely on cryptocurrencies. Nasdaq’s 60-day correlation with Bitcoin sits at 72%, exhibiting the 2 belongings have largely moved collectively.

What would possibly break this sample stays unsure, however some analysts spotlight the potential addition of Technique (MSTR) to the S&P 500. Based on Meryem Habibi, chief income officer at Bitpace, the inclusion “cements the legitimacy of a whole asset class.” Such a transfer would pressure index funds and exchange-traded funds (ETFs) monitoring the S&P 500 to buy MSTR shares.

Associated: Peter Thiel vs. Michael Saylor: Who’s making the smarter crypto treasury wager?

Even with elevated demand for US authorities bonds, fiscal imbalances may erode confidence within the home forex, a situation traditionally favorable for Bitcoin. Financial institution of America analysts reportedly mission the euro will strengthen towards the US greenback by 2026, citing commerce frictions and weakening institutional credibility.

Within the brief time period, threat aversion could push Bitcoin to retest the $108,000 mark. Nonetheless, the rising demand for short-term Treasurys alone shouldn’t be considered as a long-term bearish sign.

This text is for common data functions and isn’t supposed to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed below are the creator’s alone and don’t essentially replicate or characterize the views and opinions of Cointelegraph.