Ripple, the payments-focused digital asset agency, is increasing its U.S. dollar-backed stablecoin Ripple USD (RLUSD) to establishments in Africa by way of new partnerships with Chipper Money, VALR and Yellow Card distributors.

The rollout goals to offer companies throughout the continent entry to a secure, digital greenback designed for cross-border funds, liquidity and on-chain settlement, the corporate mentioned in a Wednesday press launch.

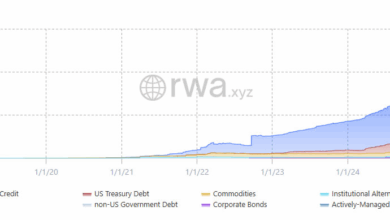

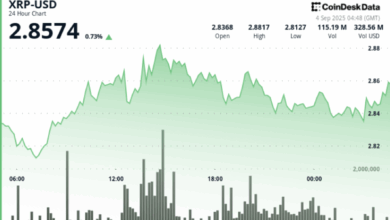

RLUSD, launched in late 2024 and issued by a New York belief firm regulated by the state’s Division of Monetary Providers, has grown to over $700 million in provide on Ethereum and the XRP Ledger (XRP), RWA.xyz knowledge exhibits. The token may very well be used for treasury operations, remittances and as collateral for buying and selling tokenized belongings equivalent to commodities or securities, Ripple mentioned.

Ripple’s growth comes as stablecoins emerge as a less expensive and quicker different to conventional fee channels, particularly in rising markets the place entry to dependable currencies and banking is usually restricted. In components of Africa, residents already use digital {dollars} like USDT for financial savings or cross-border transfers, a report by Fort Island and Brevan Howard mentioned. RLUSD’s entry introduces a regulated different aimed squarely at institutional customers, a phase that faces challenges accessing secure liquidity in native currencies.

In parallel, Mercy Corps Ventures is testing RLUSD in local weather threat insurance coverage initiatives in Kenya. In a single trial, the stablecoin funds are launched mechanically when satellite tv for pc knowledge indicators drought circumstances. One other pilot underpins rainfall insurance coverage, with payouts triggered by excessive climate occasions.

Learn extra: Ripple to Purchase Stablecoin Funds Agency Rail for $200M to Increase RLUSD