Michael Saylor’s Technique could possibly be the following crypto firm to hitch the S&P 500 inventory market index, a benchmark of the five hundred greatest US public firms by market capitalization, in keeping with analysts. The corporate should nonetheless clear hurdles earlier than being admitted, nevertheless.

Market analyst Jeff Walton forecast a 91% probability that Technique would be a part of the index as the corporate strikes towards assembly all the necessities to be included within the benchmark.

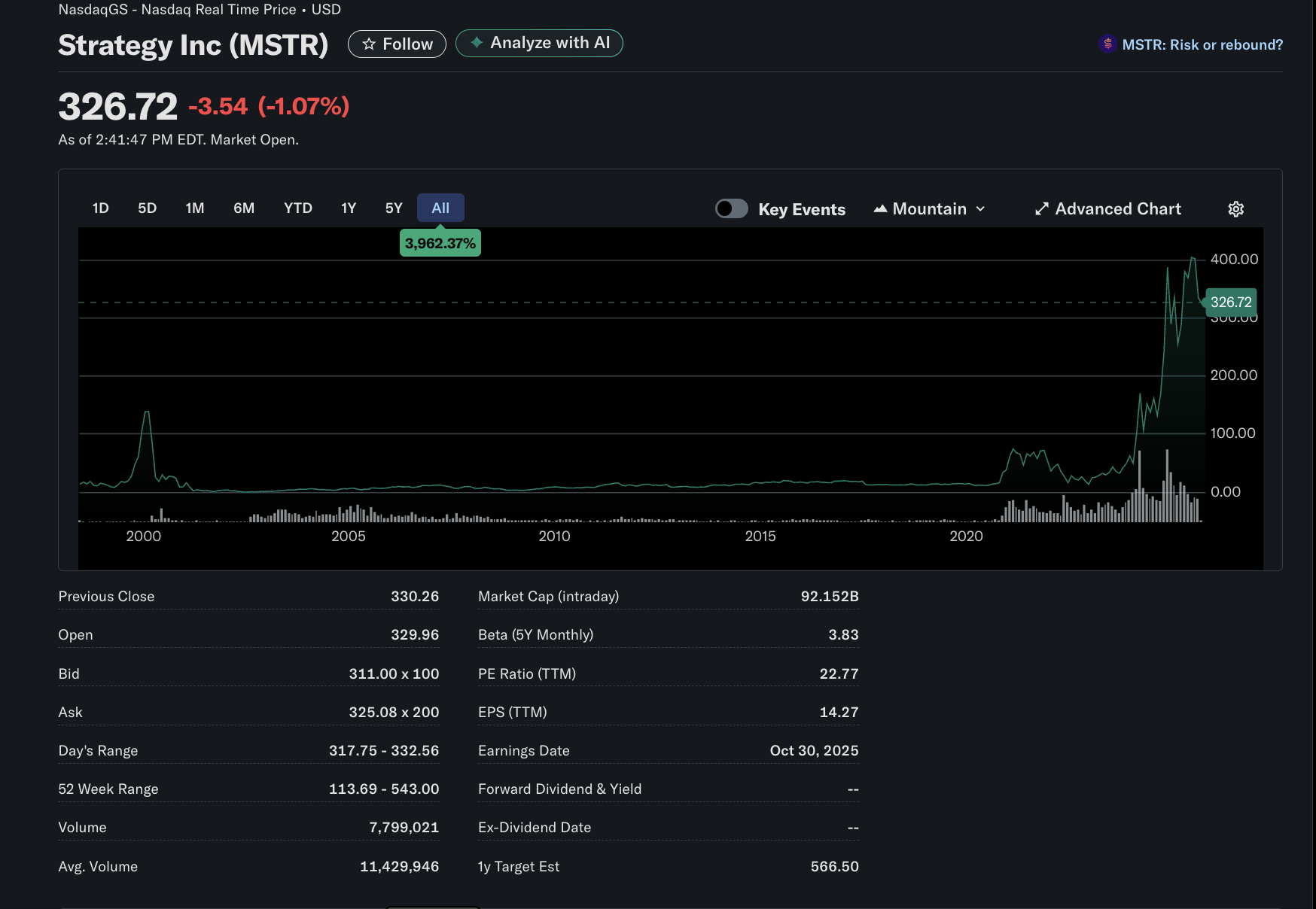

Based on knowledge from Nasdaq, Technique has buying and selling volumes of a number of million shares per day, a market capitalization of over $92 billion at time of writing and optimistic usually accepted accounting ideas (GAAP) web earnings during the last 4 quarters of over $5.3 billion.

Technique is listed on the Nasdaq 100, an index that tracks the 100 largest firms by market capitalization listed on the tech-focused Nasdaq inventory change.

Nonetheless, regardless of the corporate assembly all the necessities and already being included in a significant inventory market index, it might nonetheless be denied inclusion if the committee tasked with evaluating firms guidelines towards including it after taking a “holistic” view of the potential candidate.

The US Index Committee nonetheless will get the ultimate say

Based on S&P International methodology, firms should have a market capitalization of a minimum of $22.7 billion, a liquidity ratio of 0.75 or extra — the annual buying and selling quantity divided by the corporate’s market cap — and a buying and selling quantity of a minimum of 250,000 shares per 30 days to be eligible.

The sum of an organization’s web earnings, calculated by means of GAAP requirements during the last 4 quarters should be optimistic, with the newest quarter being worthwhile for inclusion within the index.

The US Index Committee is answerable for including new firms to the index, and has 10 voting committee members, every with equal voting rights. Choices by the committee are made utilizing a easy majority vote.

Technique, which is the world’s largest Bitcoin (BTC) treasury firm by holdings, at the moment holds 636,505 BTC in its company treasury, in keeping with BitcoinTreasuries, whereas over 1 million BTC is collectively held by publicly traded firms.

In accordance a report from Bloomberg on Thursday, attainable challenges for a move by the committee would come with the sustainability of Technique’s crypto treasury mannequin and excessive inventory volatility. Technique’s 30-day worth swings common 96%, for instance.

Impacts on the crypto market and challenges

The S&P 500 is a weighted inventory market index of the of the biggest 500 firms by market capitalization listed on the US inventory market and is rebalanced on a quarterly foundation to mirror adjustments within the make-up of the index.

Firms featured within the S&P 500 index appeal to passive flows into the crypto markets, serving to increase costs over time, whereas additionally additional intertwining digital property and legacy monetary markets.

Associated: Robinhood, Technique shares dip as they miss out on S&P 500 inclusion

Coinbase grew to become the primary crypto firm to be included within the S&P 500 index, touchdown on the benchmark in Could.

Block, a know-how firm based by Jack Dorsey, was bumped as much as the index in July and has a market cap of over $46 billion as of time of writing.

Journal: Will Robinhood’s tokenized shares REALLY take over the world? Execs and cons