American Bitcoin, a crypto mining firm linked to the Trump household, ended its uneven first day on the Nasdaq up over 16%, including thousands and thousands to the US first household’s wealth.

The corporate, backed by US President Donald Trump’s sons, Eric and Donald Trump Jr., went public after it merged with the prevailing Bitcoin (BTC) mining firm Gryphon Digital Mining (GRYP).

In early buying and selling on Wednesday, American Bitcoin (ABTC) shot up 91% from Gryphon’s Tuesday closing worth of $6.90 to a peak of $13.20 earlier than falling by half to a day low of $6.72.

The Nasdaq halted buying and selling of American Bitcoin shares 5 occasions all through the day attributable to volatility, but it surely ended the day’s session up 16.52% at simply over $8 and has climbed over 5% after-hours to $8.45.

American Bitcoin is the Trump household’s newest addition to its rising crypto portfolio and joins a development of public firms which have joined the sector by going public or switching to give attention to shopping for crypto.

Bitcoin “floodgates” are opening, says Eric Trump

Eric Trump, American Bitcoin’s co-founder and technique chief, advised Bloomberg on Wednesday that his firm’s public launch was “an unbelievable day and a variety of onerous work that’s lastly come to fruition.”

He added that he began the enterprise after proudly owning Bitcoin for a number of years and seeing “how a lot it’s being embraced globally.”

“The floodgates are simply beginning to open, so it’s type of an ideal time,” he added.

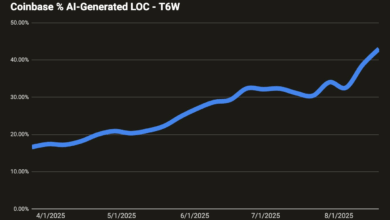

The US rose to second place on Chainalysis’ crypto adoption index, which was launched on Wednesday, with the analytics agency citing President Trump’s crypto-friendly insurance policies as a significant driver.

Eric Trump swatted away considerations that the enterprise may very well be seen as taking advantage of his father’s crypto-friendly insurance policies, saying the criticism was “completely illegitimate.”

“I acquired into this enterprise as a result of I used to be illegitimately debunked from each monetary platform within the nation,” he claimed. “My father has nothing to do with this enterprise.”

He added that President Trump had “all the time been a proponent” of cryptocurrency, which “most likely helped get him elected.” Donald Trump beforehand stated cryptocurrencies are “based mostly on skinny air” and that Bitcoin “looks as if a rip-off.”

American Bitcoin to purchase and mine

Eric Trump stated that the agency would each mine and purchase Bitcoin, switching between the methods to “whichever is best on the time.”

“There’s solely a certain quantity of Bitcoin that may be mined day by day, and we’re going to harness that to absolutely the fullest,” he stated. “On the identical time, we might be inventive. We will exit and we are able to buy Bitcoin, maintain down the treasury and once more permit the mining to greenback value common down.”

“We’re going to be implementing each methods; whichever is finest for shareholder worth is clearly what we’re going to prioritize.”

The corporate owns 2,443 BTC value $273 million — the twenty fifth largest holdings amongst public firms — as Bitcoin traded flat at round $111,850 on the day.

Second Trump crypto enterprise this week

American Bitcoin is the Trump household’s second crypto enterprise to go public this week, after tokens for his or her crypto venture World Liberty Monetary had been listed on crypto exchanges for the primary time on Monday.

The venture unlocked round 1 / 4 of its 100 billion complete provide for the World Liberty Monetary (WLFI) token, permitting its earliest buyers to promote out of the cryptocurrency.

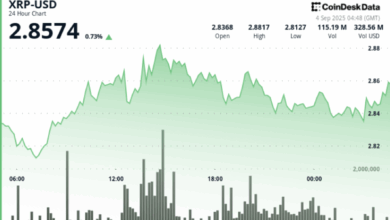

WLFI has dropped 30% from its debut worth and has continued to fall over 7% within the final 24 hours to simply over 21 cents, CoinGecko exhibits.

President Trump and sons Eric, Donald Jr and Baron Trump are all named within the venture, and an organization tied to them receives many of the income it generates. That firm additionally owns almost 1 / 4 of all WLFI, value almost $4.8 billion.

As for Eric Trump, Bloomberg estimated that his roughly 7.5% stake in American Bitcoin is value about $548 million.

He stated when requested about his stake that “we’re extremely lucky in life with or with out this endeavor.”

Journal: Bitcoin’s long-term safety finances downside: Impending disaster or FUD?