- The Pound Sterling trades broadly secure in opposition to its friends after BoE members’ speeches earlier than the Treasury Committee.

- BoE Governor Bailey hints at excessive doubts over the tempo of rate of interest cuts.

- Buyers await key US ADP Employment and ISM Companies PMI knowledge for August.

The Pound Sterling (GBP) trades calmly in opposition to its main friends on Thursday because the Financial institution of England (BoE) officers delivered blended remarks on the financial coverage outlook earlier than the Home of Commons’ Treasury Committee the day prior to this.

BoE Governor Andrew Bailey signaled important uncertainty on the tempo of rate of interest cuts within the close to time period, citing dangers to each inflation and the labor market. “I believe path for charges will proceed to be downwards, however there’s significantly extra doubt on how briskly we are able to reduce charges,” Bailey stated. He added that “I am extra involved about draw back job dangers than Financial Coverage Committee (MPC) members who voted to maintain charges on maintain”.

Talking on the listening to of the Treasury Committee, BoE Deputy Governor Clare Lombardelli and BoE financial policymaker Megan Greene reiterated a hawkish steering on the rate of interest outlook, citing upside inflation dangers. Lombardelli warned that additional financial coverage growth may derail the central financial institution’s aim of bringing inflation sustainably right down to the two% goal. Buyers ought to be aware that each BoE officers supported holding rates of interest regular within the coverage assembly in August.

Quite the opposite, BoE MPC member Alan Taylor argued in favor of lowering rates of interest at a sooner tempo, citing that the latest improve in inflation is unlikely to be persistent. Taylor favored an even bigger 50 foundation level (bp) rate of interest discount within the August assembly and revised his vote to a 25 bps decline to get a majority vote.

Concerning surging UK gilt yields, BoE Governor Bailey stated that the state of affairs appears to be world, not particular to the UK (UK), as the federal government has not raised a major debt.

Pound Sterling Value Right this moment

The desk beneath exhibits the share change of British Pound (GBP) in opposition to listed main currencies in the present day. British Pound was the strongest in opposition to the Australian Greenback.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.12% | 0.02% | 0.16% | 0.17% | 0.28% | 0.13% | 0.13% | |

| EUR | -0.12% | -0.10% | -0.02% | 0.04% | 0.20% | 0.00% | -0.04% | |

| GBP | -0.02% | 0.10% | 0.18% | 0.14% | 0.29% | 0.11% | 0.06% | |

| JPY | -0.16% | 0.02% | -0.18% | 0.04% | 0.07% | 0.04% | 0.00% | |

| CAD | -0.17% | -0.04% | -0.14% | -0.04% | 0.07% | -0.01% | -0.08% | |

| AUD | -0.28% | -0.20% | -0.29% | -0.07% | -0.07% | -0.18% | -0.24% | |

| NZD | -0.13% | -0.00% | -0.11% | -0.04% | 0.01% | 0.18% | -0.01% | |

| CHF | -0.13% | 0.04% | -0.06% | -0.01% | 0.08% | 0.24% | 0.00% |

The warmth map exhibits proportion modifications of main currencies in opposition to one another. The bottom forex is picked from the left column, whereas the quote forex is picked from the highest row. For instance, should you choose the British Pound from the left column and transfer alongside the horizontal line to the US Greenback, the share change displayed within the field will characterize GBP (base)/USD (quote).

Every day digest market movers: Pound Sterling ticks down in opposition to US Greenback forward of US knowledge

- The Pound Sterling ticks down to close 1.3435 in opposition to the US Greenback (USD) throughout the European buying and selling session on Thursday. The GBP/USD pair faces a slight promoting stress because the US Greenback stabilizes after a corrective transfer on Wednesday.

- On the time of writing, the US Greenback Index (DXY), which tracks the Buck’s worth in opposition to six main currencies, ticks as much as close to 98.25.

- The Buck fell sharply on Wednesday after the discharge of the US JOLTS Job Openings knowledge for July, which missed estimates. Contemporary jobs posted by US employers got here in at 7.18 million, decrease than expectations of seven.4 million, and the prior studying of seven.35 million. Weak US job openings knowledge intensified expectations supporting rate of interest cuts by the Federal Reserve (Fed) for the upcoming September financial coverage assembly.

- Based on the CME FedWatch instrument, the chance for the Fed to chop rates of interest in September has elevated to 97.6% from 92% seen earlier than the US JOLTS Job Openings knowledge launch.

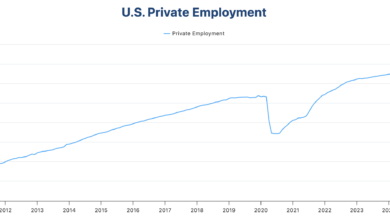

- In Thursday’s session, buyers will deal with the US ADP Employment Change and the US ISM Companies PMI knowledge for August, which might be revealed throughout North American buying and selling hours.

- The ADP is predicted to point out that new 65K staff have been added by the US non-public sector in August, considerably decrease than 104K in July. In the meantime, the US ISM Companies PMI is predicted to return in at 51.0, larger than the prior launch of fifty.1.

- On a broader be aware, the outlook of the US Greenback is unsure amid doubts surrounding the way forward for tariffs imposed by US President Donald Trump since his return to the White Home. Trump introduced on Tuesday that he’ll push the tariff case to the Supreme Court docket instantly after the appeals courtroom dominated in opposition to a majority of further imports. A panel of judges known as tariffs “unlawful” and accused Trump of improperly invoking the emergency regulation.

Technical Evaluation: Pound Sterling faces stress close to 20-day EMA

The Pound Sterling ticks down to close 1.3435 in opposition to the US Greenback on Thursday. The near-term pattern of the GBP/USD pair has turned bearish because it trades beneath the 20-day Exponential Shifting Common (EMA), which is round 1.3463.

The 14-day Relative Power Index (RSI) oscillates contained in the 40.00-60.00 vary, indicating a sideways pattern.

Wanting down, the August 1 low of 1.3140 will act as a key help zone. On the upside, the August 14 excessive close to 1.3600 will act as a key barrier.

Financial Indicator

JOLTS Job Openings

JOLTS Job Openings is a survey executed by the US Bureau of Labor Statistics to assist measure job vacancies. It collects knowledge from employers together with retailers, producers and totally different workplaces every month.

Learn extra.