Key takeaways:

-

Not like 2017, long-term XRP holders have already shifted from euphoria into doubt.

-

The XRP/BTC pair stays 90% under its 2017 peak and is caught in a distribution zone.

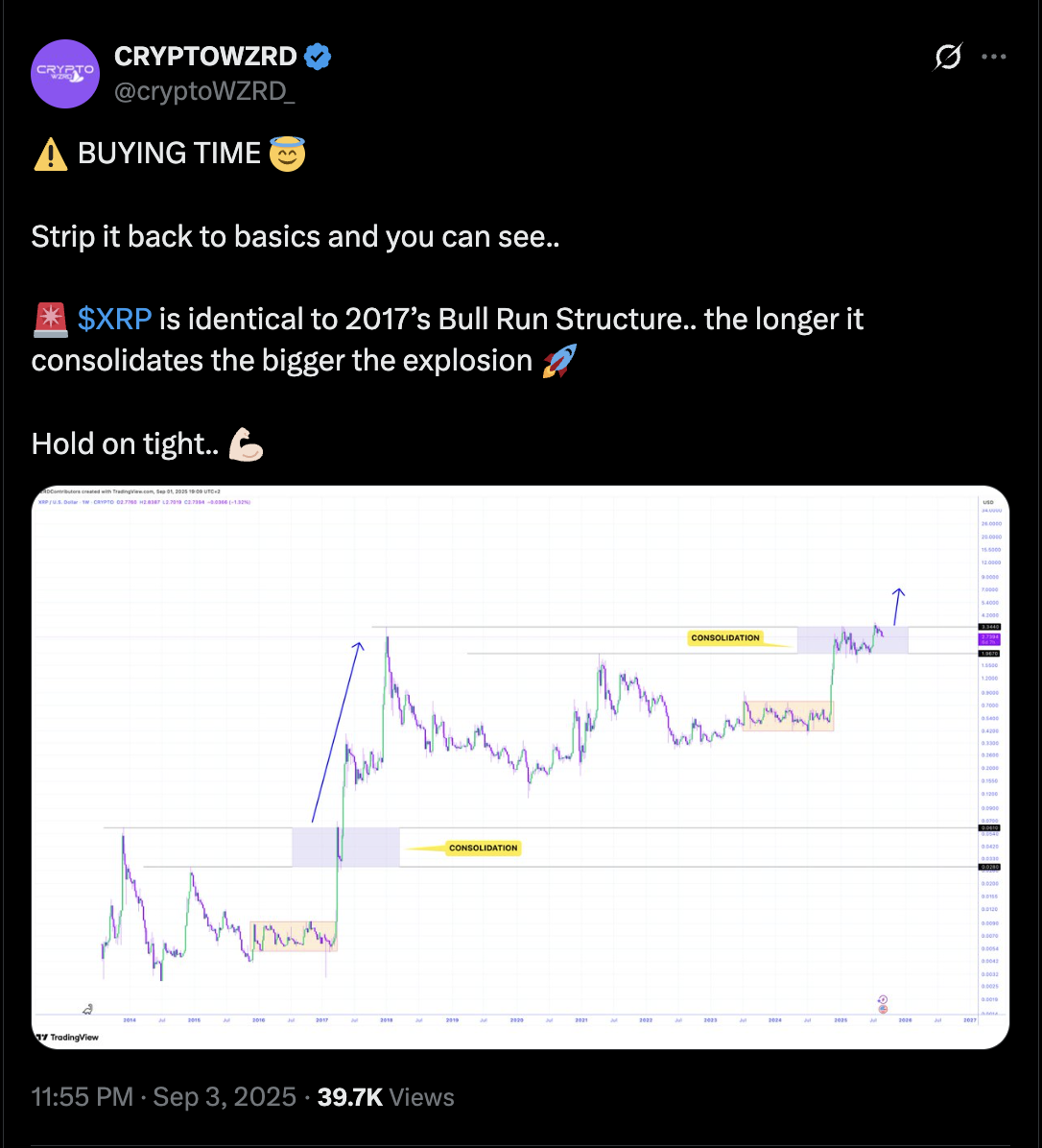

A number of XRP (XRP) analysts are referencing outdated bullish charts to foretell new value booms, with a number of commentators, together with CRYPTOWZRD and JD, arguing that XRP’s present value construction mirrors its 2017 bull run.

Again then, XRP spent months consolidating inside an enormous symmetrical triangle earlier than breaking out, briefly retesting assist, after which accelerating by over 11,900% in underneath a yr.

Chartists say immediately’s consolidation section is exhibiting the identical sample, anticipating XRP to achieve a cycle goal of $20.

Situations in 2025 are vastly completely different, nevertheless, making a repeat of 2017’s beneficial properties removed from assured.

