Key takeaways:

-

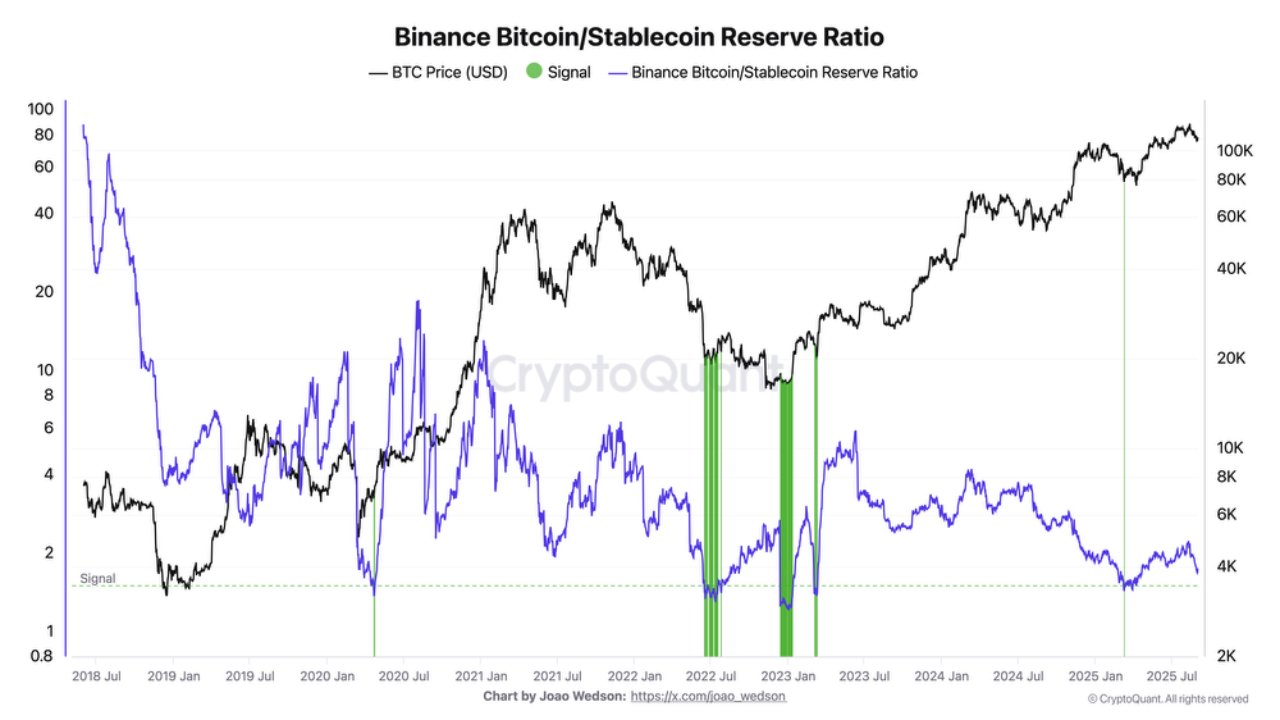

The Binance Bitcoin/stablecoin ratio nears parity at 1, a uncommon market sign.

-

Market construction metrics present BTC value stays in a revenue regime however is liable to consolidation.

-

A drop under $95,000 might set off the primary 50-week SMA bear sign this cycle.

The Binance Bitcoin/stablecoin ratio is approaching a uncommon threshold that has traditionally coincided with market bottoms. The metric, which tracks the steadiness of Bitcoin (BTC) reserves in opposition to stablecoin reserves on Binance, is nearing parity at 1, a degree final noticed in March, when Bitcoin pulled again to $78,000 earlier than rallying towards its $123,000 all-time excessive.

Knowledge from CryptoQuant signifies that this setup has appeared solely twice for the reason that final bear market, elevating curiosity as a possible purchase sign. Nevertheless, the catch is that in previous cycles, the ratio sometimes flashed on the finish of bear markets in 2023 and extra not too long ago in March. Its reappearance within the present context might subsequently danger a false sign, probably hinting at the beginning of a protracted correction reasonably than a backside.

Supporting the ratio’s energy, Binance’s ERC-20 stablecoin reserves simply hit a report $37.8 billion, reflecting regular inflows and deep liquidity. Traders on the change seem removed from overexposed to BTC, reinforcing that capital is ready on the sidelines.

