Key factors:

-

Bitcoin ignores US jobs information and falls over 2% on the day.

-

A high-volume space now comes into play as help, at the same time as evaluation sees a BTC value comeback subsequent.

-

Gold continues to make headlines by beating crypto and US shares this bull market.

Bitcoin (BTC) fell again below $109,500 after Thursday’s Wall Road open as US jobs information failed to spice up crypto.

Bitcoin fails to crack resistance in recent dip

Information from Cointelegraph Markets Professional and TradingView confirmed BTC/USD losses passing 2% on the day.

Bulls didn’t flip the world round $112,000 to help, and regardless of US unemployment numbers displaying a weakening labor market, draw back strain remained.

“$BTC bought rejected from its main resistance degree,” well-liked dealer BitBull confirmed in a put up on X.

“Till the $114K degree is reclaimed on the every day timeframe, each BTC transfer will simply be a bull lure. Additionally, the longer it will take BTC to reclaim $114K degree, larger the possibilities of a giant correction earlier than reversal.”

As Cointelegraph reported, many market contributors see a retest of $100,000 help coming within the quick time period.

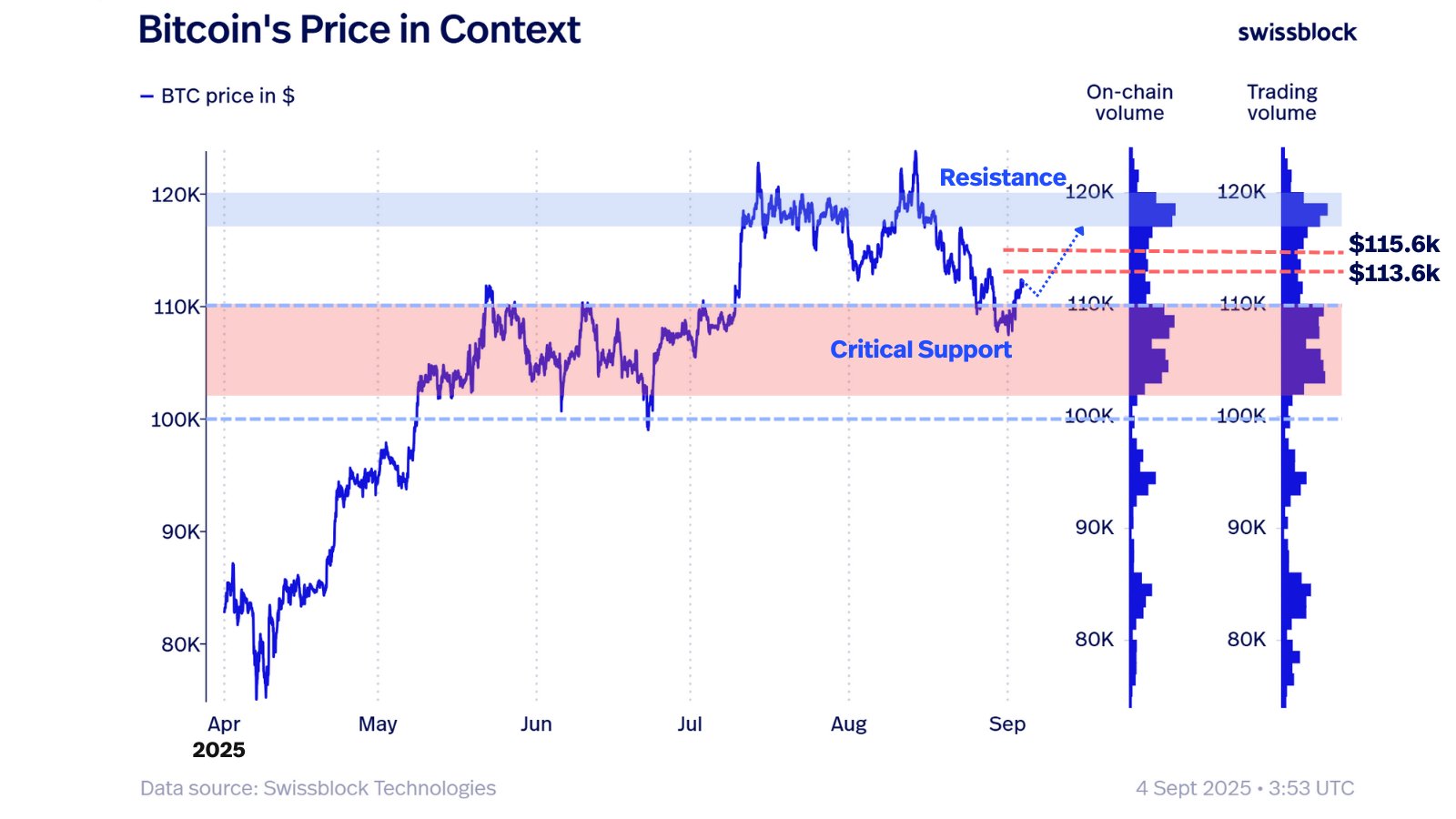

On the extra optimistic aspect, crypto market perception agency Swissblock flagged “crucial help” now mendacity at $110,000 within the type of an space of excessive buying and selling quantity. Resistance to the upside was thinning, it instructed X followers on the day.

“Bitcoin is breaking out from the crucial zone: a straight slide to $100K was by no means the bottom case. The wall resisted, till now,” a put up said.

“Above, there’s the $113.6K–$115.6K gate. After a pullback, value wants recent momentum to clear it, then cope with heavy resistance into $118K.”

Gold steals the present from crypto, shares

The macro image, in the meantime, favored shares as weaker labor market indicators cemented the chances of the Federal Reserve chopping rates of interest on Sept. 17.

Associated: Bitcoin bear market due in October with $50K backside goal: Evaluation

Amid rising inflation, nevertheless, buying and selling agency Mosaic Asset was cautious. This month’s lower, it warned, might be the Fed’s just one.

“Whereas odds for a price lower seem locked in (pending no big upside shock in August payrolls), the Fed may nonetheless be going through a “one and accomplished” state of affairs on lowering charges,” it wrote in its newest “Mosaic Chart Alerts” replace on the day.

“That’s due to proof that inflationary pressures proceed constructing with inflation-sensitive areas of the capital markets shifting larger.”

Mosaic Asset and buying and selling useful resource The Kobeissi referenced the continued gold breakout, which has crushed shares and left crypto flagging in its wake.

“It is a mixture of market pricing in larger long-term inflation and extra deficit spending,” Kobeissi defined in an X thread on Wednesday.

“And, including gas to the hearth, deficit spending is flooding the US Treasury market with provide. Gold has grow to be the GLOBAL protected haven asset.”

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a call.