Ethereum advocacy agency Etherealize has closed a $40 million funding spherical to assist it pitch the blockchain to Wall Avenue in per week that’s already seen public companies add over $1.2 billion price of Ether to their treasuries.

Etherealize stated on Wednesday that the crypto-focused enterprise companies Electrical Capital and Paradigm led the spherical, which it will use to “proceed driving institutional adoption of Ethereum.”

The corporate launched in January with funding from the Ethereum Basis and Ethereum co-founder Vitalik Buterin to teach establishments on the blockchain and the Ether (ETH) token.

Wall Avenue has but to embrace ETH as deeply because it has Bitcoin (BTC) when evaluating the buying and selling volumes and inflows to associated exchange-traded funds.

Etherealize co-founder Grant Hummer stated in January that amid the ETF launches, he seen establishments lacked schooling on ETH, which the corporate needed to deal with.

Etherealize to make use of funds for institutional instruments

Etherealize stated the $40 million could be put towards growing crypto-based monetary instruments geared toward establishments.

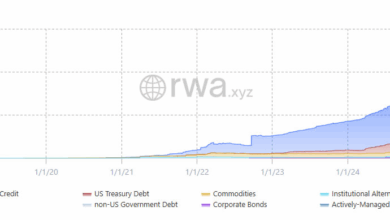

The agency desires to construct infrastructure for privately buying and selling and settling tokenized belongings, a settlement platform geared to “institutional tokenization workflows,” and functions geared toward markets for tokenized fastened revenue merchandise, reminiscent of tokenized bonds.

“Over the previous decade, Ethereum has gone from an experiment to the world’s most battle-tested, open monetary community,” stated Etherealize co-founder Danny Ryan, including the elevate would assist improve “institutional finance to fashionable, safer, globally accessible rails.”

Public companies add $1.26 billion price of ETH this week

Etherealize’s elevate comes after public companies globally have added $1.2 billion price of ETH to their holdings to date this week, in response to knowledge from the web site Strategic ETH Reserve.

The Ether Machine, a so-called crypto treasury firm that’s quickly planning to go public, made the week’s largest addition with a 150,000 ETH elevate on Tuesday, valued at $654 million.

The identical day, the biggest ETH holding agency, BitMine Immersion Applied sciences, stated it scooped up over 150,000 ETH over the earlier week, with knowledge from Arkham exhibiting it purchased an extra $65 million price on Wednesday.

Associated: Ether change reserves fall to 3-year low as ETFs, company treasuries absorb provide

Sharplink Gaming and the Hong Kong-listed Yunfeng Monetary introduced they purchased extra ETH on Tuesday, making respective purchases price $176 million and $44 million.

ETH at almost 50% odds of $6,000 this 12 months

Nick Forster, the founding father of crypto choices platform Derive, stated in a observe on Wednesday {that a} attainable Federal Reserve price minimize this month and the ETH buys by public firms have set it up “for explosive potential heading into This fall.”

He stated ETH-buying companies now maintain almost 4% of the token provide, and a price minimize might see such firms “holding 6-10% of ETH’s provide by year-end, positioning them as a serious power behind ETH’s worth motion.”

Forster predicted there was a 44% likelihood that ETH reaches $6,000 by the top of the 12 months, and gave 30% odds of it hitting that worth by the top of October.

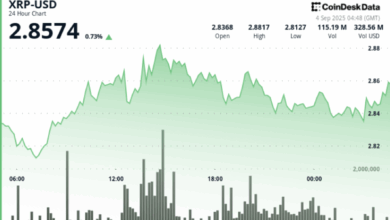

Ether is at present buying and selling for slightly below $4,400, up 1.8% on the day, nevertheless it has fallen 11.5% since its peak of round $4,950 on Aug. 24.

Commerce Secrets and techniques: Ether might ‘rip like 2021’ as SOL merchants brace for 10% drop