Overview of tax rules in India

For the monetary yr 2024-2025, Indian tax legislation treats cryptocurrencies as digital digital belongings (VDAs) underneath the Revenue Tax Act, 1961. Part 2(47A) spells out what which means: Any code, quantity, token or piece of knowledge created by means of cryptography counts as a VDA. The one exception is cash itself — Indian rupees or some other nation’s fiat forex.

VDAs embody cryptocurrencies like Bitcoin (BTC) and Ether (ETH), in addition to non-fungible tokens (NFTs) and related digital tokens. Whereas it’s authorized to purchase, promote and maintain VDAs, they don’t seem to be acknowledged as legitimate fee strategies.

In different phrases, crypto operates in a legally ambiguous house in India in 2025. It’s permitted however carefully monitored for taxation and anti-money laundering (AML) functions.

A number of businesses in India oversee crypto transactions. The Revenue Tax Division enforces tax compliance, guided by the Central Board of Direct Taxes (CBDT) underneath the Ministry of Finance, which units tax insurance policies.

In the meantime, the Monetary Intelligence Unit (FIU-IND) ensures platforms meet AML requirements, whereas the Reserve Financial institution of India (RBI) and the Securities and Trade Board of India (SEBI) form broader regulatory insurance policies.

These our bodies work collectively to supervise crypto taxation within the nation.

The Revenue Tax (No. 2) Invoice, 2025, acquired presidential assent on Aug. 22, 2025, thereby changing the Revenue Tax Act, 1961.

Taxable occasions for crypto merchants in India

India locations crypto transactions underneath a selected tax framework, with a flat 30% tax on good points from transfers and a 1% tax deducted at supply (TDS) utilized to all transfers, whether or not worthwhile or not.

A taxable occasion in crypto is any exercise that creates a tax legal responsibility underneath Indian legislation. This contains transactions that produce earnings, good points or measurable advantages in fiat cash. For those who commerce or make investments, realizing what counts as a taxable occasion is essential to staying compliant with the Revenue Tax Act.

Key taxable occasions embody:

- Buying and selling: Exchanging crypto for one more crypto or fiat forex is taxable.

- Staking rewards: Counted as earnings when acquired.

- Airdrops and laborious forks: Handled as earnings as soon as tokens are credited.

- Mining earnings: Taxed as earnings, with later gross sales topic to capital good points tax.

- Funds in crypto: Thought-about taxable enterprise or skilled earnings.

Non-taxable occasions embody holding digital belongings with out promoting or transferring crypto between private wallets. As a result of these actions don’t produce earnings or good points, they don’t seem to be topic to tax.

Do you know? Indian legislation provides no tax reduction in case you lose your crypto resulting from theft or hacks. Non-compliance can appeal to penalties, curiosity and prosecution for willful evasion.

Crypto tax charges and classifications

In India, earnings from cryptocurrencies is primarily categorized as both enterprise earnings or capital good points. If buying and selling is common and systematic, the earnings are taxed as enterprise earnings underneath customary earnings tax slabs. For many particular person buyers, income from shopping for and promoting cryptocurrencies are thought of capital good points.

As of Aug. 22, 2025, each short-term capital good points (STCG) and long-term capital good points (LTCG) on VDAs are taxed at a flat 30% fee underneath Part 115BBH.

This rule is relevant no matter how lengthy the belongings are held. No deductions, besides the price of acquisition, are permitted, and losses from one VDA can’t be offset in opposition to one other or carried ahead.

Enterprise earnings from crypto is taxed at slab charges however typically faces an analogous tax burden because of the flat 30% fee for VDAs.

