Key factors:

-

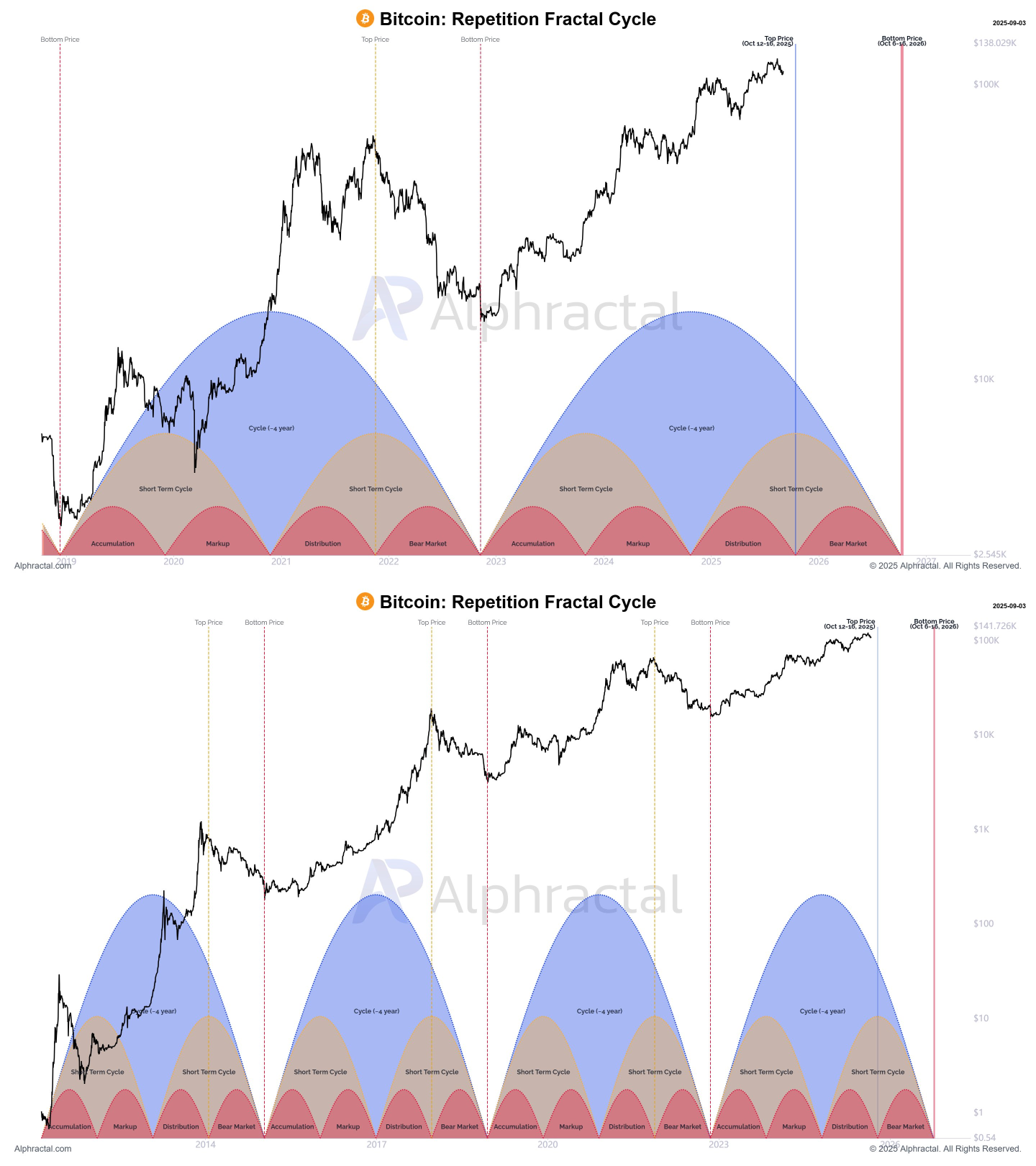

Bitcoin is approaching the beginning of its bear market if four-year cycle principle continues to be legitimate.

-

BTC value targets embody $50,000 for October 2026.

-

Bitcoin is presently battling a resistance pattern line that would spark a $100,000 help retest.

Bitcoin (BTC) might have only one month earlier than the top of a four-year cycle, triggering a $50,000 collapse.

New feedback from Joao Wedson, founder and CEO of crypto analytics platform Alphractal, additionally embody a $140,000 BTC value goal.

Can Bitcoin escape its scheduled bear market?

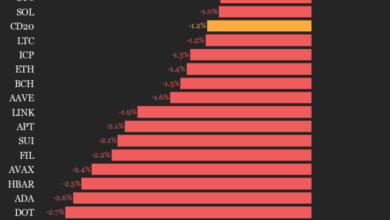

Bitcoin faces a brand new reckoning because the bull market endures its newest 15% correction from all-time highs.

