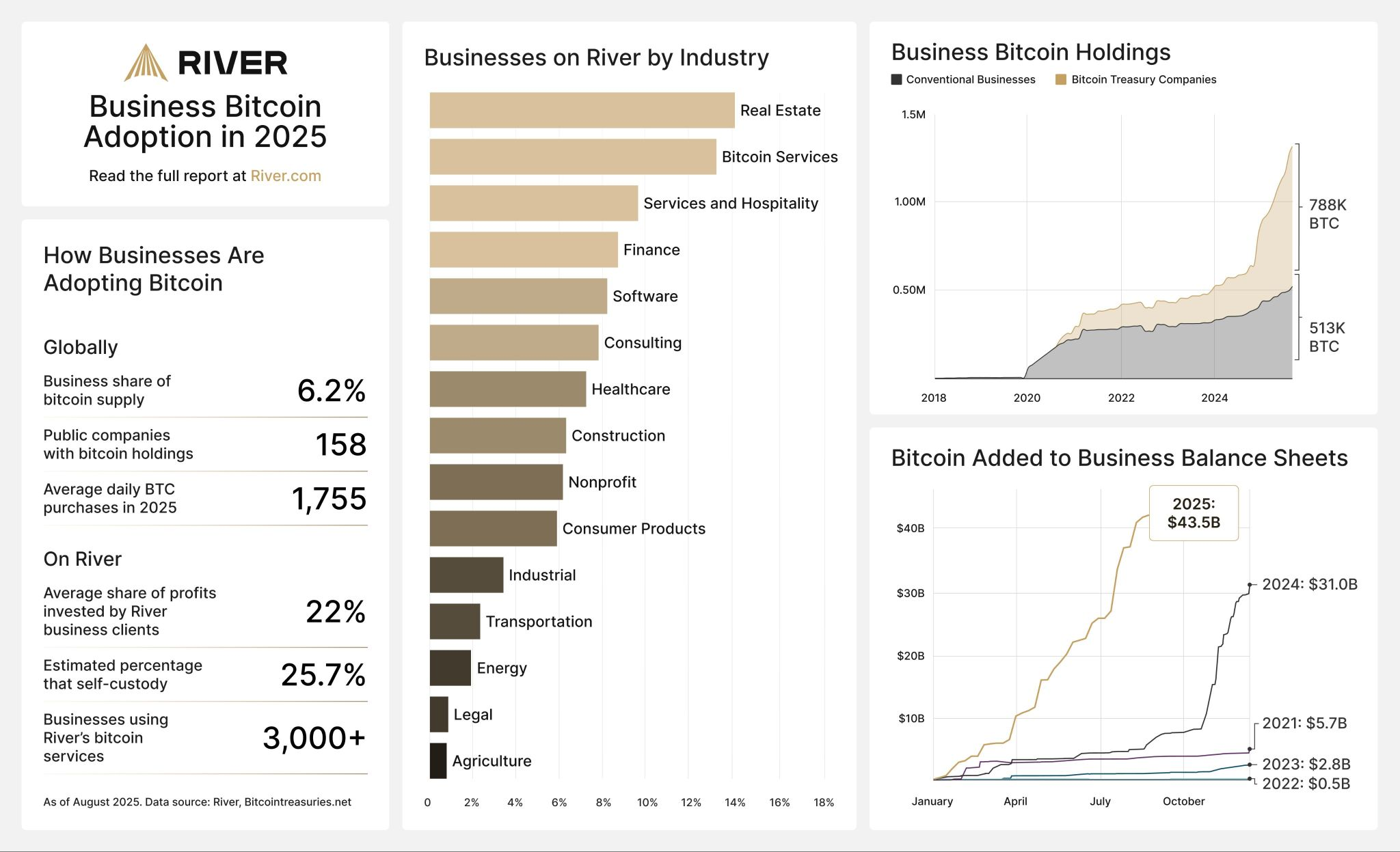

Bitcoin monetary companies agency River stated its enterprise shoppers are reinvesting a median of twenty-two% of income into Bitcoin, signaling rising grassroots adoption.

Of River’s shopper base, actual property corporations have been the largest adopters with almost 15% reinvesting income into Bitcoin (BTC), whereas hospitality, finance and software program sectors are allocating between 8% and 10%, River analysis analyst Sam Baker stated in a report on Wednesday.

Even health studios, portray and roofing corporations and spiritual nonprofits are among the many adopters.

