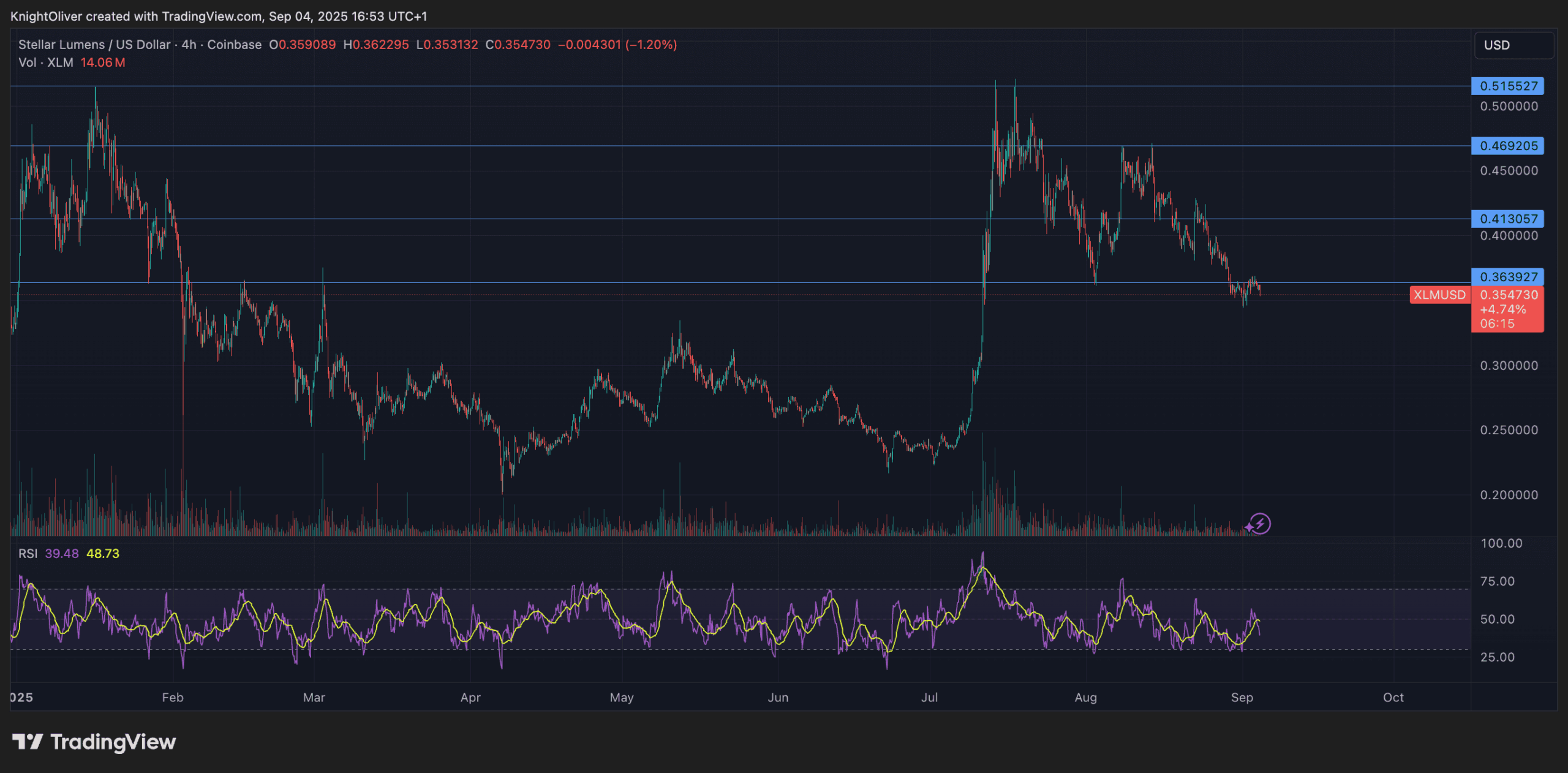

Stellar continued to slip decrease over the previous 24 hours, with value motion underscoring a transparent bearish bias. Between Sept. 3 at 15:00 and Sept. 4 at 14:00, XLM shed 2.72%, falling from $0.368 to $0.358.

The transfer got here inside a decent $0.012 vary, reflecting 3.26% intraday volatility. Sellers constantly rejected makes an attempt to push above the $0.362 stage, significantly through the Sept. 4 13:00 session, whereas the $0.357–$0.358 space briefly offered assist. Nonetheless, mounting draw back stress means that the zone could not maintain, leaving room for prolonged weak spot.

Market forces look like exacerbating Stellar’s latest decline. Regardless of a number of bounce makes an attempt, resistance close to $0.362 stays firmly intact. These dynamics coincided with the rollout of Stellar’s Protocol 23 community improve on Sept. 3, however the technical milestone failed to supply the sort of bullish catalyst wanted to counteract prevailing macro pressures.

Institutional sentiment additionally displays the cautious tone. On Sept. 2, a wave of liquidations price roughly $192,000 occurred as XLM slipped from the $0.40–$0.45 vary, highlighting merchants’ vulnerability to sudden draw back strikes. That liquidation cascade has since set the stage for the continuing retreat, which aligns with bigger patterns of risk-off positioning by main market gamers amid geopolitical and financial uncertainty.

Wanting forward, Stellar faces an important check of assist. After repeated rejection on the $0.45 resistance stage, the token is now drifting towards the $0.32–$0.30 demand zone. Whether or not this stage can entice ample shopping for curiosity will doubtless decide XLM’s near-term trajectory. For now, technical and macro alerts each level to sustained bearish momentum until broader sentiment stabilizes.

Technical Indicators Sign Additional Weak spot

- Value declined from $0.368 to $0.358, representing a 2.72% drop over 24-hours.

- General buying and selling vary reached $0.012, equal to three.26% volatility.

- Clear resistance established at $0.362 stage with a number of rejection makes an attempt.

- Excessive quantity of 21.47 million throughout 4 September 13:00 session exceeded 24-hour common of 16.23 million.

- Assist zone recognized round $0.357-$0.358 seems fragile.

- Accelerating decline in last buying and selling hours suggests continued promoting stress.

- Quantity decreased from peak 28.5 million to 16.7 million shares indicating weakening momentum.

Disclaimer: Elements of this text have been generated with the help from AI instruments and reviewed by our editorial workforce to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.