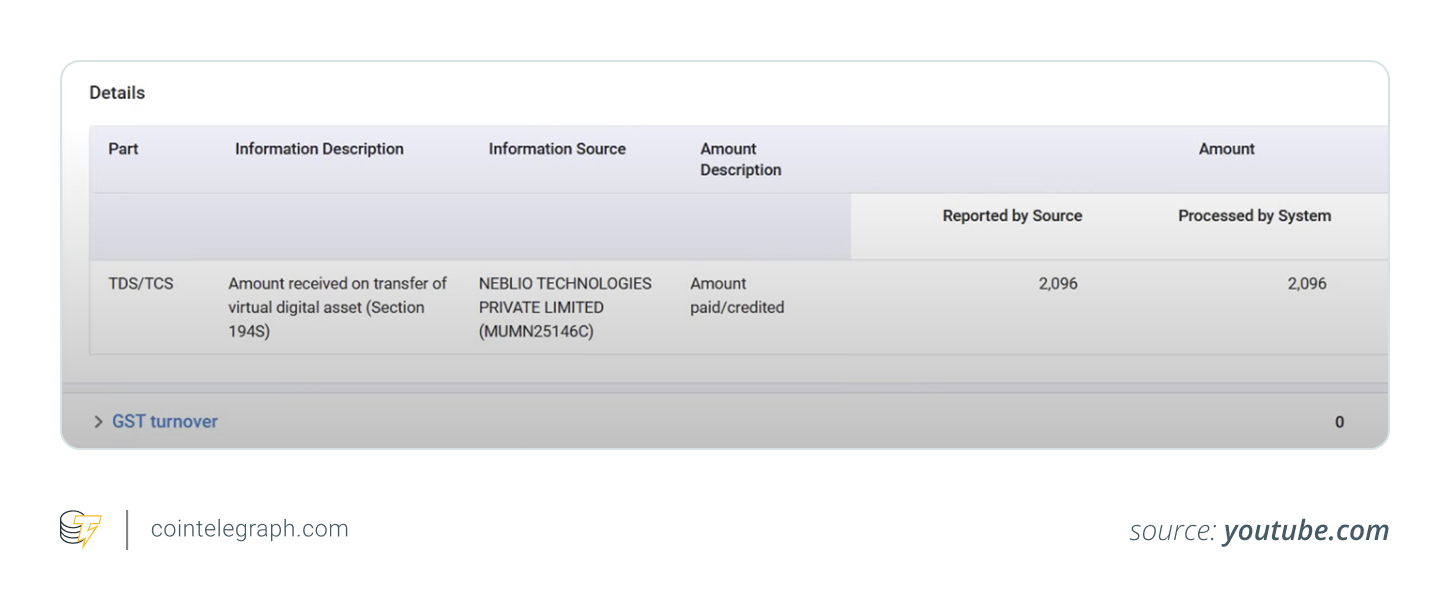

Moreover, a 1% TDS is utilized to all crypto transfers above a sure threshold to make sure transparency and compliance throughout platforms. This contains trades on centralized exchanges and peer-to-peer (P2P) transactions.

TDS on VDAs in India

India’s tax framework for cryptocurrencies features a 1% TDS underneath Part 194S. This obligatory deduction applies to most VDA transactions and was launched to enhance compliance and monitor the increasing crypto market. The principle features of crypto TDS are:

- TDS mechanism: When buying a VDA, the customer deducts a set proportion of the sale quantity as TDS and deposits it with the federal government. This deducted quantity is the tax withheld from the vendor’s fee.

- TDS fee and threshold: Part 194S imposes a 1% TDS on the sale quantity if transactions exceed 50,000 Indian rupees in a monetary yr. In sure instances, this threshold is lowered to 10,000 rupees.

- TDS for non-cash transactions: If a purchaser purchases a VDA utilizing one other VDA (non-cash fee), they need to deduct 1% TDS in money, based mostly on the sale worth, and submit it to the federal government.

- Blended fee situations: When a purchaser pays for a VDA with a mix of money and non-cash (e.g., one other VDA) and the money portion is inadequate to cowl the 1% TDS, the customer should pay the extra TDS quantity from their very own funds.

