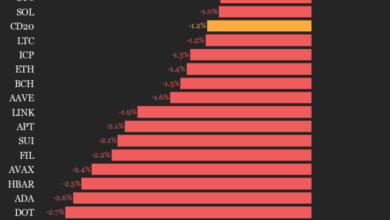

Gold is the standout performer of 2025, climbing greater than 33%.

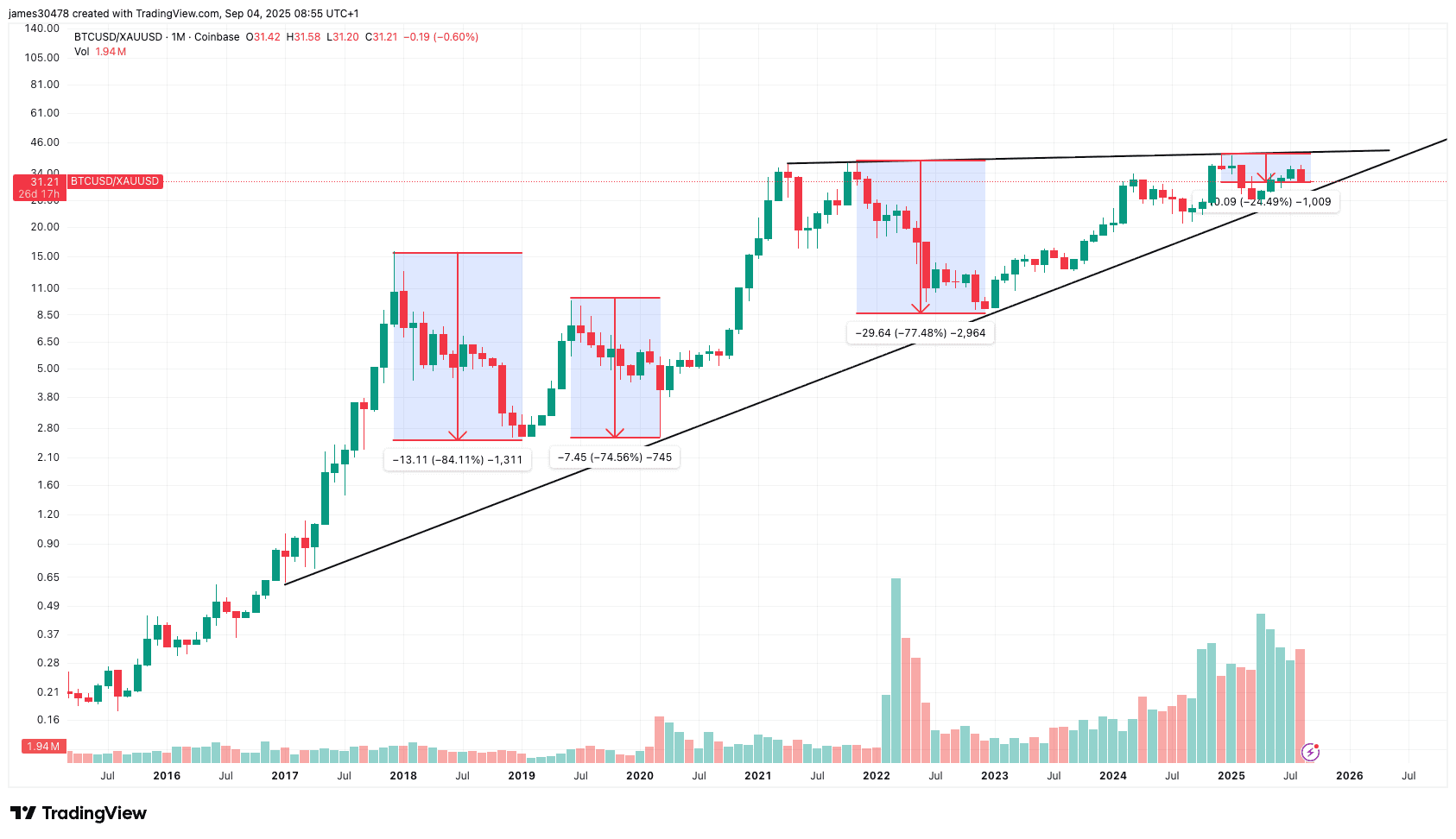

That’s 3 times the achieve of the Nasdaq 100 index and practically double bitcoin’s (BTC) efficiency. In follow meaning it now takes simply 31.2 ounces of gold to purchase one BTC, a measure often known as the BTC-XAU ratio, down from 40 ounces final December.

The steel, sometimes used as a haven in instances of economic stress, has been underpinned by falling authorities bond yields throughout main Western economies, a mirrored image of excessive debt burdens, persistent inflation considerations and slowing development. These dynamics reinforce gold’s historic function as a retailer of worth, and spotlight why it arguably deserves to be the benchmark in opposition to which all different investments are measured.

Technical evaluation reveals the BTC-XAU ratio has been consolidating inside a big ascending triangle, a bullish continuation sample that has been forming since 2017. The ratio end-2024 degree mirrored peaks seen on the finish of 2021, however has since corrected by about 25%. The construction now factors to a possible breakout by late within the fourth quarter or early subsequent yr.

Importantly, earlier cycles on this ratio noticed extreme drawdowns — 84% in 2019, 75% in 2020 and 78% in 2022 — earlier than new highs had been established. The present pullback is way shallower, suggesting underlying energy and retaining the long-term bullish case intact.