Good Morning, Asia. This is what’s making information within the markets:

Welcome to Asia Morning Briefing, a every day abstract of high tales throughout U.S. hours and an summary of market strikes and evaluation. For an in depth overview of U.S. markets, see CoinDesk’s Crypto Daybook Americas.

Bitcoin is caught in a holding sample close to $112,000, based on CoinDesk market information, however the larger story onchain may be the divide rising between how buyers deal with BTC and ETH heading into September. BTC is performing extra like a macro hedge, whereas ETH is being positioned as the actual automobile for upside.

That break up displays a mixture of coverage uncertainty and shifting dealer flows. In a latest word, QCP Capital wrote that doubts in regards to the Fed’s independence are holding time period premiums elevated, a setup that weakens the greenback and helps hedges like BTC and gold.

However choices desks and prediction markets present momentum gathering in ETH as a substitute, the place merchants see probably the most potential for a breakout.

Flowdesk reported muted implied volatility in BTC regardless of pullbacks, suggesting positioning reasonably than speculative bets. Skew stays unfavourable, which means places are costly, however that creates relative worth in name buildings. ETH danger reversals, in the meantime, have recovered from their latest selloff, indicating renewed demand for upside publicity.

SOL choices additionally noticed elevated exercise, with flows skewed to the upside on rising sentiment round its ecosystem and company Digital Asset Treasury initiatives. Spot exercise rotated into ETH beta names like AAVE and AERO, in addition to SOL betas like RAY and DRIFT, exhibiting breadth widening past majors.

Prediction markets again this rotation theme. Polymarket sentiment reinforces the rotation. Merchants count on BTC to remain capped close to $120k, whereas ETH is given a robust likelihood of breaking $5,000 — a view in step with its 20% month-to-month rally and recovering danger reversals.

Merchants are more and more treating BTC as a gentle macro hedge, whereas ETH is rising because the market’s high-conviction upside play into September.

Europe-based market maker Flowdesk wrote in a latest Telegram replace that exercise on the desk stays excessive, with shoppers broadly positioned for upside at the same time as macro dangers linger and seasonal volatility tends to choose up.

The macro backdrop units the hedge case, buying and selling flows present how positioning is shifting, and prediction markets validate it with real-money bets. Collectively, they sketch a market the place BTC anchors as a governance and inflation hedge, ETH leads on efficiency, and SOL builds momentum as breadth improves.

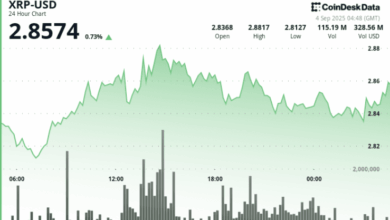

Market Actions

BTC: Bitcoin stays in a consolidation part across the $110K–112K vary, marked by waning quick‑time period volatility.

ETH: ETH is buying and selling close to $4400. Its rally is being fuelled by surging institutional curiosity, particularly through ETF inflows, and anticipation surrounding the upcoming Fusaka community improve. Worth motion is supported by sturdy structural demand as ETH continues to solidify its position in DeFi and good contracts.

Gold: Gold is buying and selling round report highs propelled by expectations of an imminent Federal Reserve charge minimize (markets now value in a couple of 92% likelihood), weakening confidence in Fed independence, and elevated demand from ETFs and central banks performing as conviction patrons.

Nikkei 225: Asia-Pacific shares climbed Thursday, led by a 0.57% acquire in Japan’s Nikkei 225, as Wall Road’s tech rally lifted sentiment regardless of lingering financial worries.

S&P 500: U.S. shares rose Wednesday as Alphabet gained after avoiding a breakup in an antitrust ruling and buyers boosted September Fed rate-cut bets regardless of recent labor market considerations.

Elsewhere in Crypto:

- U.S. CFTC Offers Go-Forward For Polymarket’s New Change, QCX (CoinDesk)

- Pump.enjoyable’s New Charge Mannequin Arms Out $2M to Creators in First 24 Hours (Decrypt)

- AI Brokers Will Turn into Largest Stablecoin Consumer, Says Novogratz (Bloomberg)