- The Japanese Yen lacks any agency intraday directional bias on Thursday amid blended cues.

- BoJ fee hike ambiguity and home political uncertainty appear to undermine the JPY.

- Rising Fed fee reduce bets hold the USD depressed and act as a headwind for USD/JPY.

The Japanese Yen (JPY) struggles to capitalize on its restoration from a one-month trough touched in opposition to its American counterpart the day gone by and oscillates in a slender vary through the Asian session on Thursday. Market contributors stay divided over the seemingly timing and tempo of Financial institution of Japan (BoJ) fee hikes amid tariff-related uncertainties. Moreover, the current surge in international bond yields has shifted focus once more to rising debt ranges throughout main economies, together with Japan, which, together with home political uncertainty, holds again the JPY bulls from putting aggressive bets.

Including to this, a steady efficiency across the fairness markets is seen as one other issue performing as a headwind for the safe-haven JPY. In the meantime, expectations that wages are set to rise additional in a good labor market, which, in flip, might gas demand-driven inflation, hold the door open for added BoJ tightening. In distinction, the US Federal Reserve (Fed) is extensively anticipated to decrease borrowing prices later this month, and the bets have been reaffirmed by softer US JOLTS Job Openings knowledge on Wednesday. This retains the US Greenback (USD) bulls on the defensive and may proceed to assist the JPY.

Japanese Yen merchants appear non-committed as heightened political uncertainty offsets BoJ-Fed coverage divergence

- Financial institution of Japan Deputy Governor Ryozo Himino warned on Tuesday that international financial uncertainty stays excessive, suggesting that the central financial institution is in no rush to push up still-low borrowing prices. Nevertheless, BoJ Governor Kazuo Ueda on Wednesday confirmed readiness to proceed elevating rates of interest if the economic system and costs transfer in step with the central financial institution’s projections.

- In the meantime, traders proceed to wager that the BoJ might increase charges earlier than year-end on the again of agency wage development, nonetheless sticky inflation, and a brighter financial outlook. This, in flip, acts as a tailwind for the Japanese Yen through the Asian session on Thursday, although home political uncertainty caps the in a single day restoration from a one-month low touched the day gone by.

- The Japanese ruling occasion’s secretary normal Hiroshi Moriyama’s intention to resign have stoked uncertainty round Prime Minister Shigeru Ishiba’s management. The announcement revived worries about Japan’s fiscal place and contributed to the current surge in Japan’s 30-year authorities bond yield to a report excessive, properly above the three% mark, touched earlier this week.

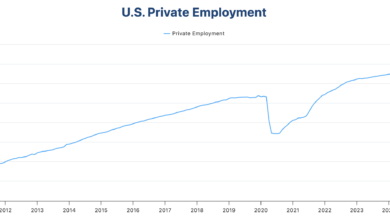

- The US Bureau of Labor Statistics (BLS) revealed the Job Openings and Labor Turnover Survey (JOLTS) on Wednesday, which confirmed that the variety of job openings on the final enterprise day of July stood at 7.18 million. This adopted the earlier month’s downwardly revised studying of seven.35 million and got here in properly beneath the market expectation of seven.4 million.

- However, the softer knowledge elevated the chance of the Federal Reserve chopping rates of interest on the finish of a two-day coverage assembly on September 17. Furthermore, merchants are pricing in at the very least two 25 foundation factors fee cuts by the year-end, which, in flip, fails to help the US Greenback to draw any significant patrons and will act as a headwind for the USD/JPY pair.

- Merchants now stay up for Thursday’s US financial docket – that includes the ADP report on private-sector employment and ISM Companies PMI. The main focus, nevertheless, will stay glued to the official US month-to-month employment particulars – popularly often known as the Nonfarm Payrolls (NFP) report – on Friday, which is able to drive the USD and supply a contemporary impetus to the USD/JPY pair.

USD/JPY bears await acceptance beneath 148.00 earlier than positioning for deeper losses

The in a single day failure to construct on momentum past the 200-day Easy Shifting Common (SMA) and a pointy pullback from the 61.8% Fibonacci retracement stage of the downfall from the August month-to-month swing excessive favour the USD/JPY bears. That stated, constructive oscillators on the day by day chart make it prudent to attend for acceptance beneath the 148.00 mark earlier than positioning for deeper losses. Spot costs may then speed up the autumn to the 147.40 intermediate assist en path to the 147.00 mark and the 146.70 horizontal zone. A convincing break beneath the latter would expose the August swing low, across the 146.20 area, earlier than spot costs ultimately take a look at the 146.00 mark.

On the flip facet, a constructive transfer again above the 148.30-148.25 static barrier might elevate the USD/JPY pair again in direction of the 200-day SMA, at present pegged close to the 148.75-148.80 area. Some follow-through shopping for, resulting in a subsequent energy past the 149.00 mark and the 149.20 space, or the 61.8% Fibo. retracement stage, will probably be seen as a contemporary set off for bulls. Spot costs may then goal to reclaim the 150.00 psychological mark. The momentum might prolong additional in direction of difficult the August month-to-month swing excessive, across the 151.00 neighborhood.

Financial institution of Japan FAQs

The Financial institution of Japan (BoJ) is the Japanese central financial institution, which units financial coverage within the nation. Its mandate is to difficulty banknotes and perform forex and financial management to make sure worth stability, which suggests an inflation goal of round 2%.

The Financial institution of Japan embarked in an ultra-loose financial coverage in 2013 so as to stimulate the economic system and gas inflation amid a low-inflationary surroundings. The financial institution’s coverage is predicated on Quantitative and Qualitative Easing (QQE), or printing notes to purchase property akin to authorities or company bonds to offer liquidity. In 2016, the financial institution doubled down on its technique and additional loosened coverage by first introducing unfavorable rates of interest after which straight controlling the yield of its 10-year authorities bonds. In March 2024, the BoJ lifted rates of interest, successfully retreating from the ultra-loose financial coverage stance.

The Financial institution’s large stimulus induced the Yen to depreciate in opposition to its most important forex friends. This course of exacerbated in 2022 and 2023 as a result of an rising coverage divergence between the Financial institution of Japan and different most important central banks, which opted to extend rates of interest sharply to combat decades-high ranges of inflation. The BoJ’s coverage led to a widening differential with different currencies, dragging down the worth of the Yen. This pattern partly reversed in 2024, when the BoJ determined to desert its ultra-loose coverage stance.

A weaker Yen and the spike in international vitality costs led to a rise in Japanese inflation, which exceeded the BoJ’s 2% goal. The prospect of rising salaries within the nation – a key aspect fuelling inflation – additionally contributed to the transfer.