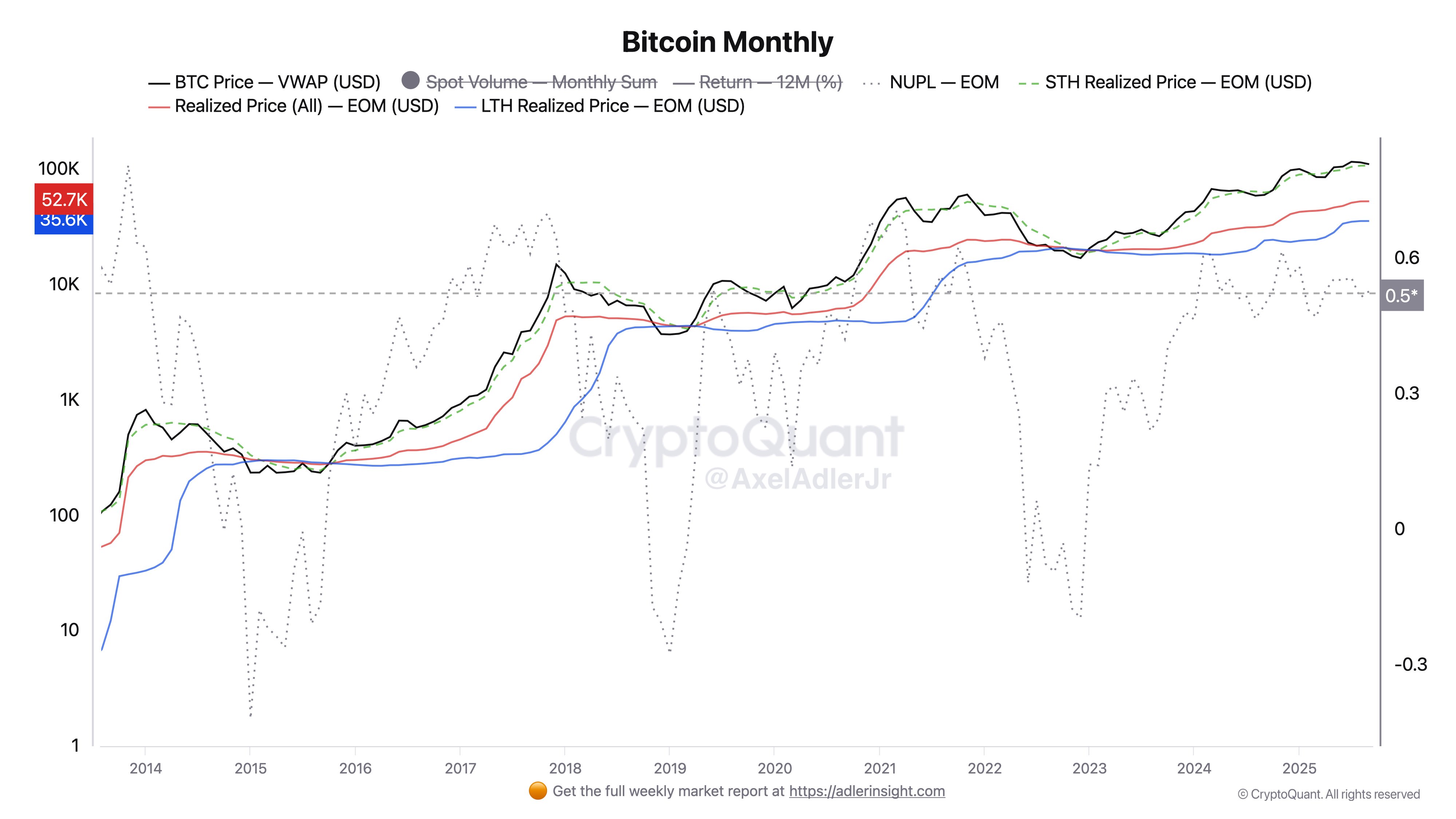

On the identical time, Bitcoin researcher Axel Adler Jr. cautioned that the market stays in a “restore part.” The analyst famous that Bitcoin sits at $110,700, simply above the short-term holder realized value of $107,600, a key month-to-month bull assist zone.

Structural indicators stay intact, with the general realized value at $52,800 and long-term holder realized value at $35,600, each nicely under present ranges. The online unrealized revenue/loss (NUPL) ratio at 0.53 suggests the market is in a broad revenue regime however nonetheless shy of euphoric extremes.

Briefly, greater timeframes stay bullish, however sensitivity to profit-taking means consolidation might lengthen. Whether or not the Binance ratio as soon as once more marks a turning level or as a substitute alerts turbulence will hinge on Bitcoin’s capability to carry key assist.

Associated: Bitcoin’s ‘euphoric part’ cools as $112K turns into key BTC value degree

Bitcoin’s 50-week SMA nonetheless defines the bear market danger

One other vital gauge for Bitcoin is the 50-week easy transferring common (SMA), which has constantly signaled cycle shifts since 2018. Historic knowledge exhibits that each time Bitcoin closed a weekly candle under the 50-SMA, extended corrections adopted, with a 63% drawdown in 2018 and a 67% decline in 2022. The one exception was in 2020, when BTC shortly rebounded after the COVID-19 pandemic-induced crash.

Since March 2023, Bitcoin has managed to remain above the 50-SMA, with key retests in August 2024 and March 2025 failing to provide a weekly shut under the indicator. Based mostly on adjusted ranges, the evaluation estimates {that a} drop into the $90,000 to $95,000 vary might push BTC under the 50-SMA for the primary time on this cycle.

Such a transfer would ship the primary clear-cut technical sign of a bear market, elevating the stakes for whether or not present consolidation resolves greater or slides into deeper correction.

Associated: Bitcoin bear market due in October with $50K backside goal: Evaluation

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a call.