Amid misgivings over the long run, Wedson sees the potential of a brand new bear market beginning as quickly as October.

Importing charts of its so-called “Repetition Fractal Cycle” to X, he confirmed that BTC/USD is approaching the time when bear markets traditionally take over.

“After all, it will be reckless to imagine that Bitcoin has solely slightly over one month left on this cycle primarily based solely on this chart,” he acknowledged.

“Nonetheless, I can’t assist however assume—this may very well be simply sufficient time for BTC to dip towards the $100K vary earlier than rocketing previous $140K throughout the similar interval. Who would dare to doubt that situation?”

Wedson notes that this cycle is markedly in contrast to others earlier than it, because of the presence of main institutional traders and Bitcoin’s ascent to main asset standing.

“The true query is whether or not this fractal will stay dependable within the face of heavy hypothesis round ETFs and rising institutional demand,” he continued.

A US macroasset bear market might effectively type the nail within the coffin for Bitcoin bulls if it coincides with the fractal’s bear-market schedule.

The query boils all the way down to the standing of the four-year value cycle amid rising debate over its relevance in 2025.

As soon as October hits and if bears acquire power, BTC value backside targets, already daring, now embody yet one more stage on the radar for October 2026. Wedson summarized:

“Personally, I’m wanting to see whether or not the brand new wave of crypto lovers are proper in claiming the 4-year cycle is over and Bitcoin will now rise endlessly—or if 2025 marks the ultimate breath earlier than a pointy correction, with costs probably sinking under $50K within the 2026 bear market.”

All eyes on the $100,000 BTC value battle

As Cointelegraph continues to report, market contributors favor a $100,000 help retest as half of the present correction.

Associated: Bitcoin short-term holders spark uncommon BTC value backside sign at $107K

One standard dealer even sees that occasion coming this week. He says the bull market will likely be over if the bulls fail to carry the $100,000 mark.

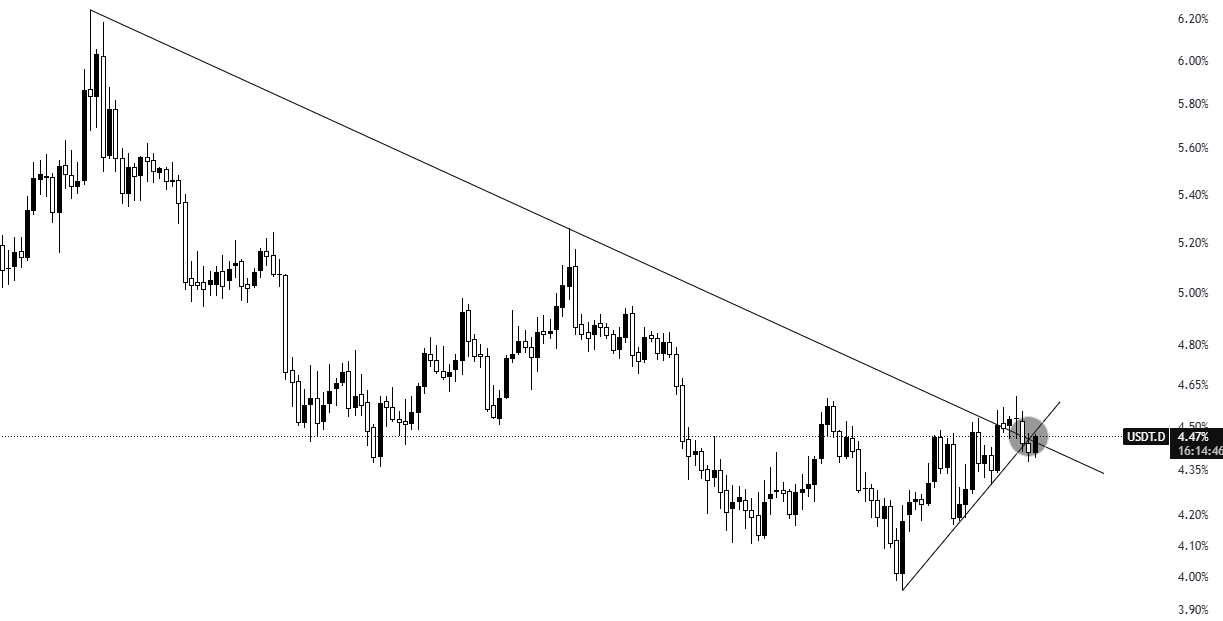

BTC/USD is presently making an attempt to interrupt via a downward-sloping pattern line, which has fashioned the ceiling for value all through the correction that started in mid-August.

“This 1 chart decides if $BTC breaks under $100K or breaks to new ATH,” standard dealer Killa instructed X followers Thursday.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a choice.