- The ADP and NFP reviews will function indicators of US employment this week, the canary within the cage for the Fed’s coverage.

- The US non-public sector is predicted to have added 68K new payrolls in August.

- The US Greenback struggles on the decrease finish of August’s buying and selling vary.

This week, the US employment is ready to take centre stage. Computerized Knowledge Processing Inc. (ADP), the most important payroll processor within the US, is ready to launch the ADP Employment Change report for August, measuring the change within the variety of individuals privately employed within the US, at 12:15 GMT on Thursday.

Buyers will probably be particularly attentive to August’s ADP job report, after July’s Nonfarm Payrolls (NFP) shock that triggered the ousting of a key Labour Division official and despatched the US Greenback (USD) right into a tailspin.

August’s figures will even be essential to find out the Federal Reserve’s (Fed) financial coverage, as will probably be the final employment report forward of the September 16 and 17 assembly.

These figures are available in a context of escalating assaults from US President Donald Trump on the Federal Reserve, calling for much less restrictive rates of interest, as merchants ramp up their bets for a resumption of the Fed’s easing cycle in September.

The ADP survey is usually revealed a couple of days earlier than the official Nonfarm Payrolls information are launched. It’s ceaselessly considered as an early indicator of potential traits that could be mirrored within the Bureau of Labor Statistics (BLS) employment report. Nonetheless, the 2 reviews don’t at all times align.

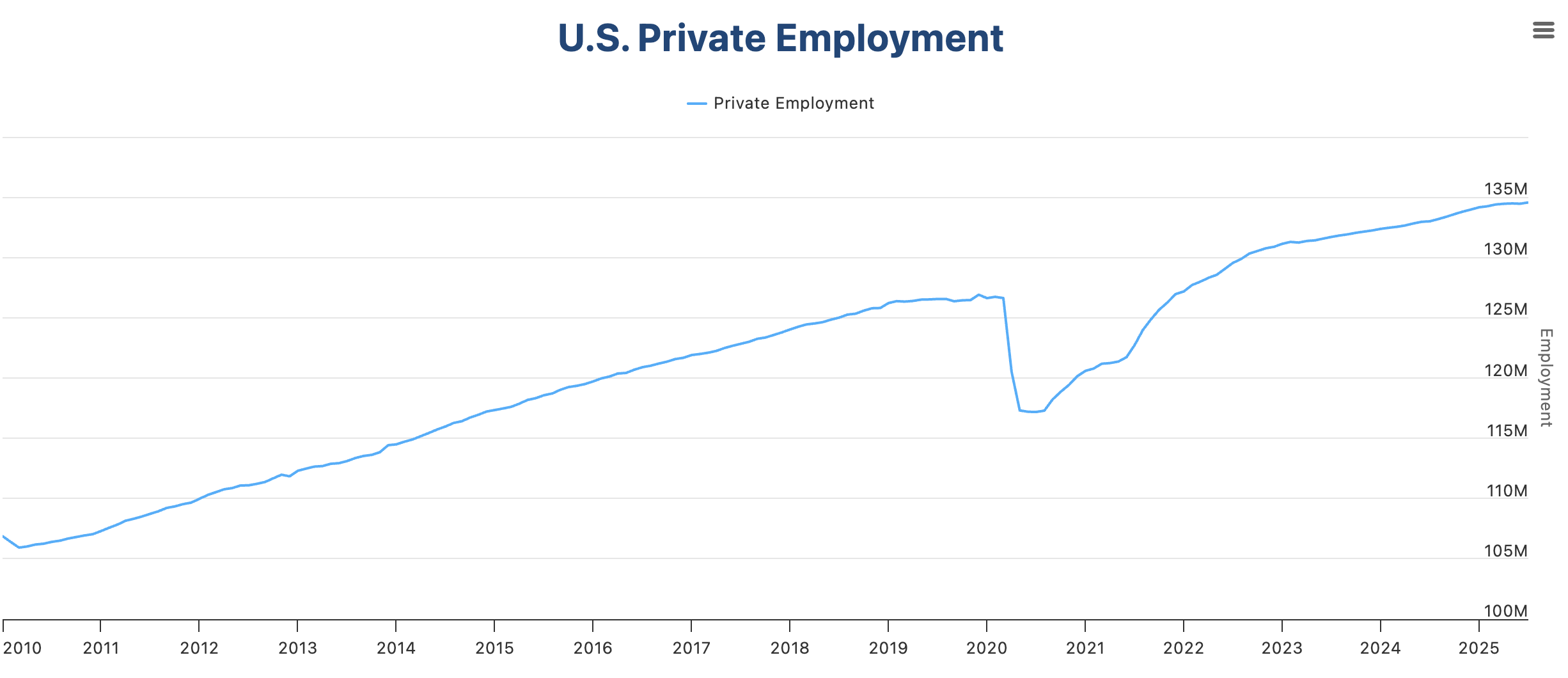

Chart from Computerized Knowledge Processing

Labour information may verify a Fed price minimize in September

Employment serves as a basic factor of the Fed’s twin mandate, along side retaining worth stability.

