Key takeaways:

-

From memecoin to mainstream? The primary $175 million DOGE treasury is launched.

-

DOGE worth bullish megaphone sample places a 550% rally to $1 in play.

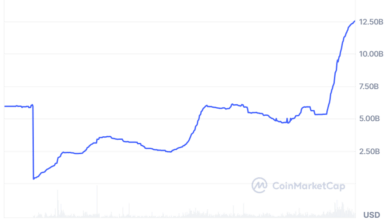

Dogecoin’s (DOGE) worth has rallied 10% from its month-to-month lows at $0.205 to an intraday excessive of $0.224 on Thursday. This transfer is fueled by the launch of the primary official Dogecoin treasury by CleanCore Options.

Can institutional adoption propel DOGE worth above $1?

A $175 million Dogecoin “Technique”

CleanCore Options, a Nebraska-based maker of aqueous ozone cleansing methods, turns into the primary publicly traded firm to undertake Dogecoin as its major treasury reserve asset.

The corporate disclosed a $175 million non-public placement backed by over 80 institutional and crypto-native buyers, marking a historic step for the cryptocurrency.

Associated: KuCoin targets 10% of Dogecoin mining capability by way of new mining platform

This initiative, backed by the Dogecoin Basis and the Home of DOGE, goals to institutionalize DOGE by making a foundation-backed treasury technique.

🚨 NEW: Home of Doge, the Dogecoin Basis and CleanCore Options have launched a 175 million $DOGE treasury initiative. pic.twitter.com/i1AVzML2sB

— Cointelegraph (@Cointelegraph) September 2, 2025

The transfer mirrors Technique’s BTC-only “technique” and Bitcoin’s ETF-driven success, probably unlocking billions in institutional inflows.

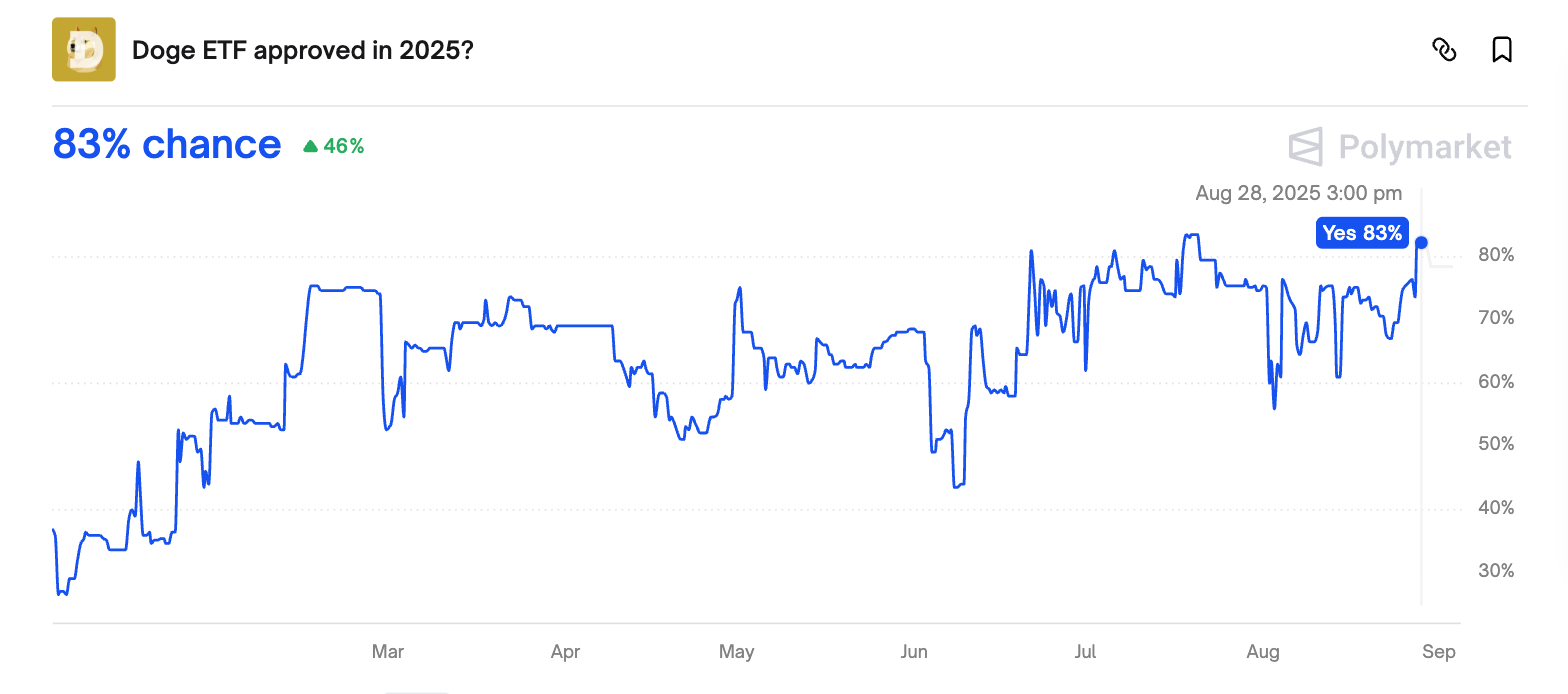

Analysts recommend this might drive demand as regulated capital can enter the market, with the 21Shares Dogecoin ETP already accepted for buying and selling in Europe and a 79% probability of a spot ETF approval in 2025, per information from Polymarket.

This attainable new demand from Dogecoin ETFs and firms may justify a $1 goal by late 2025.

DOGE worth megaphone targets $1-$1.40

The weekly candle timeframe exhibits Dogecoin buying and selling inside a bullish megaphone sample, because the chart under exhibits.

The value bounced off the decrease trendline of the sample at $0.15 in June, indicating the beginning of one other vital transfer upward.

“Dogecoin is at present providing us an enormous alternative on the weekly timeframe,” analyst Bitcoinsensus stated in a publish on Tuesday.

An accompanying chart revealed that Dogecoin has beforehand posted greater proportion positive factors whereas buying and selling throughout the identical megaphone sample, with virtually each rally beating the final.

“As we’ve seen prior to now, this coin has been transferring upward in impulsive waves, every being greater than the earlier one,” the analyst stated, including:

“This subsequent wave may probably result in costs as excessive as $1.40.”

Such a transfer would characterize a 550% worth improve from the present ranges.

Fellow analyst Barry ChartMonkey made the same statement in mid-August, saying that the rebound from $0.15 in June was a “signal of a brand new bullish leg for the 2-year Bullish Megaphone,” with the opportunity of hitting the three.618 Fibonacci extension at $1.15.

📈LONG: $DOGE by @TradingShot@dogecoin DOGE simply accomplished its first 1D Golden Cross formation in 9 months! This might be an indication of a brand new bullish leg for the 2-year Bullish Megaphone, with earlier peaks hitting the three.618 Fibonacci extension. #Dogecoin #BullishLeg #Fibonacci pic.twitter.com/mXGR8vTaQ8

— Barry | ChartMonkey (@ChartMonkeyBTC) August 13, 2025

Zooming in, the highest memecoin consolidates inside a symmetric triangle on the each day chart, information from Cointelegraph Markets Professional and TradingView exhibits.

A break above the resistance line of the triangle at $1.225 (the 50-day easy transferring common) would affirm a bullish breakout from consolidation. The measured bullish goal of the sample is $0.37, or a 72% improve in DOGE worth.

As Cointelegraph reported, Dogecoin’s break above the 50-day SMA would keep away from a deeper drop towards the $0.19-$0.16 zone.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a call.