Ether whales have been ramping up their ETH shopping for for the reason that token dipped to yearly lows in April, in accordance with crypto sentiment platform Santiment.

“In precisely 5 months, they’ve added 14.0% extra cash,” Santiment mentioned in an X submit on Wednesday, referring to whale holders with 1,000 to 100,000 ETH, valued between $4.41 million and $440.81 million.

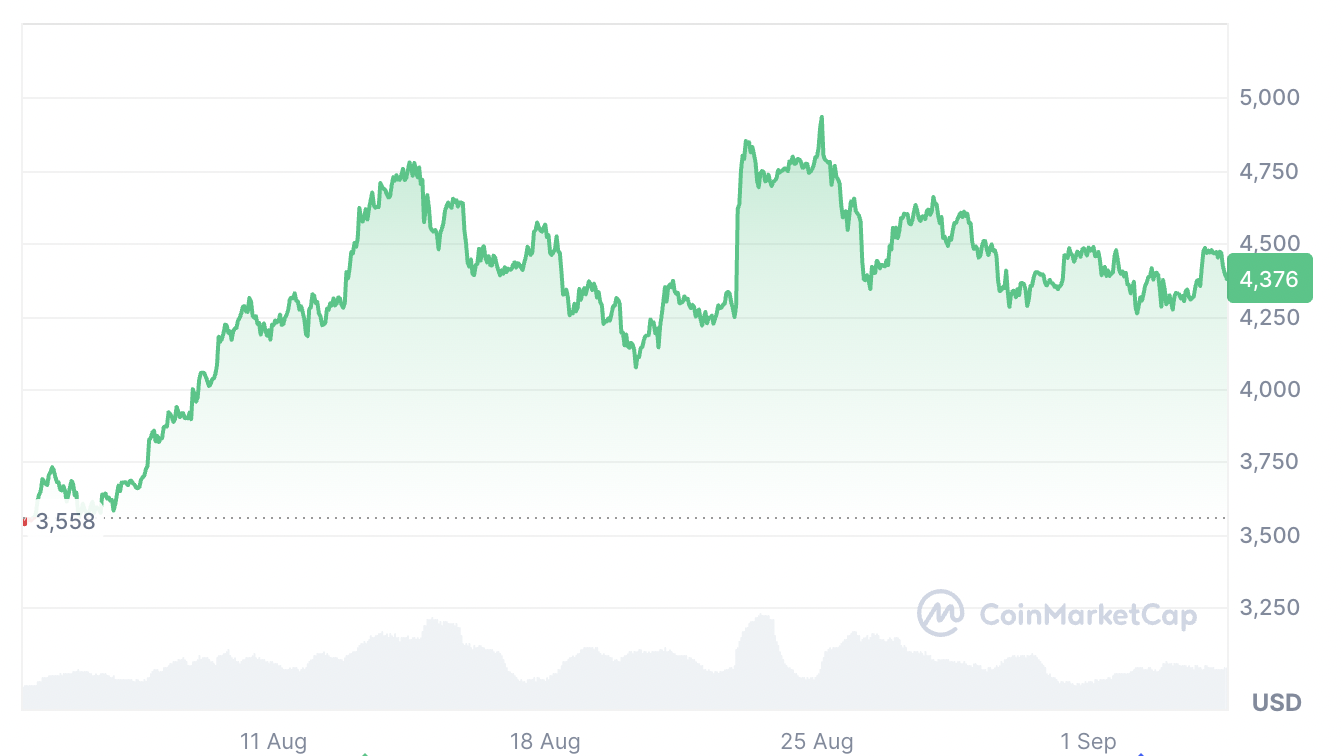

Ether (ETH) is buying and selling at $4,376, and is now up 197.30% from its yearly low of $1,472 on April 9, in accordance with CoinMarketCap.

Crypto market members sometimes watch whale exercise to evaluate sentiment since sell-offs can sign bearishness, whereas accumulation can counsel bullishness and expectations of upper costs.

Some ETH whales received caught out by the rally

Nevertheless, not all whales timed the market nicely. Some offered close to the underside and ended up chasing the rally again.

On Might 22, a crypto pockets spent $3.8 million to buy 1,425 Ether, after promoting 2,522 ETH for $3.9 million in April, when the asset was buying and selling at about $1,570.

Many attribute Ether’s surge primarily to growing ETF inflows and rising ETH treasury holdings, with the 2 largest treasury corporations — Sharplink Gaming and BitMine Immersion Applied sciences — making their first purchases in June, when Ether traded between $2,228 and $2,813 over the month.

BitMine, the biggest ETH treasury firm, now holds $8.22 billion price of ETH, whereas Sharplink Gaming holds $3.69 billion, in accordance with StrategicETHReserve.

ETH treasuries now maintain almost 3% of complete provide

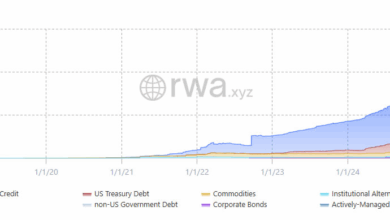

Ether treasury corporations at present maintain $15.83 billion price of ETH, which equates to roughly 2.97% of your entire provide.

In the meantime, August was robust for Ethereum ETF funds, which noticed $3.87 billion in inflows in contrast with Bitcoin ETFs’ $751 million outflows.

Ether might attain $15K by the top of the 12 months, says analyst

In the identical month, Ether reclaimed its 2021 all-time highs of $4,878, reaching as excessive as $4,934 on Aug. 24.

Some are anticipating Ether’s value to go a lot increased. Head of digital asset analysis for Fundstrat, Sean Farrell, mentioned ETH might go as excessive as $12,000 to $15,000 by year-end.

Associated: ETH breakout or fakeout? Merchants debate whether or not Ether holds $4.5K

Nevertheless, others counsel that a lot of the market’s focus will finally return to Bitcoin.

The ETH/BTC ratio, which measures Ether’s relative energy in opposition to Bitcoin (BTC), is down 2.27% throughout the previous seven days, in accordance with TradingView.

Blockchain intelligence agency Arkham mentioned in an X submit on Wednesday that “Establishments are coming again to BTC.”

“ETFS simply offered $135M ETH and purchased $332M BTC,” Arkham mentioned.

Journal: Astrology might make you a greater crypto dealer: It has been foretold