In that sense, the unexpectedly weak job information seen in July boosted hypothesis about draw back dangers to the financial system and compelled the central financial institution to shift its focus away from the inflationary dangers of Trump’s tariffs.

The poor employment achieve seen in July, coupled with sharp downward revisions of the earlier two months’ launch within the NFP, rattled markets, shattering the idea of US financial exceptionalism and forcing the Federal Reserve to rethink its hawkish stance.

US inflation figures seen over the earlier week have contributed to easing considerations about escalating worth pressures, no less than for now, and Fed President Jerome Powell accepted the thought of a one-off affect from commerce tariffs. A major change of tone that strengthened the case for fast rate of interest cuts.

One other Client Costs Index (CPI) report is due forward of this month’s Federal Open Market Committee (FOMC) assembly, however additional indicators of a weakening labour market may virtually verify a Fed minimize on the subsequent assembly.

The CME Group’s Fed Watch Device is displaying a virtually 90% likelihood of a 25 foundation level minimize this month, forward of the discharge of US employment numbers, and no less than one other quarter level minimize earlier than the top of the 12 months.

When will the ADP report be launched, and the way might it have an effect on the US Greenback Index?

The ADP Employment Change report for August is ready to be launched on Thursday at 12:15 GMT. The market consensus factors to 68K new jobs following a 104K enhance in July. The US Greenback Index (DXY), which measures the worth of the Buck in opposition to the world’s most traded currencies, is transferring up from four-week lows, however stays properly beneath the degrees seen earlier than the discharge of July’s employment figures

In opposition to this background, the danger is on a weaker-than-expected studying, which might drive the Fed to speed up its easing cycle and produce the potential for a 50-basis-point minimize to the desk, triggering contemporary promoting strain on the US Greenback.

An upbeat consequence, quite the opposite, would ease considerations a couple of sharp financial slowdown, however is unlikely to change expectations about Fed easing, no less than till Thursday’s figures are confirmed by Friday’s NFP report. Such an end result is more likely to have a reasonable constructive affect on the USD.

Concerning the EUR/USD, Guillermo Alcala, FX analyst at FXstreet, sees the pair searching for course inside the final 150-pip horizontal vary that has contained worth motion since early August.

Alcalá sees an essential resistance space forward of 1.1740: “The confluence between the descending trendline resistance, now round 1.1730, and 1.1740, which encompasses the peaks of August 13 and 22, in addition to Monday’s excessive, is more likely to pose a severe problem for bulls.”

To the draw back, Alcalá highlights the assist space above 1.1575: “Euro bears are more likely to face important assist on the backside of the month-to-month vary, between 1.1575 and 1.1590, which capped bears on August 11, 22, and 27. Additional down, the 50% Fibonacci retracement degree of the early August bullish run, at 1.1560, may present some assist forward of the August 5 low, close to 1.1530.

Fed FAQs

Financial coverage within the US is formed by the Federal Reserve (Fed). The Fed has two mandates: to attain worth stability and foster full employment. Its main device to attain these targets is by adjusting rates of interest.

When costs are rising too shortly and inflation is above the Fed’s 2% goal, it raises rates of interest, rising borrowing prices all through the financial system. This leads to a stronger US Greenback (USD) because it makes the US a extra enticing place for worldwide traders to park their cash.

When inflation falls beneath 2% or the Unemployment Price is just too excessive, the Fed could decrease rates of interest to encourage borrowing, which weighs on the Buck.

The Federal Reserve (Fed) holds eight coverage conferences a 12 months, the place the Federal Open Market Committee (FOMC) assesses financial situations and makes financial coverage choices.

The FOMC is attended by twelve Fed officers – the seven members of the Board of Governors, the president of the Federal Reserve Financial institution of New York, and 4 of the remaining eleven regional Reserve Financial institution presidents, who serve one-year phrases on a rotating foundation.

In excessive conditions, the Federal Reserve could resort to a coverage named Quantitative Easing (QE). QE is the method by which the Fed considerably will increase the movement of credit score in a caught monetary system.

It’s a non-standard coverage measure used throughout crises or when inflation is extraordinarily low. It was the Fed’s weapon of selection in the course of the Nice Monetary Disaster in 2008. It entails the Fed printing extra {Dollars} and utilizing them to purchase excessive grade bonds from monetary establishments. QE normally weakens the US Greenback.

Quantitative tightening (QT) is the reverse means of QE, whereby the Federal Reserve stops shopping for bonds from monetary establishments and doesn’t reinvest the principal from the bonds it holds maturing, to buy new bonds. It’s normally constructive for the worth of the US Greenback.

Financial Indicator

ADP Employment Change

The ADP Employment Change is a gauge of employment within the non-public sector launched by the most important payroll processor within the US, Computerized Knowledge Processing Inc. It measures the change within the variety of individuals privately employed within the US. Typically talking, an increase within the indicator has constructive implications for shopper spending and is stimulative of financial development. So a excessive studying is historically seen as bullish for the US Greenback (USD), whereas a low studying is seen as bearish.

Learn extra.

Subsequent launch:

Thu Sep 04, 2025 12:15

Frequency:

Month-to-month

Consensus:

68K

Earlier:

104K

Supply:

ADP Analysis Institute