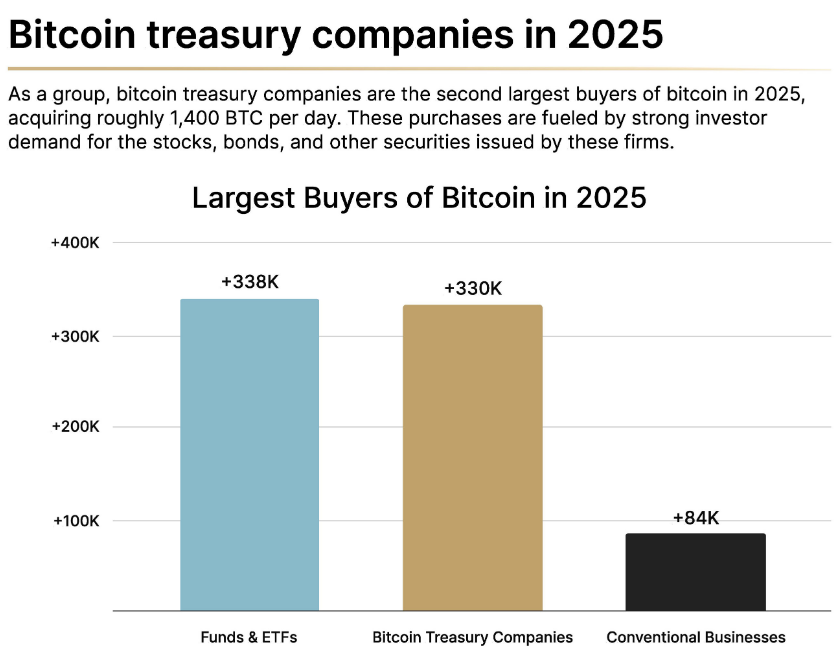

Baker stated companies like these have quietly acquired 84,000 Bitcoin in 2025 — a large stash representing a couple of quarter of the holdings of institutional fund managers and company Bitcoin treasuries have accrued.

“Whereas Bitcoin treasury corporations have captured a lot of the media highlight, what is commonly neglected is adoption by standard companies that use Bitcoin to enrich their present enterprise fashions,” he added.

Baker stated enhancements in Bitcoin’s accounting requirements, regulatory readability, rising institutional acceptance and a powerful bull market have created the “ideally suited situations for the widespread adoption we’re witnessing in the present day.”

Enterprise and institutional Bitcoin adoption has been one of many greatest catalysts behind Bitcoin’s bull run to $124,450 this cycle.

There have been durations the place spot Bitcoin exchange-traded fund issuers have scooped up 10 occasions extra Bitcoin than what miners have been capable of produce, pushing up Bitcoin’s worth.

It contrasts considerably with the 2020-2021 bull cycle, the place companies largely sat on the sidelines as Bitcoin topped $69,000 totally on retail hype.

Smaller companies have a better path to Bitcoin adoption

Baker famous that 75% of the companies it serves have 50 staff or fewer, arguing that the small corporations can have a better time adopting Bitcoin as fewer hurdles are concerned.

Then again, bigger corporations with committee-based decision-making are extra inclined to comply with norms and keep away from controversy, Baker stated, explaining why so few S&P 500 corporations maintain Bitcoin.

“Even when a CEO or CFO is personally satisfied of Bitcoin’s long-term worth, they’re unlikely to advocate for adoption until peer corporations have already finished so.”

Many are solely investing modest quantities into Bitcoin

Nevertheless, River discovered that over 40% of the companies allocate between 1% to 10% into Bitcoin, whereas solely 10% make investments greater than half of their internet revenue into the cryptocurrency.

Associated: Tether USDT stablecoin seen on Bolivian retailer worth tags

For smaller corporations, Bitcoin buys could be fairly small — lower than $10,000. Final week, Rhode Island-based Western Predominant Self Storage added simply 0.088 Bitcoin, value $9,830, in a single buy, bringing its whole holdings to 0.43 Bitcoin.

Regardless of the elevated adoption, Baker stated most companies aren’t even contemplating Bitcoin on account of “widespread misunderstandings and restricted consciousness.”

He pointed to a Cornell College survey the place solely 6% of Individuals have been conscious that Bitcoin’s provide is capped at 21 million, whereas one other survey discovered 60% of Individuals admitted they “don’t know a lot” concerning the cryptocurrency.

“In different phrases, Bitcoin is commonly dismissed not as a result of it has been evaluated and rejected, however as a result of most decision-makers do not have the understanding to guage it within the first place.”

Journal: The one factor these 6 international crypto hubs all have in widespread…