How does decentralized finance (DeFi) work? In right this moment’s Crypto for Advisors e-newsletter, Elisabeth Phizackerley and Ilan Solot and from Marex Options co-authored this piece concerning the mechanics of a DeFi transaction utilizing Ethena, Pendle and Aave and the way all of them work collectively to create funding yields.

Then, DJ Windle breaks down the ideas and solutions questions on these investments in “Ask an Knowledgeable.”

Thanks to our sponsor of this week’s e-newsletter, Grayscale. For monetary advisors close to Minneapolis, Grayscale is internet hosting an unique occasion, Crypto Join, on Thursday, September 18. Study extra.

– Sarah Morton

DeFi Yield Engines: Ethena, Pendle, Aave, and Hyperliquid

In conventional finance, advisers are used to merchandise like bond funds, cash market devices, or structured notes that generate yield by recycling capital extra effectively. In decentralized finance (DeFi), an analogous thought exists — however powered totally by sensible contracts, exploring how monetary markets can run on blockchain rails. There was no scarcity of DeFi experiments over the previous six years, for the reason that sector kicked off; nevertheless, few have labored in addition to the interaction between Ethena, Pendle, and Aave. Collectively, these three protocols have constructed a self-reinforcing cycle that channels greater than $4 billion in composable property. Because the area develops, the interlinkages will probably broaden even additional, for instance, by integrating components of Hyperliquid and its new layer-1, HyperEVM. First, some definitions:

- Ethena: like a cash market fund producing yield from futures.

- Pendle: like a bond desk splitting that yield into “fastened” vs. “floating” parts.

- Aave: like a financial institution providing loans towards crypto-native collateral.

- Hyperliquid: like every crypto alternate for futures and spot buying and selling, however absolutely on-chain.

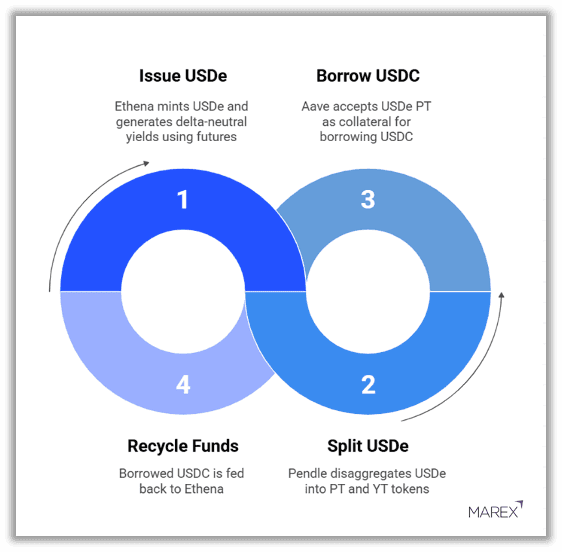

The unique USDe PT loop works roughly like this: It begins with Ethena, which points USDe, an artificial greenback backed by a mix of stablecoins and crypto. Ethena makes use of deposits to implement delta-neutral methods on futures contracts to generate yield, which will get paid to stakers of USDe. Staked USDe is incomes round 9% as of late August.

Pendle then takes USDe and decomposes it into two components: Principal Tokens (PTs) and Yield Tokens (YTs). YTs characterize the variable stream of yield (and any factors accrued) from the underlying asset – USDe on this case. Whereas PTs characterize the underlying worth of USDe, which is offered by Pendle at a reduction (like a T-bill) then redeemed one-to-one at maturity.

Then Aave closes the loop by permitting traders to borrow towards their PT deposits. Since PTs have a predictable redemption construction, they work nicely as collateral. So, depositors typically borrow USDC (for instance), and recycle it again into Ethena to mint new USDe, which flows once more into Pendle, reinforcing the loop.

In brief, Ethena generates yield, Pendle packages it, and Aave leverages it. This construction now accounts for almost all of Ethena’s deposits on Aave and most of Pendle’s whole worth locked (TVL), making it one of the crucial influential yield engines on-chain.

This flywheel didn’t solely work as a result of yields are engaging, however as a result of the protocols share a typical basis. All three are EVM-compatible, making integration simpler. Every is designed to be absolutely on-chain and crypto-native, avoiding dependencies on banks or off-chain property. Moreover, they function in the identical DeFi “neighborhood,” with overlapping person bases and liquidity swimming pools that speed up adoption. What might need in any other case remained a distinct segment experiment has turn into a core constructing block of on-chain yield methods.

The pure query now’s whether or not a fourth protocol will be part of, and Hyperliquid has a robust case for doing so. Ethena makes use of Hyperliquid perps as a part of its yield-generating technique, and USDe is already embedded inside each HyperCore and the HyperEVM. Pendle has $300 million in TVL tied to HyperEVM merchandise, and its new Boros funding-rate markets is a pure match for Hyperliquid perpetual futures. Aave’s relationship with Hyperliquid is extra tentative, however the emergence of HyperLend, a pleasant fork on HyperEVM, factors to a deeper integration forward. As Hyperliquid expands, the system may evolve from a closed loop right into a broader community. Liquidity would not simply cycle inside three protocols however move straight into perpetual futures markets, deepening capital effectivity and reshaping how on-chain yield methods are constructed.

The Ethena-Pendle-Aave loop already exhibits how briskly DeFi can scale when protocols share the identical atmosphere. Hyperliquids may push this mannequin even additional.

– Ilan Solot, senior world markets strategist and co-head of digital property, Marex Options

– Elisabeth Phizackerley, macro strategist analyst, Marex Options

Ask an Knowledgeable

Q. What does “composability” imply in DeFi?

A. In conventional finance, merchandise exist in silos. In DeFi, composability means protocols plug into one another like Lego blocks. Ethena creates yield, Pendle packages it, and Aave lends towards it, all on-chain. This makes development quick but additionally means dangers can unfold rapidly.

Q. What are Principal Tokens (PTs) and Yield Tokens (YTs)?

A. Pendle splits an asset into two components. The Principal Token (PT) is like shopping for a bond at a reduction and redeeming it later. The Yield Token (YT) is much like a coupon, offering an revenue stream. It’s merely a technique to separate principal from yield in crypto type.

Q. What’s a “delta-neutral technique”?

A. Ethena makes use of this to maintain its artificial greenback secure. By holding crypto and shorting futures concurrently, beneficial properties and losses offset one another. The setup stays dollar-neutral whereas nonetheless producing yield much like market-neutral hedge fund methods, however on-chain.

– DJ Windle, founder and portfolio supervisor, Windle Wealth

Hold Studying

- There at the moment are 92 cryptocurrency-related ETF purposes pending approval with the U.S. Securities and Alternate Fee.

- Google Cloud is creating the Common Ledger (GCUL), a brand new Layer-1 blockchain designed for monetary establishments.

- SEC Chair Paul Atkins has floated the imaginative and prescient for a unified “SuperApp Alternate” the place traders may commerce every part from tokenized shares and bonds to cryptocurrencies and digital property beneath a single platform.