- No TAN requirement for specified individuals: Underneath Part 203A, a “specified particular person” (as outlined underneath the legislation) is just not required to acquire a tax deduction and assortment account quantity (TAN) for TDS functions.

- TDS exemption for specified individuals: No TDS is deducted for a specified particular person if the whole VDA consideration in a monetary yr is 50,000 rupees or much less.

- TDS exemption for non-specified individuals: For people aside from specified individuals, no TDS is deducted if the VDA consideration is 10,000 rupees or much less in a monetary yr.

- Priority over e-commerce guidelines: If a VDA transaction falls underneath each Part 194S and Part 194-O (associated to e-commerce operators), the provisions of Part 194S take precedence.

- TDS on suspense or non permanent accounts: If the customer deposits the VDA fee right into a suspense or non permanent account of the vendor, the vendor is liable for deducting the TDS.

Do you know? Utilizing overseas exchanges doesn’t exempt merchants’ income from offshore platforms. They have to declare their transactions in Indian ITRs, which can set off FEMA scrutiny.

Tips on how to calculate crypto taxes in India

To calculate crypto taxes in India, you first want to find out the price foundation, which is the acquisition worth of the VDA plus associated bills like change or transaction charges. This serves as the premise for calculating good points or losses when the asset is offered or transferred.

Merchants can use strategies similar to first-in-first-out (FIFO), last-in-first-out (LIFO) or particular identification to trace transactions, relying on the accuracy of their information. The chosen methodology impacts the taxable acquire calculation and should be used constantly.

In crypto-to-crypto trades, the transaction is handled as promoting one asset (triggering good points or losses) and shopping for one other, with each valued at their honest market worth in rupees on the time of the commerce.

Sure bills, similar to transaction charges, pockets or change prices and crypto tax software program prices, might be included in the price of acquisition. Nevertheless, Indian legislation doesn’t permit broader deductions past these acquisition prices.

