Bitcoin is decrease than it was 24 hours in the past, down about 0.7%, however nonetheless firmly throughout the vary that is constrained it for the reason that final week of August. The decline’s turn out to be a bit extra pronounced since midnight UTC, with a drop of about 0.9%.

For the broader market, the CoinDesk 20 Index has fallen 1.3% since midnight, with all however one part heading south. XRP is the one token within the inexperienced, and that is up lower than 0.1%.

The unfavourable sentiment is echoed within the choices and perpetual futures markets. Perpetual funding charges have dropped and put choices, or safety towards value declines, dominating over calls. Greater than $4.5 billion in choices is about to run out on Deribit on Friday, alongside the U.S. jobs report for August.

“Open curiosity is tilted towards places, with notable clustering across the $105,000 to $110,000 strikes, suggesting draw back safety stays a key theme,” the derivatives alternate mentioned in a submit on X.

Derivatives Positioning

- BTC derivatives positioning has cooled, exercise remains to be there nonetheless, with momentum and directional conviction wanting muted somewhat than stagnant.

- Open curiosity in perpetual futures throughout main venues has dropped from the current peak close to $33 billion to about $30 billion.

- On the identical time, the three-month annualized foundation retains compressing to roughly 5%–6% throughout Binance, OKX and Deribit, leaving the carry commerce solely marginally worthwhile.

- Choices knowledge is sending blended indicators. Whereas the upward-sloping implied volatility curve suggests the market expects long-term volatility to be greater than short-term, different metrics level to a extra instant bearish outlook.

- Particularly, the 25 delta skew continues to be both flat or barely unfavourable, with merchants paying a premium for places over calls to achieve draw back safety. This short-term bearish sentiment is contradicted by 24-hour put name quantity, with calls (63%) dominating choices contracts for BTC.

- Funding price APRs throughout main perpetual swap venues are little modified round 4%-6% annualized, in keeping with Velo knowledge. Hyperliquid is the one alternate with a price greater than 6% for BTC, reflecting a pocket of stronger long-term curiosity relative to different exchanges. Total, funding dynamics counsel a steady market with remoted indicators of froth, somewhat than broad directional conviction.

- Coinglass knowledge exhibits $225 million in 24-hour liquidations, with a 50-50 break up between longs and shorts. ETH ($65million), BTC ($46 million) and others ($19 million) had been the leaders when it comes to notional liquidations.

- The Binance liquidation heatmap signifies $110,250 as a core liquidation degree to watch, in case of a value drop.

Token Speak

By Oliver Knight

- Donald Trump-linked DeFi token phrase liberty monetary (WLFI) slumped to a report low $0.174 on Thursday because the token’s reputation begins to fade simply days after its buying and selling debut.

- The 21% day by day drawdown may be attributed to quite a lot of components, notably the truth that some token holders are nonetheless in revenue after buying in the course of the token sale. These holders will probably be tempted to lock of their earnings as hype across the undertaking fades.

- One dealer made $250 million after shopping for $15 million in the course of the sale, one other misplaced $2.2 million after going lengthy on WLFI futures.

- Whereas WLFI is linked to the U.S. president, when it comes to growth and innovation, there’s nothing apparent to distinguish it from the hundreds of different DeFi-themed tokens. Because of this merchants could also be inclined to leap ship till they see growth of the undertaking.

- “WLFI crew, cease sleeping and begin taking motion. The neighborhood is already indignant, no less than don’t lose the final remaining buyers,” one holder wrote on X.

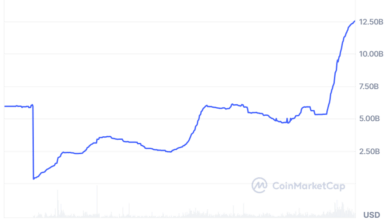

- The chart seems to be eerily much like the TRUMP memecoin that was launched in January. After a interval of preliminary upside, TRUMP misplaced 89% of its worth and day by day quantity dwindled from $39 billion on opening day to only $210 million prior to now 24 hours.

- In an try to quell the promoting strain, the undertaking revealed on X that WLFI held by the crew wouldn’t be bought on the open market, stating that each token within the treasury can be topic to governance and never the crew’s discretion.

- The tweet didn’t stem the decline, and costs continued to tumble shortly after.

Saksham Diwan contributed to this report.