Crypto holdings reported in Australian Self-Managed Tremendous Funds have dropped by roughly 4% year-on-year regardless of a crypto market rally, in line with the Australian Taxation Workplace.

The information, which has been adjusted for constant valuation, exhibits that in June 2025, SMSF crypto holdings have been at 3.02 billion Australian {dollars} ($1.97 billion), roughly $100 million Australian {dollars} lower than the reported $3.12 billion in June 2024, as per the ATO report revealed on Wednesday.

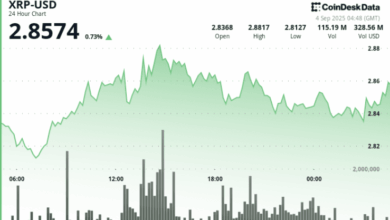

The autumn got here regardless of Bitcoin (BTC) value growing roughly 60% over the identical interval, whereas the general Asia-Pacific area bolstered its standing because the “world hub of grassroots crypto exercise,” in line with a latest report from Chainalysis.

Nonetheless, Australian crypto trade Coinstash’s head of SMSF technique, Simon Ho, instructed Cointelegraph that the “quantity might be undercooked.”

Spike in crypto curiosity over two years is “vital,” says exec

Ho defined that “the June 2025 information that you just see shouldn’t be reflective of actuals as a result of it’s primarily based on June 30, 2025, tax return filings, which aren’t due till Might 2026.”

June 2025’s crypto holding figures are roughly 41% greater than these of June 2023, the identical 12 months the Australian authorities signaled additional give attention to regulatory readability for the crypto business by releasing the token mapping session paper.

Ho mentioned it was the distinction between these two years that was “vital from the information launched yesterday.”

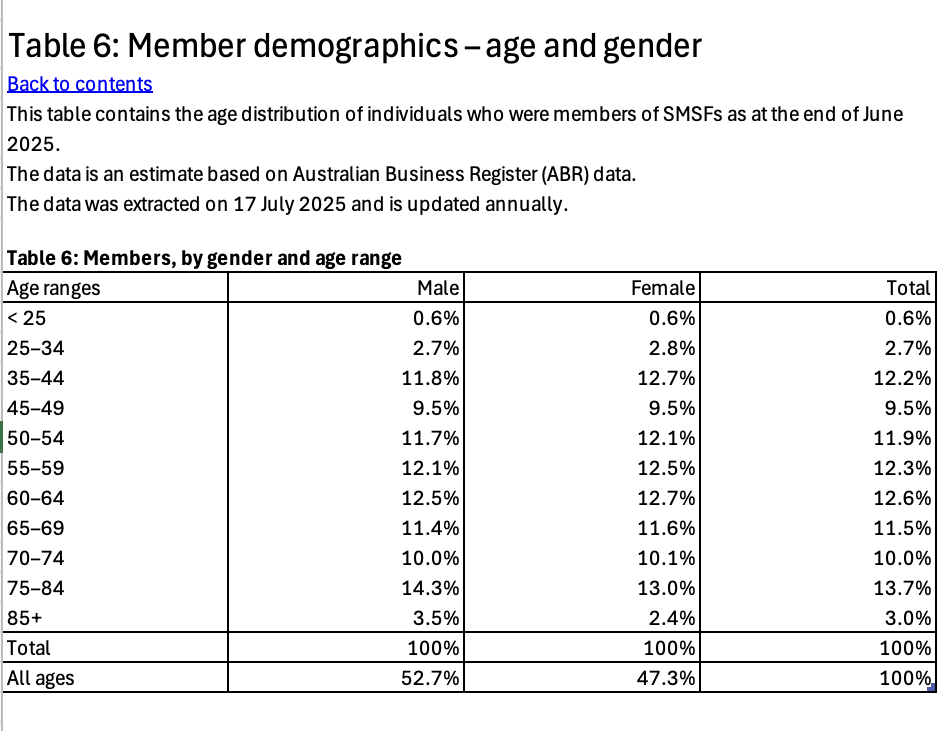

A Self-Managed Tremendous Fund (SMSF) permits members to handle their retirement financial savings, quite than contributing to a pooled superannuation fund. Australians can typically entry their SMSF as soon as they retire and have reached not less than 60 years of age.

Crypto exchanges put together for a flood of retirement savers

SMSFs are 96.7% dominated by members over 35 years previous. The most important share is within the 75 – 84 12 months previous age bracket, which accounts for 13.7%.

Current information from Australian crypto trade Unbiased Reserve exhibits that over 50% of younger Australians aged between 25 and 34 personal crypto (53%), making them the biggest demographic of crypto holders.

This means that the SMSF information might change considerably within the coming years, relying on how youthful Australians method retirement planning.

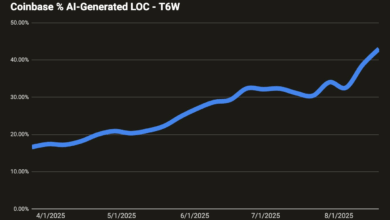

In the meantime, Australian crypto exchanges are already making ready for additional adoption.

On Monday, Bloomberg reported that Coinbase and OKX are introducing companies for SMSFs in Australia.

The business has been calling upon the newly reelected Labor authorities to urgently make digital asset laws a high precedence to make sure Australia doesn’t fall additional behind world markets.

Crypto retirement beneficial properties traction globally

Globally, extra persons are changing into receptive to investing in crypto as a part of their retirement planning.

Associated: Bitcoin bulls ‘nonetheless in management’ as BTC value passes $112K — Evaluation

A survey of two,000 UK adults by insurance coverage firm Aviva, revealed on Aug. 26, discovered that 27% have been open to holding crypto of their retirement funds, with simply over 40% citing greater potential returns as their motivation.

In the meantime, US President Donald Trump signed an government order in the identical month allowing US 401(ok) retirement plans to incorporate Bitcoin and different cryptocurrencies.

Journal: Astrology might make you a greater crypto dealer: It has been foretold