America Federal Reserve introduced that it’s going to quickly host a convention on funds innovation and tokenization in what is popping into a giant week of developments for real-world asset (RWA) tokenization.

The Federal Reserve Board on Wednesday introduced that it’s going to host a convention on funds innovation on Oct. 21, bringing collectively business consultants to debate “the best way to additional innovate and enhance the funds system.”

The convention will function panel discussions on a number of features of funds innovation, it said. These embody tokenizing monetary services, converging conventional and decentralized finance (DeFi), rising stablecoin use instances and enterprise fashions, and the intersection of synthetic intelligence and funds.

“I stay up for analyzing the alternatives and challenges of latest applied sciences, bringing collectively concepts on the best way to enhance the protection and effectivity of funds, and listening to from these serving to to form the way forward for funds,” mentioned Fed Governor Christopher Waller.

The concentrate on RWA tokenization comes amid heightened Wall Road curiosity in tokenization following the passage of key stablecoin laws in July and a peak in onchain worth for tokenized property.

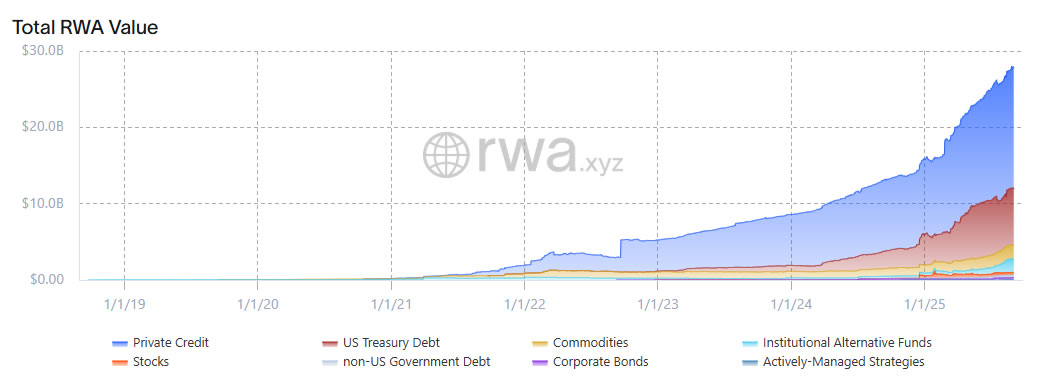

RWA onchain worth hits ATH

It additionally comes because the onchain worth of tokenized real-world property is at an all-time excessive of $27.8 billion, surging 223% for the reason that starting of this yr, in accordance with RWA.xyz. Most of that is dominated by tokenized personal credit score and US Treasury debt.

Associated: $400T TradFi market is a large runway for tokenized RWAs: Animoca

Ethereum stays the business commonplace blockchain for tokenizing property, with a market share of 56%, together with stablecoins, and greater than 77% if together with layer-2 networks.

Ondo Finance launches tokenized US inventory platform

Additionally this week, crypto oracle supplier Chainlink introduced a partnership with tokenization platform Ondo Finance for its lately launched Ondo World Markets RWA platform, which was described as “Wall Road 2.0”.

The initiative brings greater than 100 tokenized US shares and exchange-traded funds onchain.

Ondo Finance said on Wednesday that the brand new platform, introduced in February, is now dwell on Ethereum for non-US traders.

Journal: Bitcoin to see ‘yet one more huge thrust’ to $150K, ETH strain builds: Commerce Secrets and techniques