Crypto tax reporting and compliance necessities in India

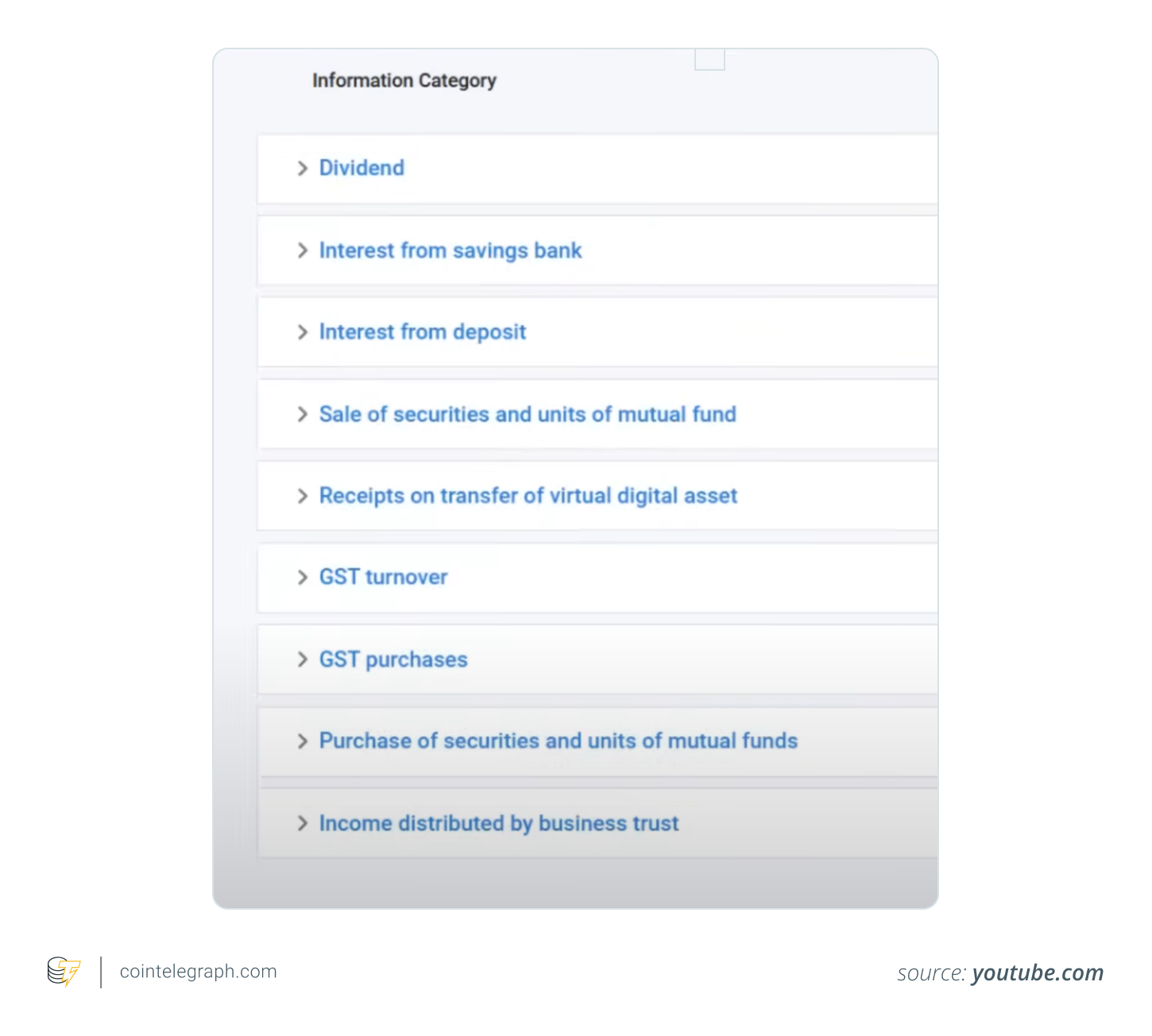

Indian tax legislation makes reporting crypto transactions obligatory, with no exceptions for losses. Revenue should be proven underneath the VDAs class. ITR-2 normally covers capital good points, and ITR-3 applies to enterprise earnings. From FY 2025-26, a brand new Schedule VDA would require every crypto transaction to be reported individually.

Taxpayers should hold correct information, together with transaction particulars, change statements, pockets addresses and rupee valuations, to help their filings. These information are very important, notably throughout audits or scrutiny.

For people not requiring an audit, the deadline for submitting earnings tax returns in 2025 is July 31, 2025. Companies requiring an audit should file by Oct. 31, 2025.

Non-compliance can result in penalties, similar to curiosity on unpaid taxes, fines for late submitting and potential prosecution for deliberate tax evasion. Due to this fact, well timed and correct reporting is essential for crypto merchants and buyers.

Do you know? Presents in crypto are taxable if the worth exceeds 50,000 rupees, except acquired from family members or throughout particular exempt events.

Challenges and customary points for crypto merchants in India concerning taxation

Taxation is a fancy problem for crypto merchants in India resulting from altering rules and restricted readability in sure areas of the crypto ecosystem. Though good points from VDAs are taxed, a number of challenges create confusion and compliance difficulties.

Key challenges embody:

- Lack of readability in tax legal guidelines for DeFi and NFTs: Rules for staking, lending and NFT gross sales are unclear, leading to inconsistent reporting.

- Monitoring high-volume trades throughout a number of platforms: Frequent buying and selling on varied exchanges makes it difficult to precisely calculate good points and preserve information.

- Tax implications of cross-border transactions: Utilizing overseas exchanges or wallets raises points associated to the International Trade Administration Act, 1999 (FEMA), double taxation and worldwide reporting necessities.

- Coping with misplaced or stolen crypto belongings: Indian tax legislation provides no reduction for theft or loss, leaving merchants unsure about easy methods to report such occasions of their filings.