Information Background

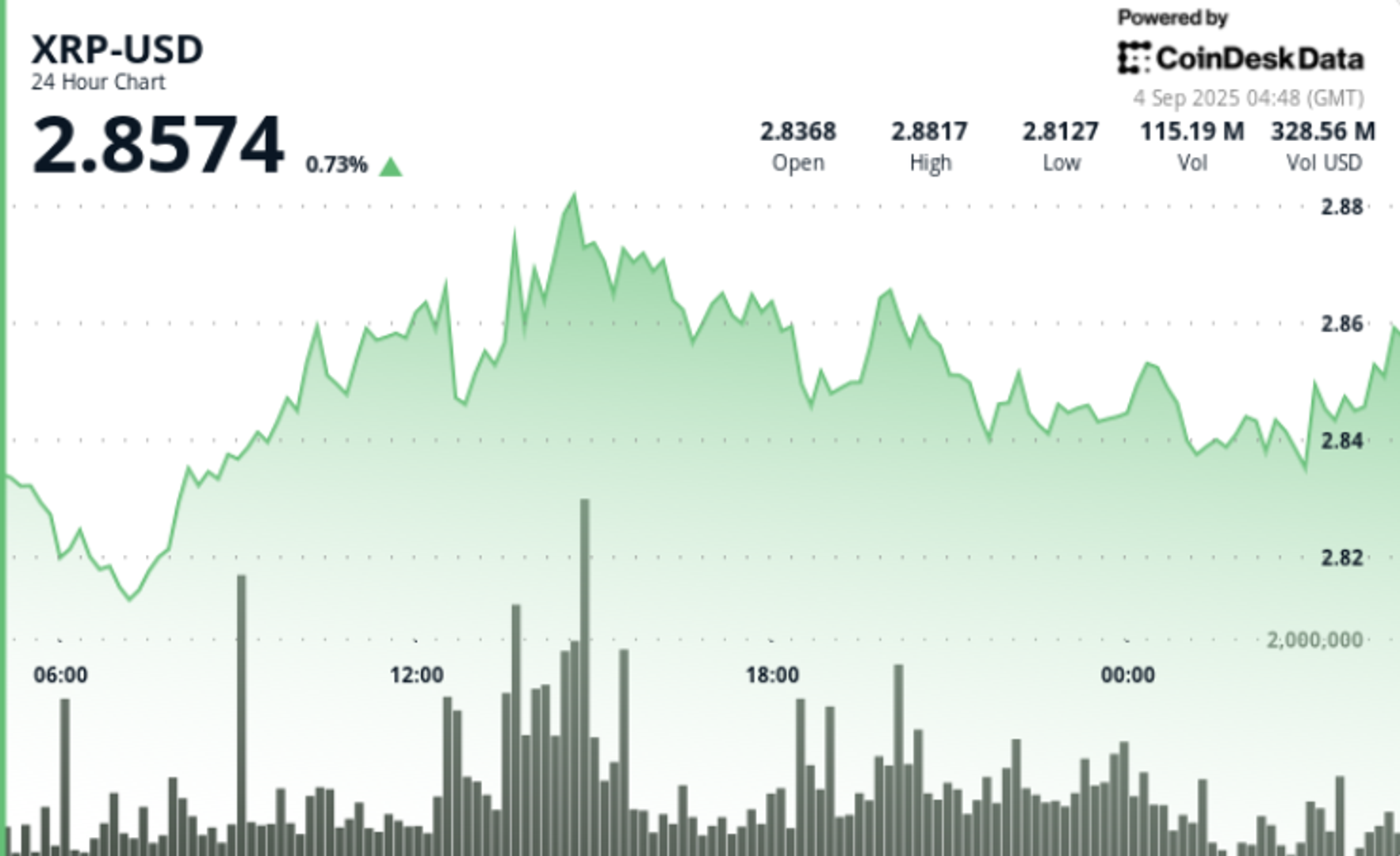

- XRP traded in a slender 2% vary from $2.81 to $2.87 in the course of the 24h session from Sept. 2 at 14:00 to Sept. 3 at 13:00.

- Giant wallets collected roughly 340M XRP (~$960M) over the previous two weeks at the same time as establishments liquidated ~$1.9B since July.

- Complete transaction quantity throughout the XRP Ledger reached 2.15B XRP on Sept. 1, greater than double typical each day exercise.

- Analysts stay break up: some spotlight long-term bullish constructions (symmetrical triangles, Elliott Wave counts) with upside towards $7–$13, whereas others warn of fading momentum under multi-year resistance trendlines.

Worth Motion

- XRP opened close to $2.84 and closed at $2.85, up barely regardless of intraday volatility.

- Worth dipped early from $2.84 → $2.79, then rebounded to $2.87 by noon on Sept. 3.

- Help developed at $2.82, repeatedly attracting bids.

- Resistance capped upside close to $2.86, the place distribution strain intensified.

- Closing-hour buying and selling noticed a reversal: a spike to $2.873 (12:38 GMT) on 5.38M quantity was rejected, pushing value again underneath $2.85.

Technical Evaluation

- Help: $2.82 zone stays the important thing demand space. Under that, $2.70 and $2.50 are subsequent.

- Resistance: $2.86–$2.88 continues to behave as overhead provide. $3.00 is the psychological hurdle, with $3.30 as breakout affirmation.

- Momentum: RSI regular in mid-50s, exhibiting impartial bias with slight bullish lean.

- MACD: Histogram converging towards bullish crossover, signaling momentum may strengthen if quantity persists.

- Patterns: Symmetrical triangle consolidation underneath $3.00 intact. Break above $3.30 unlocks larger targets.

- Quantity: Session surges (93M–95M vs 44M avg) level to energetic institutional flows.

What Merchants Are Watching

- Whether or not $2.82 assist holds underneath renewed strain.

- A decisive shut above $2.86–$2.88, then $3.00 and $3.30 for a breakout setup.

- Whale flows: continued accumulation versus ongoing institutional promoting.

- Regulatory and macro catalysts, together with Fed coverage and pending SEC readability, which may shift sentiment rapidly.