New financial information rejects Trump’s 350bps price reduce dream as Bitcoin falls whereas shares climb

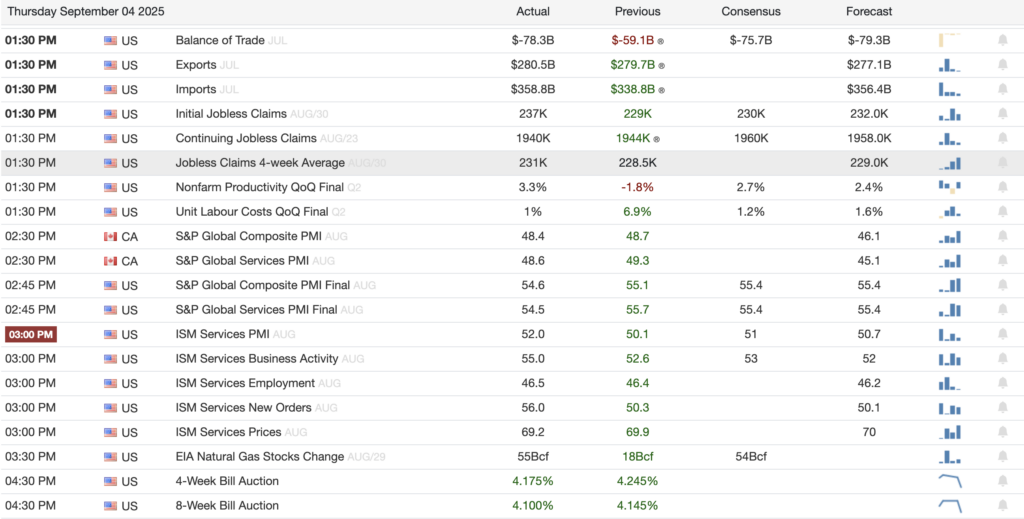

US providers inflation stayed elevated in August, complicating expectations for the Federal Reserve as markets search for a September coverage adjustment.

The probability of a small 25bps reduce is now growing, which is more likely to anger President Donald Trump, who has advocated for a mammoth 350bps reduce.

The ISM Companies Costs Index registered 69.2, solely barely under the prior month’s studying, whereas new orders strengthened to 56.0 from 50.3. Employment contracted for a second month at 46.5, pointing to softer hiring circumstances.

Broader financial information supplied a combined view. Nonfarm productiveness within the second quarter was revised as much as 3.3%, whereas unit labor prices dropped to 1% from 6.9% within the earlier quarter.

Weekly jobless claims ticked increased to 237,000, with persevering with claims regular close to 1.94 million. The commerce deficit widened to $78.3 billion in July as imports climbed to $358.8 billion in opposition to exports of $280.5 billion.

The Crypto Investor Blueprint: A 5-Day Course On Bagholding, Insider Entrance-Runs, and Lacking Alpha

Earlier this week, the Fed’s Beige Guide described a steady economic system with modest worth progress and enterprise uncertainty tied to tariffs and coverage outlooks, reinforcing expectations of a measured quarter-point reduce in September.

San Francisco Fed President Mary Daly acknowledged she doesn’t assist a 50 foundation level transfer, backing gradual easing as an alternative. Market odds have priced a near-certain discount within the coverage price.

Bitcoin traded decrease right now, shifting from $110,000 to $109,300, whereas the S&P 500 ETF gained 0.3% from 644 to 646. The divergence mirrored warning in digital property and regular demand for equities as price expectations centered on a modest reduce.