Lengthy-term XRP holders doubt increased costs

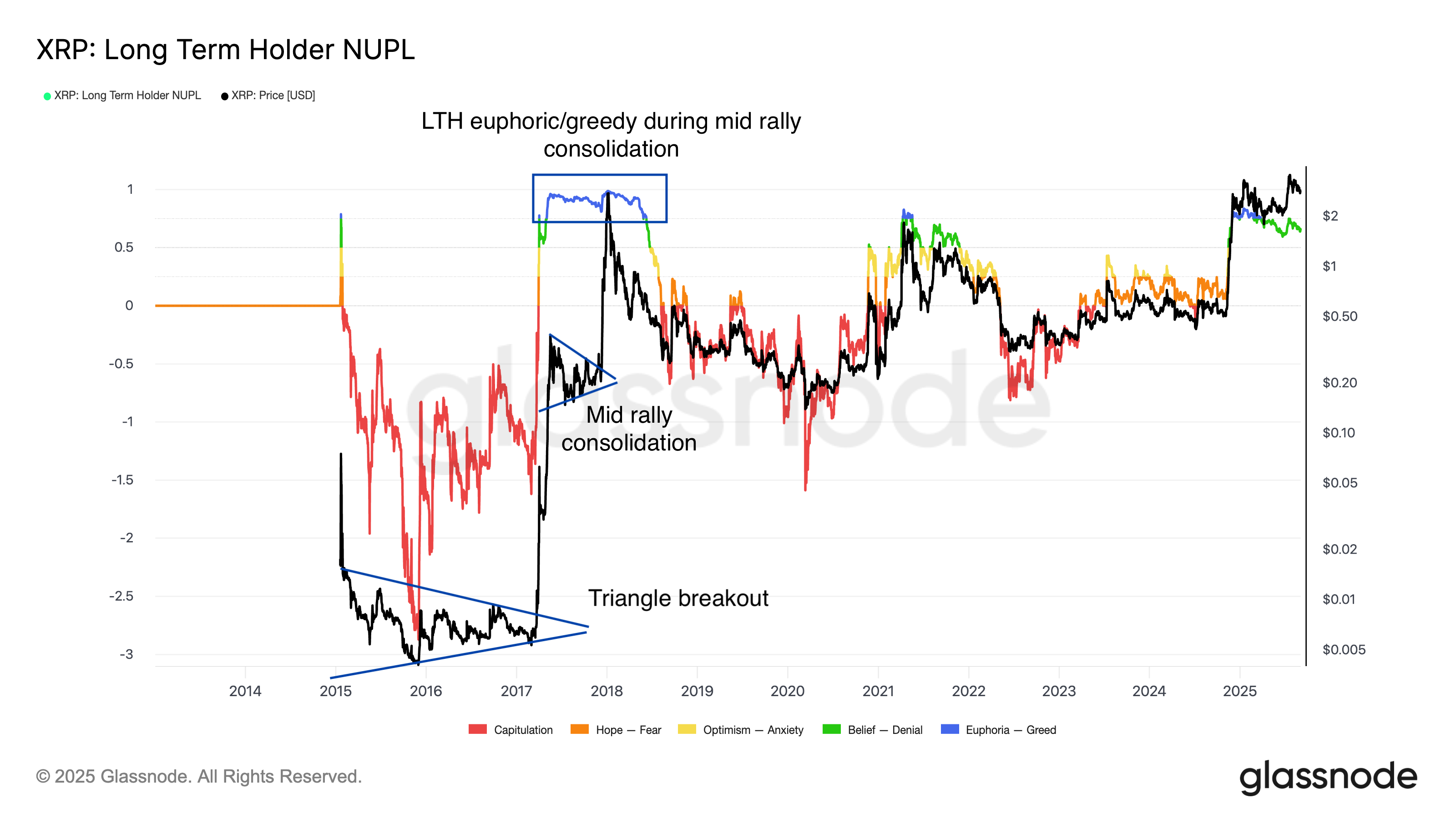

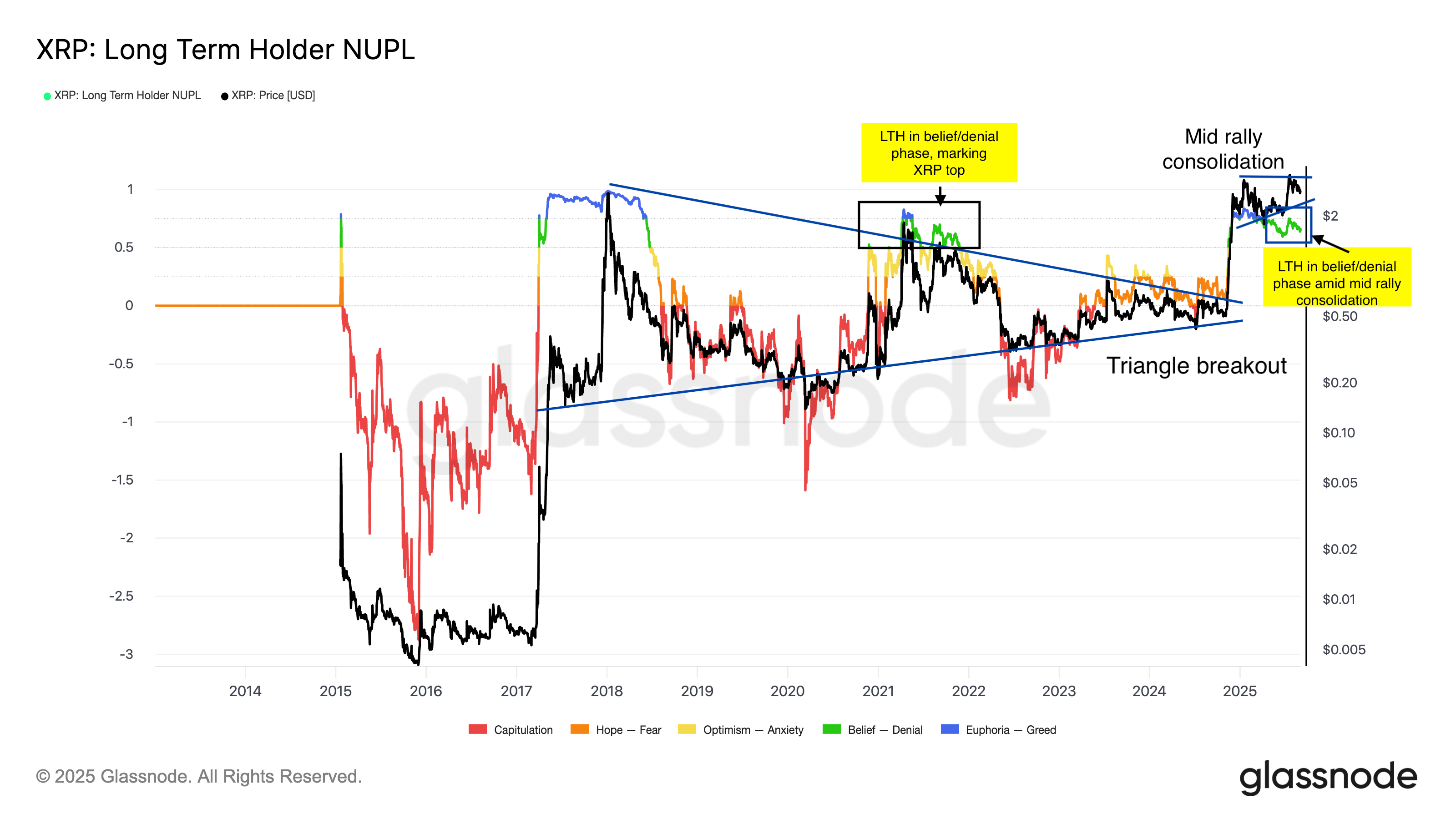

One approach to check whether or not XRP’s 2025 rally actually mirrors 2017 is by trying on the Internet Unrealized Revenue/Loss (NUPL) for long-term holders.

In 2017, when XRP broke out of its large triangle and started its monster rally, the long-term holder NUPL went straight into the Euphoria–Greed zone (blue).

Meaning holders have been sitting on large income and have been nonetheless assured sufficient to journey the rally increased.

Importantly, sentiment by no means slipped again into the “Perception–Denial” stage (inexperienced) till nicely after the highest, exhibiting robust conviction throughout the parabolic rise.

In 2025, the scenario seems to be completely different. Despite the fact that XRP has rallied strongly, the NUPL information reveals long-term holders have already moved from Euphoria–Greed down into Perception–Denial.

This section suggests traders are questioning whether or not the rally can final, an indication of hesitation slightly than conviction.

As a substitute, their temper seems to be extra prefer it did in 2021, when pleasure gave approach to doubt simply earlier than the market cooled.

XRP value stays weak versus Bitcoin

In 2017, XRP’s surge within the US greenback phrases additionally accompanied sharp beneficial properties in opposition to Bitcoin (BTC).

Again then, the XRP/BTC pair climbed by greater than 3,700% to over 0.00023 BTC inside a yr. That transfer mirrored XRP’s place on the time as one of many few large-cap altcoins providing a payments-focused narrative.

In 2025, the construction is completely different.

XRP/BTC has rebounded to round 0.000025 BTC in September from mid-2024 lows close to 0.000010 BTC. Nonetheless, the pair stays about 90% under its 2017 peak.

It’s additional testing a long-term distribution zone at 0.000025–0.000030 BTC, the place rallies stalled a number of instances between 2019 and 2022.

The 2017 ICO-driven surge additionally had fewer opponents, with XRP being one of many oldest cryptocurrencies. At present, it contends with rivals like Ether (ETH), Solana (SOL), and Sui (SUI), alongside rising stablecoins within the cross-border settlement house.

Associated: Altseason received’t begin till extra crypto ETFs launch: Bitfinex

In different phrases, will probably be a lot tougher for XRP bulls to attain five-digit share beneficial properties this time as they did in 2017.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a choice.